Tax Exempt Form

What is the Tax Exempt Form?

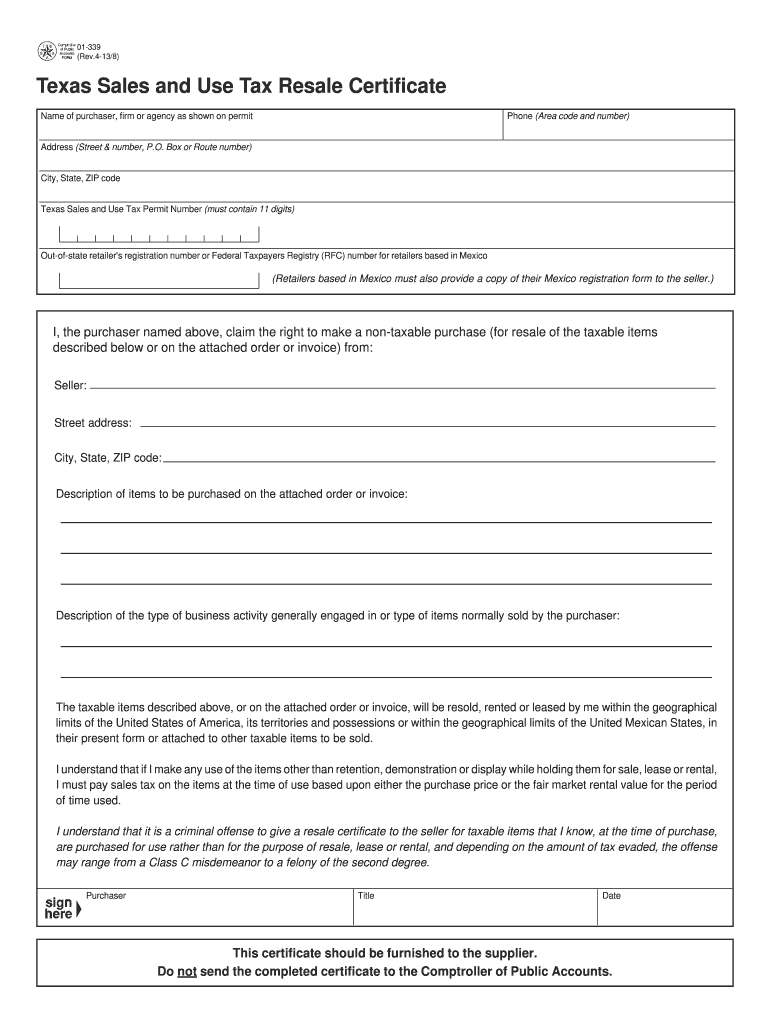

The tax exempt form in Texas is a crucial document that allows qualifying entities to purchase goods and services without paying sales tax. This form is primarily used by organizations that are exempt from taxation under state law, such as non-profits, religious institutions, and certain government entities. The Texas sales and use tax resale certificate, often referred to as the Texas reseller certificate, is a specific type of tax exempt form that enables businesses to buy items intended for resale without incurring sales tax.

How to Use the Tax Exempt Form

To use the tax exempt form effectively, the entity must fill it out accurately and present it to the seller at the time of purchase. The seller must retain this form for their records to validate the tax-exempt status of the transaction. It is important to ensure that all information, such as the name of the exempt organization and the reason for the exemption, is clearly stated. This helps prevent any issues during audits or reviews by the Texas Comptroller.

Steps to Complete the Tax Exempt Form

Completing the tax exempt form involves several key steps:

- Obtain the appropriate form, such as the Texas sales and use tax resale certificate form 2021 or the form 01-339.

- Fill in the name and address of the exempt organization accurately.

- Specify the reason for the exemption, ensuring it aligns with state guidelines.

- Provide the seller's information and describe the items being purchased.

- Sign and date the form to validate it.

After completing the form, present it to the seller when making a purchase to ensure that sales tax is not charged.

Legal Use of the Tax Exempt Form

The legal use of the tax exempt form is governed by Texas state law. To be valid, the form must be completed in accordance with the regulations set forth by the Texas Comptroller. This includes ensuring that the organization qualifies for tax exemption and that the form is used solely for tax-exempt purchases. Misuse of the form can lead to penalties, including back taxes owed and fines.

Eligibility Criteria

Eligibility for using the tax exempt form in Texas typically includes non-profit organizations, educational institutions, and governmental bodies. Each organization must demonstrate its tax-exempt status through proper documentation. For example, non-profits may need to provide proof of their 501(c)(3) status. It is essential to verify that the entity meets the criteria outlined by the Texas Comptroller to avoid issues during transactions.

Form Submission Methods

The tax exempt form can be submitted in various ways, depending on the seller's policies. Common methods include:

- In-person submission at the time of purchase.

- Mailing the completed form to the seller for their records.

- Submitting the form electronically if the seller supports digital documentation.

Each method has its own advantages, and it is important to choose the one that best fits the transaction and the seller's requirements.

Quick guide on how to complete tax exempt form 139353

Complete Tax Exempt Form effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without interruptions. Manage Tax Exempt Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and eSign Tax Exempt Form without hassle

- Obtain Tax Exempt Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Tax Exempt Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax exempt form 139353

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax exempt form Texas?

A tax exempt form Texas is the document used by qualifying organizations in Texas to claim exemption from sales tax. This form is essential for nonprofits, government entities, and certain educational institutions to ensure they are not charged sales tax on eligible purchases.

-

How can airSlate SignNow help with tax exempt forms in Texas?

airSlate SignNow simplifies the process of sending and signing tax exempt forms in Texas with its user-friendly interface. Users can easily create, edit, and eSign these documents, ensuring compliance and quick processing without the hassle of printed paperwork.

-

Is there a cost associated with using airSlate SignNow for tax exempt forms Texas?

Yes, there are various pricing plans available for airSlate SignNow, each tailored to meet different business needs. By choosing airSlate SignNow, customers can access the convenient features necessary for managing tax exempt forms Texas effectively at a competitive price.

-

What features does airSlate SignNow offer for managing tax exempt forms Texas?

airSlate SignNow offers features like customizable templates, secure eSignature capabilities, cloud storage, and real-time tracking for tax exempt forms Texas. These features ensure a streamlined workflow, making it easier to manage documentation requirements promptly.

-

How long does it take to setup airSlate SignNow for tax exempt forms Texas?

Setting up airSlate SignNow for managing tax exempt forms Texas is quick and straightforward—often requiring just a few minutes. Once registered, users can easily create and access templates specifically designed for tax exempt declarations.

-

Can I integrate airSlate SignNow with other software for handling tax exempt forms Texas?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions, enhancing your ability to handle tax exempt forms Texas efficiently. Whether you're using accounting software or CRMs, the integration can signNowly streamline your paperwork process.

-

Is the eSigning process for tax exempt forms Texas secure?

Yes, airSlate SignNow employs industry-leading security measures to ensure that the eSigning process for tax exempt forms Texas is secure. All documents are encrypted, and users can audit and track changes to maintain compliance and integrity.

Get more for Tax Exempt Form

- Sga form

- Uganda martyrs university ngetta campus form

- Download job application form for mcdonaldamp39s application form org images pcmac

- Norway radiographer registration form

- Osha training toolbox talk basic electrical safety stay aware of overhead power lines form

- Santa clara county civil grand jury complaint form

- Retireesurvivor of retiree contact information change form

- Riverside lawyer referral service form

Find out other Tax Exempt Form

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure