Plexus 1099 Form

What is the Plexus 1099

The Plexus 1099 is a tax form issued by Plexus Worldwide, primarily used to report income earned by independent contractors and affiliates. This form is crucial for individuals who receive payments from Plexus for services rendered or products sold. It provides essential details, such as the total amount earned during the tax year, which is reported to the Internal Revenue Service (IRS). Understanding this form is vital for accurate tax reporting and compliance.

How to obtain the Plexus 1099

To obtain your Plexus 1099, you must first ensure that your tax information is correctly entered in your Plexus back office. Typically, the form is made available online through your account by January 31 of each year. If you cannot find the form in your account, you may need to contact Plexus customer support for assistance. It's important to keep your contact information updated to receive notifications regarding your tax documents.

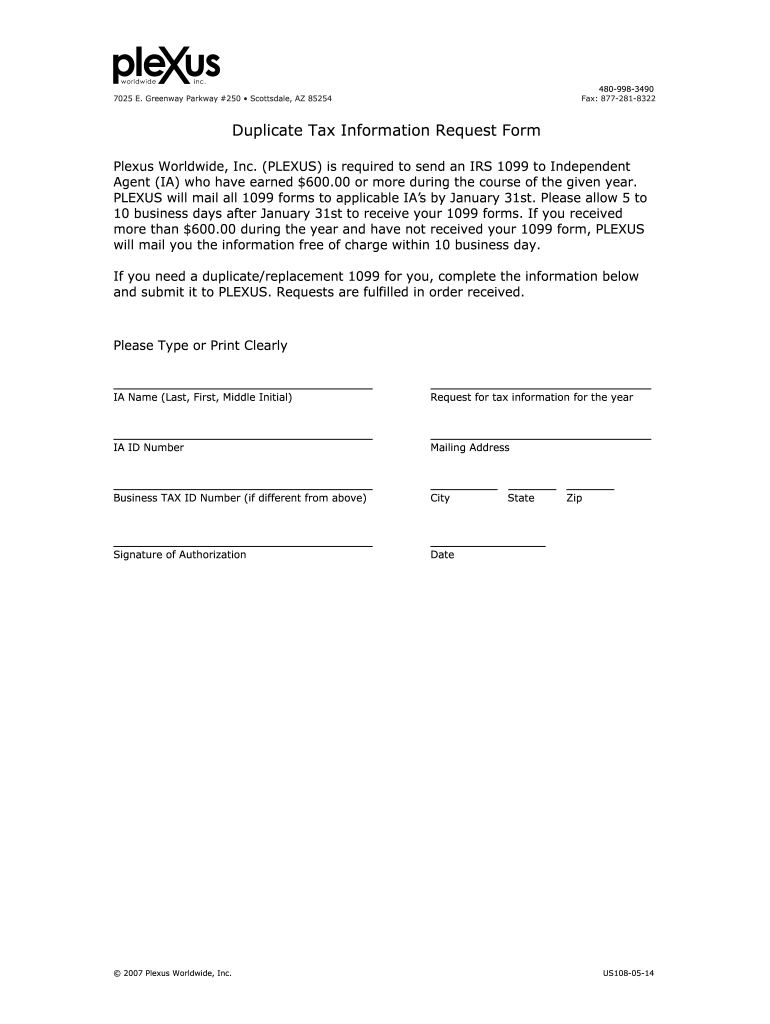

Steps to complete the Plexus 1099

Completing the Plexus 1099 involves several steps:

- Gather all relevant income information from your Plexus back office.

- Review the details on the 1099 to ensure accuracy, including your name, address, and Social Security number.

- Fill out the necessary sections, including the total income earned.

- Consult with a tax professional if you have questions about reporting this income.

- Submit the completed form to the IRS by the appropriate deadline.

Legal use of the Plexus 1099

The Plexus 1099 is legally binding and must be used in accordance with IRS regulations. It serves as an official record of income and is necessary for filing your federal tax return. To ensure compliance, it is essential to report the income listed on the form accurately. Failure to do so may result in penalties or audits from the IRS.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Plexus 1099. The IRS requires that the form be sent to recipients by January 31 of each year. Additionally, the completed form must be submitted to the IRS by the end of February if filing by paper, or by March 31 if filing electronically. Staying informed about these dates helps avoid penalties for late submissions.

Who Issues the Form

The Plexus 1099 is issued by Plexus Worldwide, which is responsible for providing accurate income reporting for its affiliates and independent contractors. The company compiles the necessary income data throughout the year and generates the form for distribution. Understanding who issues the form is important for ensuring that you receive the correct documentation needed for your tax filings.

Quick guide on how to complete plexus 1099

Complete Plexus 1099 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the correct version and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly and without complications. Handle Plexus 1099 on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign Plexus 1099 with ease

- Locate Plexus 1099 and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal authority as a handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in a few clicks from any device you prefer. Edit and eSign Plexus 1099 and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the plexus 1099

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Plexus Evo and how does it work?

Plexus Evo is an innovative document management solution offered by airSlate SignNow that enables users to effortlessly send and eSign documents. It streamlines the entire signing process, making it fast and efficient while ensuring security and compliance. With Plexus Evo, businesses can increase productivity by managing all document workflows in one user-friendly platform.

-

What are the key features of Plexus Evo?

Plexus Evo includes a range of powerful features designed to enhance document management. Key features include customizable templates, automated reminders for signers, and robust tracking capabilities. Additionally, Plexus Evo supports team collaboration, enabling multiple users to work on documents simultaneously while tracking changes.

-

How does Plexus Evo integrate with other tools?

Plexus Evo seamlessly integrates with various third-party applications, including CRM systems, cloud storage solutions, and project management tools. This allows businesses to incorporate eSigning into their existing workflows without disruption. The integration capabilities enhance user experience by making document management more cohesive.

-

What are the benefits of using Plexus Evo for businesses?

Using Plexus Evo offers signNow advantages for businesses, such as reduced turnaround time for document signing and improved efficiency in operations. By simplifying the signing process, Plexus Evo helps organizations save time and resources, allowing them to focus on core business functions. Furthermore, enhanced security measures provide peace of mind regarding sensitive information.

-

How much does Plexus Evo cost?

Plexus Evo offers competitive pricing plans tailored to meet the varying needs of businesses. The pricing structure is designed to provide cost-effective solutions whether you are a small business or an enterprise. Interested customers can find detailed information about the pricing plans on the airSlate SignNow website.

-

Is Plexus Evo suitable for large enterprises?

Yes, Plexus Evo is highly suitable for large enterprises that require robust document management and eSigning capabilities. Its scalability ensures that it can handle high volumes of documentation without compromising performance. Additionally, Plexus Evo's extensive feature set supports complex workflows typical in large organizations.

-

Can I try Plexus Evo before committing to a plan?

Absolutely! airSlate SignNow offers a free trial for Plexus Evo, allowing potential users to explore its features and functionalities risk-free. This trial period enables businesses to evaluate how Plexus Evo fits their document management needs before making a financial commitment.

Get more for Plexus 1099

Find out other Plexus 1099

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe