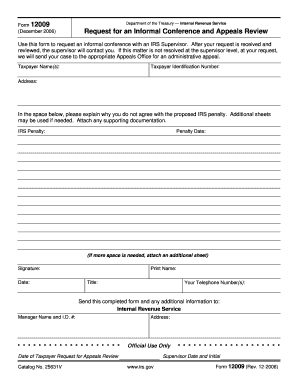

Form 12009

What is the Form 12009

The Form 12009 is an official document used by the Internal Revenue Service (IRS) for specific tax-related purposes. This form serves as a declaration for individuals or entities that need to report certain financial activities or changes. Understanding the purpose of the form is essential for compliance with IRS regulations and for ensuring accurate tax reporting.

How to use the Form 12009

Using the Form 12009 involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents and data relevant to the form. Next, fill out the form carefully, ensuring that each section is completed with accurate information. It is crucial to review the form for any errors before submission, as inaccuracies can lead to delays or penalties. Once completed, the form can be submitted according to the specified guidelines.

Steps to complete the Form 12009

Completing the Form 12009 requires a systematic approach to ensure accuracy and compliance. Here are the key steps:

- Review the IRS Form 12009 instructions carefully to understand the requirements.

- Gather all necessary financial documents, including income statements and relevant tax records.

- Fill out the form, paying close attention to each section and ensuring all information is accurate.

- Double-check the completed form for any errors or omissions.

- Submit the form according to the IRS guidelines, either electronically or via mail.

Legal use of the Form 12009

The legal use of the Form 12009 is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted in a timely manner. Compliance with the IRS requirements ensures that the form is legally binding and can be used in any necessary legal contexts. It is important to maintain copies of the submitted form and any related documentation for future reference.

Form Submission Methods

The Form 12009 can be submitted through various methods, depending on the preferences of the filer. The primary submission methods include:

- Online Submission: Many filers choose to submit the form electronically through the IRS e-filing system, which offers a quick and efficient way to file.

- Mail Submission: For those who prefer traditional methods, the form can be printed and mailed to the appropriate IRS address as specified in the instructions.

- In-Person Submission: Filers may also visit local IRS offices to submit the form in person, ensuring that it is received directly by IRS personnel.

Filing Deadlines / Important Dates

Filing deadlines for the Form 12009 are critical to avoid penalties and ensure compliance with IRS regulations. Typically, the form must be submitted by the designated due date, which may vary based on the specific tax situation of the filer. It is essential to stay informed about these dates and plan accordingly to ensure timely submission.

Quick guide on how to complete form 12009

Prepare Form 12009 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the resources needed to create, modify, and electronically sign your documents swiftly without any holdups. Manage Form 12009 from any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign Form 12009 without hassle

- Find Form 12009 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or mislaid documents, time-consuming form searches, and errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 12009 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 12009

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 12009 and how can airSlate SignNow help?

Form 12009 is a key document often required for various business processes. With airSlate SignNow, you can effortlessly create, send, and eSign form 12009, ensuring that the entire process is legally binding and secure, making it easier to manage your paperwork.

-

Is there a cost associated with using airSlate SignNow for form 12009?

Yes, airSlate SignNow offers flexible pricing plans to suit different business needs. Whether you require basic features or advanced integrations for handling form 12009, you can choose a subscription that aligns with your budget while maximizing efficiency.

-

What features does airSlate SignNow offer for processing form 12009?

airSlate SignNow provides a variety of features tailored for processing form 12009, including customizable templates, automatic reminders, and comprehensive tracking capabilities. These tools streamline your workflow and increase the speed of document turnaround.

-

Can I integrate airSlate SignNow with other software for form 12009?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as CRM systems and cloud storage services, making it easier to manage form 12009 alongside your other business tools without losing efficiency.

-

What benefits does airSlate SignNow provide for using form 12009?

Using airSlate SignNow for form 12009 offers numerous benefits, including enhanced security through encrypted signatures, reduced processing times, and increased operational efficiency. The intuitive platform ensures that even users with minimal tech skills can navigate the signing process.

-

How can I ensure my form 12009 is secure when using airSlate SignNow?

airSlate SignNow prioritizes security by employing advanced encryption and compliance with industry standards. When you create and send form 12009 through our platform, you can be assured that your sensitive data is protected at all times.

-

Is it easy to track the status of form 12009 with airSlate SignNow?

Yes, tracking the status of form 12009 is straightforward with airSlate SignNow. You will receive real-time notifications as recipients interact with the document, allowing you to stay updated on the signing progress and follow up as needed.

Get more for Form 12009

- Dss 1515 foster home fire inspection safety report info dhhs state nc form

- P46 employee without a form p45 hays plc

- Ownership declaration form

- Ins vir doc form

- Even faster web sites pdf form

- Ccys referral form wakulla county schools wakulla schooldesk

- Powered by tc pdf www tcpdf orgel5florida high form

- 20142015 player sponsorship form brevardsoccer

Find out other Form 12009

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement