Client Data Sheet for Taxes Form

What is the Client Data Sheet for Taxes

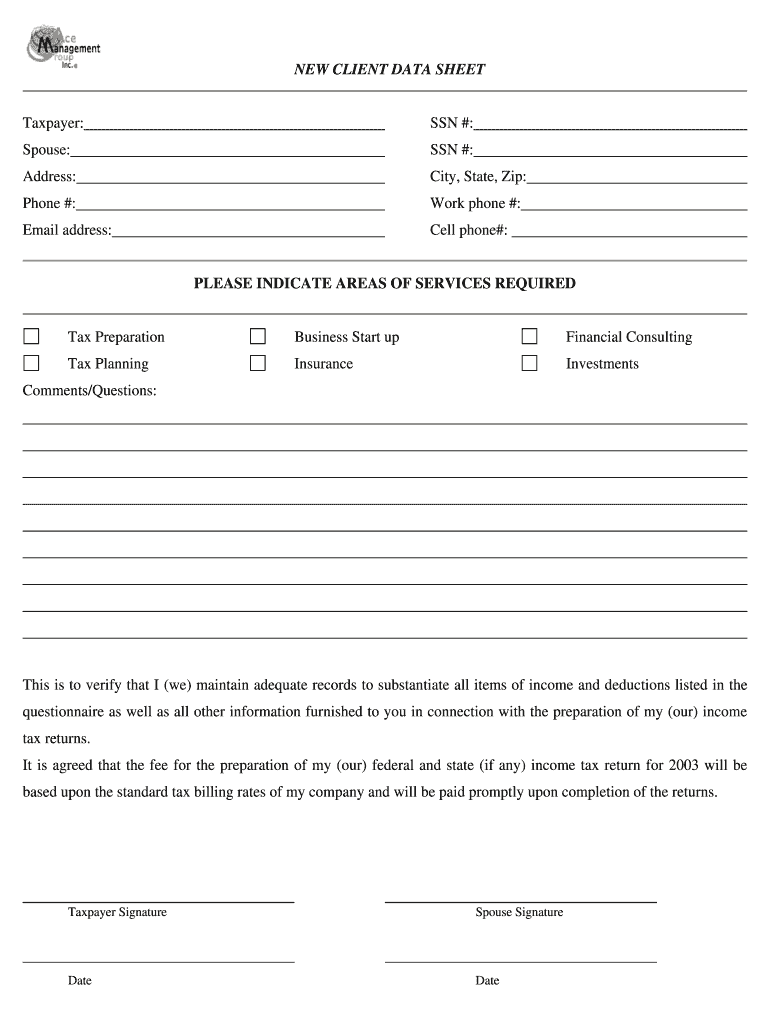

The Client Data Sheet for Taxes, often referred to as a tax preparation client intake form, is a comprehensive document designed to gather essential information from clients preparing their tax returns. This form collects personal details, financial information, and specific tax-related data necessary for accurate tax preparation. It serves as a foundational tool for tax preparers, ensuring they have all relevant information to maximize deductions and comply with IRS regulations.

Key Elements of the Client Data Sheet for Taxes

A well-structured Client Data Sheet for Taxes includes several key elements that are crucial for effective tax preparation. These typically encompass:

- Personal Information: Client's name, address, Social Security number, and contact information.

- Filing Status: Information regarding whether the client is single, married, or head of household.

- Income Sources: Details about wages, self-employment income, dividends, and other income types.

- Deductions and Credits: Information about potential deductions, such as mortgage interest, medical expenses, and education credits.

- Previous Tax Returns: Access to prior tax returns can help identify carryover items and ensure consistency.

Steps to Complete the Client Data Sheet for Taxes

Completing the Client Data Sheet for Taxes involves several straightforward steps. Clients should follow these guidelines to ensure accuracy:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill in personal information accurately, ensuring names and Social Security numbers are correct.

- Provide details about all sources of income, including self-employment and investment income.

- List any deductions or credits that may apply, referencing supporting documentation.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the Client Data Sheet for Taxes

The Client Data Sheet for Taxes is legally binding when filled out accurately and signed by the client. It is essential for tax preparers to ensure compliance with IRS guidelines and state regulations. The information provided on this form can be used to prepare tax returns, and any discrepancies may lead to penalties or audits. Therefore, both clients and tax preparers must treat this document with care and diligence.

IRS Guidelines

The IRS provides specific guidelines regarding the information required for tax preparation. Tax preparers should ensure that the Client Data Sheet for Taxes aligns with these guidelines to avoid issues during filing. This includes understanding what documentation is necessary to support claims for deductions and credits, as well as ensuring that all income is reported accurately. Following IRS guidelines helps maintain compliance and reduces the risk of audits.

Required Documents

Clients should prepare a set of required documents to complete the Client Data Sheet for Taxes effectively. Commonly needed documents include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Records of other income sources, such as rental or investment income.

- Documentation for deductions, including receipts for charitable contributions and medical expenses.

- Previous year’s tax return for reference.

Quick guide on how to complete income tax forms

Discover how to effortlessly navigate the Client Data Sheet For Taxes process with this simple guide

E-filing and submitting forms online is gaining ground and becoming the preferred option for numerous clients. It offers several benefits compared to traditional printed materials, including convenience, time savings, improved precision, and security.

With tools like airSlate SignNow, you can find, modify, validate, enhance, and transmit your Client Data Sheet For Taxes without getting stuck in endless printing and scanning. Follow this quick tutorial to begin and complete your document.

Apply these instructions to acquire and complete Client Data Sheet For Taxes

- Start by clicking the Get Form button to access your document in our editor.

- Be guided by the green label on the left indicating required fields so you don’t skip any.

- Utilize our advanced features to comment, modify, sign, secure, and refine your document.

- Protect your file or transform it into a fillable form using the appropriate tab tools.

- Review the document for errors or inconsistencies.

- Press DONE to complete the editing process.

- Rename your document or keep it as is.

- Select the storage service you wish to use for saving your document, send it via USPS, or click the Download Now button to retrieve your file.

If Client Data Sheet For Taxes isn’t what you were looking for, feel free to explore our extensive library of pre-filled forms that you can fill out with minimal effort. Experience our platform today!

Create this form in 5 minutes or less

FAQs

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

If poker is your only profession and you have no other sources of income, how do you pay taxes for that in India? Which ITR forms should I fill out?

As per Section 115BB of the Income tax Act, 1961 any income of winnings from any lottery or crossword puzzle or race including horse race or card game and other game of any sort or from gambling or betting of any form or nature whatsoever (which includes income from poker) is taxable at 30% plus education cess of 3% (Total 30.9%). There is not benefit of basic exemption limit but Chapter VIA deductions are available i.e. section 80C, 80 D and other seciton 80- deductions. TDS is also deductible at 30%.

-

What are some things people coming out of highschool should know?

How to manage finances. Balancing a checkbook, investing, saving, budgeting. ( NEVER LOAN $$$$ to family or friends, and never believe the old "I'll pay you back as soon as I get my tax refund",,,,. the odds are against you and more likely to create bigger problems! You NEVER solve money problems by throwing more money st that problem.How to have a discussion, argument, even a fight with your SO or other adults..,but using rules where you don't insult/yell/scream/touch with anger/be condescending /curse or any other bad thing to or at your partner!!! Really LISTEN, than think about what was just said and reflect…. THEN respond. Never ever ever break these rules especially in front of children. Go for a walk and have your discussion anywhere, just don't do it in front of kids , no kids should never hear adult issues or be used as pawns!!!DON'T use " but " in arguments or excuses…..it invalidates anything said before it! ( I love you, BUT you're annoying = you're annoying )How to manage your own independent living space or home. That includes cooking /cleaning /shopping/ laundry /pet care /bill paying ,Your vehicle- you should know how to change a tire, how to refill air in tires to proper psi, know where to and how to replace fluids/check fluids:, I know if there are only specific fluids you should use , and how to check and edo general maintenance.How to read a road map.How to get and manage a job interview. How to make your resume , how to dress for an interview, how to prepare for an interview,how to practice for an interview, pre-research the job and company-know what the average starting salary for that position is, check into benefits, and vacation time, etc. practice what questions you should ask the interviewer during the interview.

Create this form in 5 minutes!

How to create an eSignature for the income tax forms

How to make an electronic signature for the Income Tax Forms in the online mode

How to create an eSignature for the Income Tax Forms in Chrome

How to make an electronic signature for putting it on the Income Tax Forms in Gmail

How to generate an eSignature for the Income Tax Forms straight from your smartphone

How to make an electronic signature for the Income Tax Forms on iOS devices

How to make an electronic signature for the Income Tax Forms on Android OS

People also ask

-

What is a tax preparation client intake form template PDF?

A tax preparation client intake form template PDF is a standardized document that helps tax professionals collect essential information from their clients. This template ensures all necessary data is gathered efficiently, streamlining the tax preparation process and enhancing client communication.

-

How can airSlate SignNow help with tax preparation client intake form template PDFs?

airSlate SignNow provides an easy-to-use platform to create, send, and eSign tax preparation client intake form template PDFs. With its efficient document workflow management, tax professionals can quicken the intake process, focus on providing better service, and maintain compliance with client data protection standards.

-

Is there a cost associated with using the tax preparation client intake form template PDF?

airSlate SignNow offers competitive pricing plans that cater to varying business needs. Users can access features for managing their tax preparation client intake form template PDF effectively, ensuring a cost-effective solution for all document signing and management requirements.

-

Can I customize the tax preparation client intake form template PDF?

Yes, airSlate SignNow allows full customization of your tax preparation client intake form template PDF. You can add your branding, modify fields, and ensure the form meets your specific requirements, making it a fully tailored solution for your tax preparation needs.

-

What features does airSlate SignNow offer for tax preparation client intake forms?

airSlate SignNow offers a variety of features for tax preparation client intake forms, including eSigning capabilities, secure document storage, and real-time tracking of document status. These features streamline the client intake process, helping you handle documents efficiently.

-

Are there integrations available for managing the tax preparation client intake form template PDF?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software tools, ensuring that your tax preparation client intake form template PDF is effortlessly incorporated into your existing workflows. This enhances productivity and maintains data accuracy between systems.

-

How does using a tax preparation client intake form template PDF benefit my business?

Utilizing a tax preparation client intake form template PDF improves your business efficiency by standardizing client data collection. It reduces errors, speeds up the processing time, and enhances the client experience, leading to higher satisfaction and potential for repeat business.

Get more for Client Data Sheet For Taxes

- University of kentucky accident report form

- Medical seat belt waiver form

- Louisiana dept of transportation and development gov form

- Alaskaunited states trade representative form

- Alaska application voluntary pdf form

- Alaska gas storage facility tax credit early cessation of operations form

- Specified credits not eligible small business form

- Alaska qualified in state oil refinery infrastructure form

Find out other Client Data Sheet For Taxes

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document