Rcg Massachusetts Rental Application Form

What is the Massachusetts Rental Application?

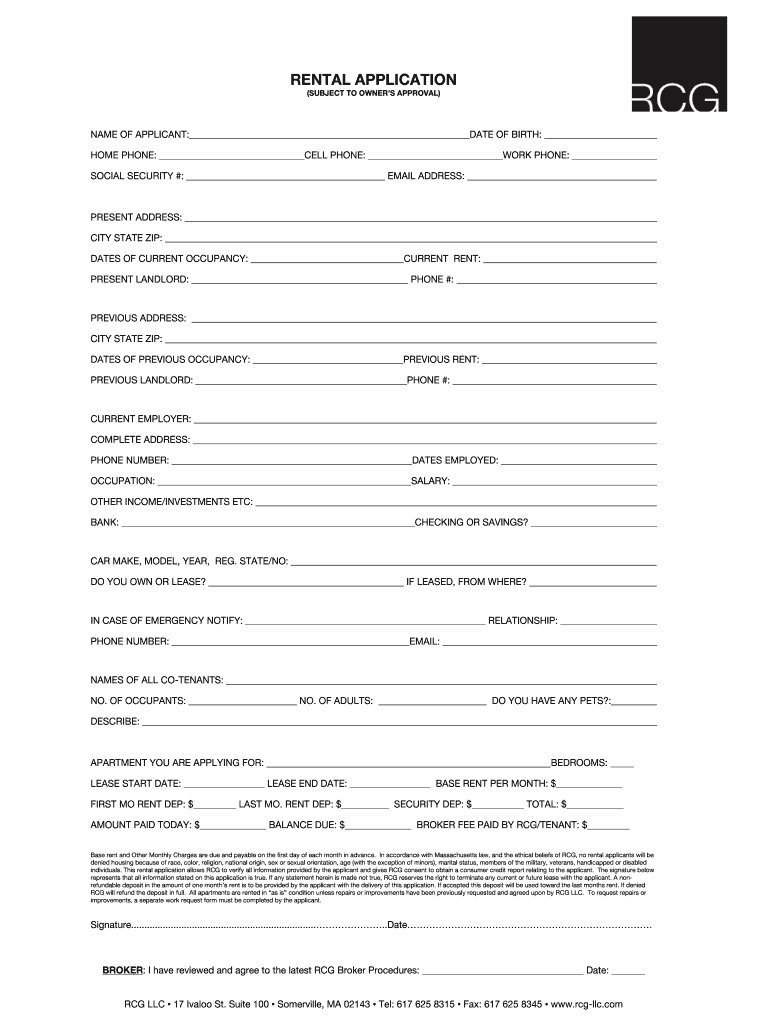

The Massachusetts rental application is a document used by landlords to collect essential information from potential tenants. This form typically includes personal details such as the applicant's name, contact information, employment history, income, and references. It serves as a preliminary screening tool to help landlords assess the suitability of applicants for rental properties. By gathering this information, landlords can make informed decisions regarding lease agreements.

Key Elements of the Massachusetts Rental Application

A comprehensive Massachusetts rental application should include the following key elements:

- Personal Information: Full name, date of birth, and social security number.

- Contact Details: Current address, phone number, and email address.

- Employment History: Current employer, job title, and income verification.

- Rental History: Previous addresses, landlord contact information, and duration of stay.

- References: Personal or professional references who can vouch for the applicant's character.

- Consent for Background Check: Authorization for the landlord to conduct credit and background checks.

Steps to Complete the Massachusetts Rental Application

Completing the Massachusetts rental application involves several straightforward steps:

- Gather necessary information, including personal details and employment history.

- Fill out the application form accurately, ensuring all sections are completed.

- Review the application for any errors or omissions before submission.

- Sign the application to authorize background checks and confirm the accuracy of the information provided.

- Submit the application to the landlord or property management company, either online or in person.

Legal Use of the Massachusetts Rental Application

The Massachusetts rental application must comply with state laws to ensure it is legally binding and enforceable. Landlords are required to follow fair housing laws, which prohibit discrimination based on race, color, religion, sex, national origin, familial status, or disability. Additionally, the application should not request information that could lead to discriminatory practices. It is advisable for landlords to keep the application process transparent and consistent for all applicants.

How to Obtain the Massachusetts Rental Application

The Massachusetts rental application can be obtained in various ways:

- Online: Many property management websites offer downloadable templates of the rental application.

- Local Real Estate Offices: Real estate agencies often provide rental application forms for their listings.

- Legal Document Services: Websites that specialize in legal forms may have customizable rental application templates.

Digital vs. Paper Version of the Massachusetts Rental Application

Both digital and paper versions of the Massachusetts rental application serve the same purpose, but they offer different advantages. The digital version allows for easier storage, sharing, and completion. It can be filled out and signed electronically, streamlining the application process. On the other hand, a paper version may be preferred by those who are more comfortable with traditional methods or lack access to technology. Regardless of the format, it is essential to ensure that the application is completed accurately and submitted promptly.

Quick guide on how to complete printable rental application pdf rcg llccom

Ensure Proper Details on Rcg Massachusetts Rental Application

Negotiating contracts, managing listings, organizing meetings, and showings—real estate agents and industry experts juggle a variety of responsibilities daily. Many of these responsibilities involve numerous documents, such as Rcg Massachusetts Rental Application, that need to be completed swiftly and as accurately as possible.

airSlate SignNow is a comprehensive solution that assists professionals in the real estate field in reducing the document load, allowing them to focus more on their clients’ objectives throughout the entire negotiation process and helping them secure the best conditions on the agreement.

How to complete Rcg Massachusetts Rental Application using airSlate SignNow:

- Access the Rcg Massachusetts Rental Application page or utilize our library’s search functions to find what you require.

- Click Get form—you will be taken directly to the editor.

- Begin completing the document by selecting fillable fields and entering your information into them.

- Add additional text and modify its settings if needed.

- Select the Sign option in the upper toolbar to generate your eSignature.

- Explore other features available to annotate and refine your form, such as drawing, highlighting, adding shapes, etc.

- Access the note tab and add remarks regarding your document.

- Conclude the process by downloading, sharing, or sending your document to your designated users or organizations.

Bid farewell to paper permanently and enhance the homebuying process with our intuitive and powerful platform. Experience increased efficiency when signNowing Rcg Massachusetts Rental Application and other real estate documents online. Try our solution!

Create this form in 5 minutes or less

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How many application forms does a person need to fill out in his/her lifetime?

As many as you want to !

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the printable rental application pdf rcg llccom

How to make an eSignature for the Printable Rental Application Pdf Rcg Llccom in the online mode

How to generate an electronic signature for your Printable Rental Application Pdf Rcg Llccom in Google Chrome

How to make an eSignature for putting it on the Printable Rental Application Pdf Rcg Llccom in Gmail

How to make an electronic signature for the Printable Rental Application Pdf Rcg Llccom straight from your mobile device

How to create an electronic signature for the Printable Rental Application Pdf Rcg Llccom on iOS devices

How to create an eSignature for the Printable Rental Application Pdf Rcg Llccom on Android devices

People also ask

-

What is a rental application Massachusetts PDF?

A rental application Massachusetts PDF is a standardized document that landlords use to collect information about potential tenants. This form typically includes personal details, rental history, and financial information, allowing landlords to make informed decisions about who to rent to.

-

How can I create a rental application Massachusetts PDF using airSlate SignNow?

With airSlate SignNow, you can easily create a rental application Massachusetts PDF by utilizing our customizable templates. Simply select the template, edit it to fit your requirements, and save it as a PDF for easy distribution and eSignature.

-

Is there a cost associated with using the rental application Massachusetts PDF feature on airSlate SignNow?

airSlate SignNow offers flexible pricing plans that include access to the rental application Massachusetts PDF feature. Depending on your business needs, you can choose a plan that fits your budget while enjoying industry-leading document management capabilities.

-

What are the key benefits of using a rental application Massachusetts PDF?

Utilizing a rental application Massachusetts PDF allows landlords to streamline the tenant screening process. It provides a uniform way to collect essential tenant information, reduces paperwork, and enhances the professionalism of your property management practices.

-

Can I integrate airSlate SignNow with other applications for handling rental applications?

Yes, airSlate SignNow offers various integrations with popular real estate and property management platforms. This enables you to seamlessly incorporate rental application Massachusetts PDF documents into your existing workflows, making tenant management more efficient.

-

Are there any mobile options available for completing a rental application Massachusetts PDF?

Absolutely! airSlate SignNow is optimized for mobile use, allowing prospective tenants to fill out and eSign rental application Massachusetts PDF forms from their smartphones or tablets. This flexibility increases convenience for users and speeds up the application process.

-

What features does airSlate SignNow provide for managing rental applications?

airSlate SignNow provides robust features for managing rental applications, including document tracking, automated reminders, and secure eSigning. These tools are designed to enhance your workflow and ensure that the rental application Massachusetts PDF process is quick and hassle-free.

Get more for Rcg Massachusetts Rental Application

Find out other Rcg Massachusetts Rental Application

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word