Credit Application Form

What is the Credit Application

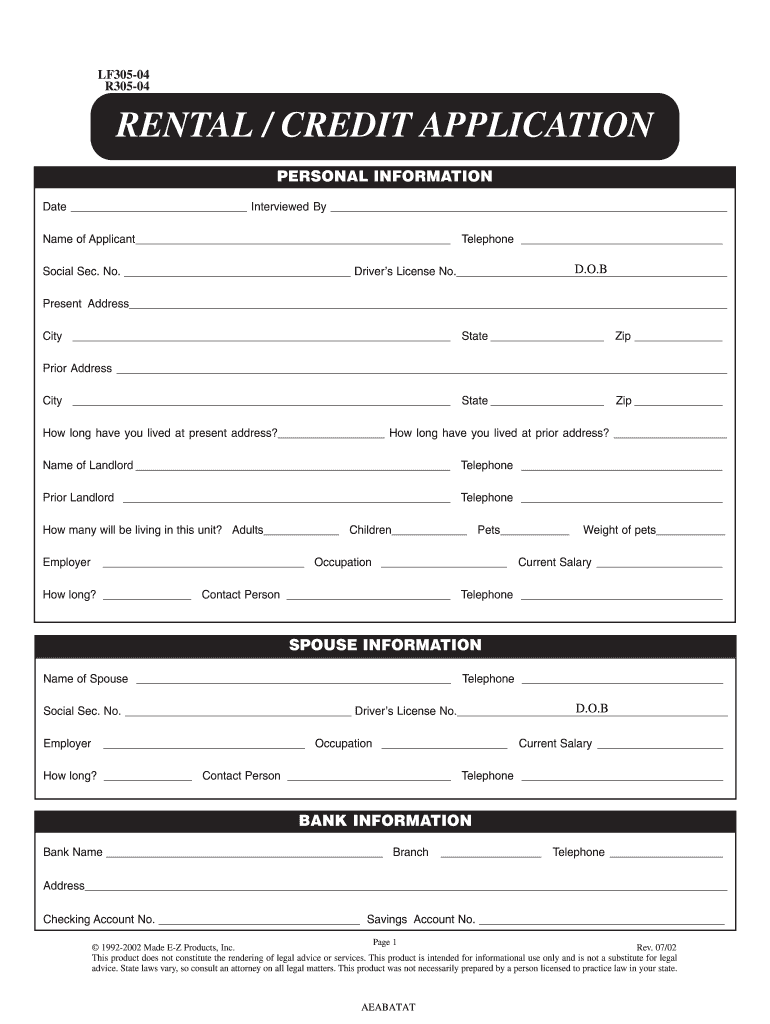

A credit application is a formal request submitted by individuals or businesses seeking to obtain credit or a loan from a financial institution or lender. This document typically includes personal and financial information necessary for the lender to assess the applicant's creditworthiness. The credit application form serves as a foundational tool for evaluating the ability of the applicant to repay borrowed funds.

Key Elements of the Credit Application

The credit application form generally consists of several key components that provide essential information to the lender. These elements may include:

- Personal information: Name, address, date of birth, and Social Security number.

- Employment details: Current employer, job title, and income level.

- Financial information: Current debts, assets, and monthly expenses.

- Credit history: Previous loans, credit cards, and payment history.

- Signature: Acknowledgment of the terms and conditions associated with the application.

Steps to Complete the Credit Application

Completing a credit application requires careful attention to detail. Here are the typical steps involved:

- Gather necessary documents: Collect financial statements, proof of income, and identification.

- Fill out the application: Provide accurate and complete information in each section.

- Review the application: Check for any errors or omissions before submission.

- Submit the application: Send the completed form to the lender through the preferred method, whether online or in person.

Legal Use of the Credit Application

The credit application must comply with various legal standards to ensure that it is valid and enforceable. In the United States, lenders are required to adhere to regulations such as the Fair Credit Reporting Act (FCRA) and the Equal Credit Opportunity Act (ECOA). These laws protect consumers by ensuring fair treatment during the credit application process and safeguarding their personal information.

Form Submission Methods

Credit applications can be submitted through several methods, allowing flexibility for applicants. Common submission methods include:

- Online: Many lenders offer digital platforms for completing and submitting applications.

- Mail: Applicants can send printed versions of the credit application to the lender.

- In-person: Some individuals may choose to visit a branch location to submit their application directly.

Eligibility Criteria

Eligibility for credit is determined by several factors outlined in the credit application. Lenders typically assess:

- Credit score: A numerical representation of creditworthiness based on credit history.

- Income level: Sufficient income to support loan repayment.

- Debt-to-income ratio: A calculation that compares monthly debt payments to gross monthly income.

- Employment stability: Length of time at current job and overall employment history.

Quick guide on how to complete credit application 73489795

Complete Credit Application easily on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Credit Application on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Credit Application effortlessly

- Locate Credit Application and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your needs in document management with just a few clicks from a device of your choice. Modify and eSign Credit Application and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit application 73489795

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit application form?

A credit application form is a document used by businesses to collect essential information from potential customers when applying for credit. This form typically includes details such as personal identification, financial history, and credit references, helping businesses assess the creditworthiness of applicants.

-

How does airSlate SignNow streamline the credit application process?

airSlate SignNow simplifies the credit application process by allowing businesses to create, send, and eSign credit application forms digitally. This eliminates paperwork and reduces processing time, enabling businesses to quickly evaluate and respond to credit applications.

-

What features does airSlate SignNow offer for credit application forms?

airSlate SignNow provides a variety of features for credit application forms, including customizable templates, automated workflows, and secure cloud storage. These features enhance efficiency and security, ensuring all submitted forms are easily accessible and properly managed.

-

What are the benefits of using airSlate SignNow for credit applications?

By using airSlate SignNow for credit applications, businesses can improve the applicant experience through fast and user-friendly processes. Additionally, electronic signatures enhance compliance and authentication, making it a reliable choice for critical credit assessments.

-

Is it easy to integrate airSlate SignNow with other applications for credit management?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, enhancing your credit management system. This compatibility allows businesses to efficiently manage credit application forms alongside existing software tools.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to cater to different business needs. Whether you're a small business or a larger organization, you can choose a plan that suits your requirements, making it an economical solution for managing credit application forms.

-

Can I customize my credit application form using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize credit application forms to fit their specific business needs. You can add your branding, modify fields, and adjust the layout to ensure the form aligns with your company’s style and requirements.

Get more for Credit Application

Find out other Credit Application

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple