Tc 318 Utah 2016-2026

What is the TC 318 Utah

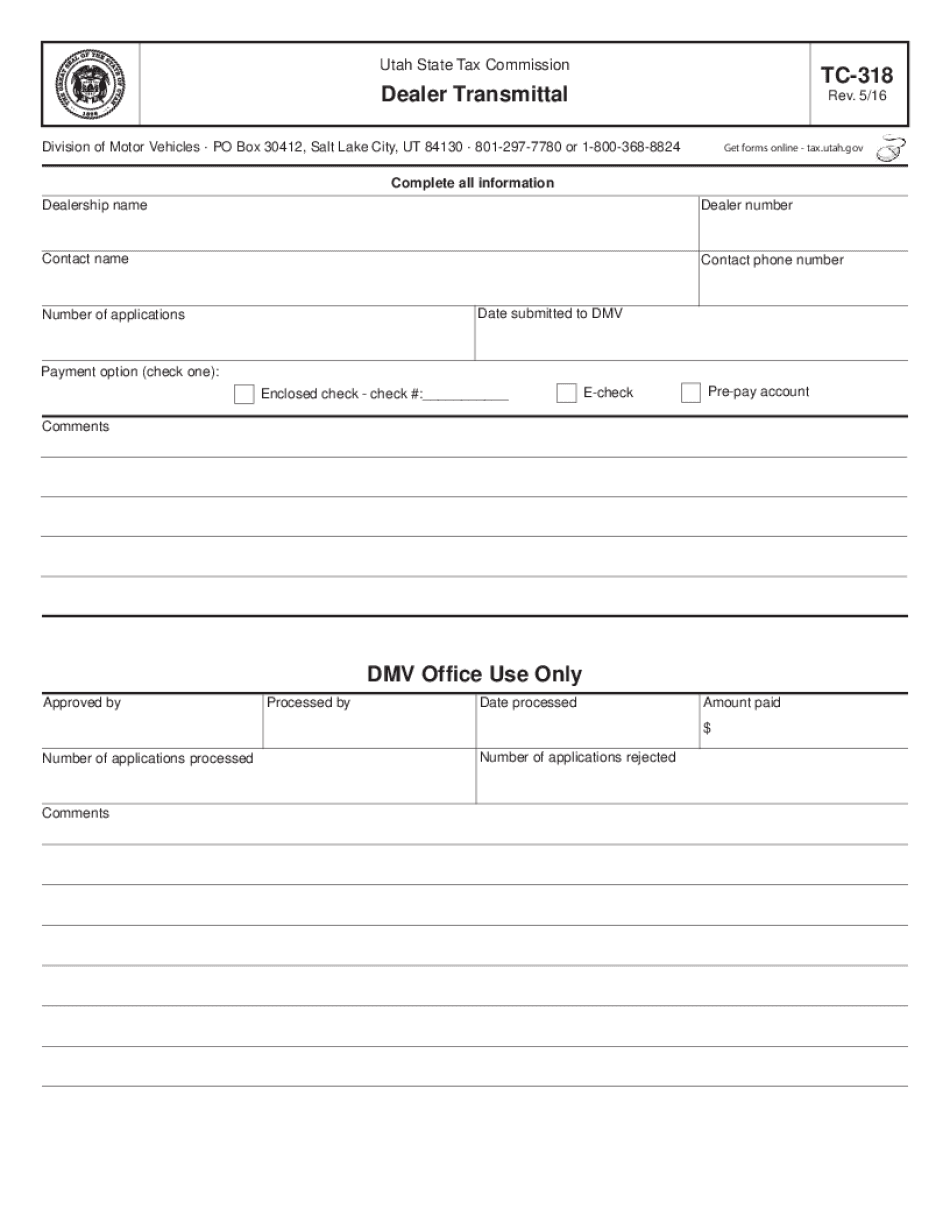

The TC 318 is a specific form used in Utah for the dealer transmittal process. This form is essential for vehicle dealers who need to report sales and other transactions to the Utah Tax Commission. It serves as a record of the transactions and ensures compliance with state tax regulations. By utilizing the TC 318, dealers can streamline their reporting processes and maintain accurate records of their sales activities.

How to use the TC 318 Utah

Using the TC 318 involves several steps to ensure accurate completion. Dealers must first gather all necessary information related to their vehicle sales, including buyer details, vehicle identification numbers, and sale prices. Once the required data is compiled, dealers can fill out the TC 318 form, ensuring that all fields are completed accurately. After completing the form, it must be submitted to the Utah Tax Commission either electronically or via mail, depending on the dealer's preference.

Steps to complete the TC 318 Utah

Completing the TC 318 involves a systematic approach to ensure accuracy and compliance. Here are the steps to follow:

- Gather all relevant transaction information, including buyer details and vehicle specifics.

- Access the TC 318 form, which can be obtained from the Utah Tax Commission's website or through authorized dealers.

- Fill out the form with the necessary details, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Utah Tax Commission through the chosen method, either electronically or by mail.

Legal use of the TC 318 Utah

The TC 318 is legally recognized as a valid document for reporting vehicle sales in Utah. To ensure its legal standing, dealers must adhere to specific guidelines set forth by the Utah Tax Commission. This includes providing accurate information, submitting the form by the designated deadlines, and maintaining compliance with state tax laws. Proper use of the TC 318 helps protect dealers from potential legal issues related to tax compliance.

Required Documents

To successfully complete and submit the TC 318, dealers must have several documents on hand. These typically include:

- Sales invoices for each vehicle sold.

- Proof of ownership documents, such as titles or bills of sale.

- Identification documents for the buyer.

- Any additional documentation required by the Utah Tax Commission.

Form Submission Methods

The TC 318 can be submitted to the Utah Tax Commission through various methods. Dealers have the option to file the form electronically, which is often the preferred method for its speed and efficiency. Alternatively, the form can be mailed to the appropriate address provided by the Utah Tax Commission. In-person submissions may also be accepted at designated locations, allowing for direct interaction with tax officials if needed.

Quick guide on how to complete tc 318 utah

Prepare Tc 318 Utah seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Tc 318 Utah on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-centered operation today.

How to modify and eSign Tc 318 Utah effortlessly

- Find Tc 318 Utah and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes just a few seconds and holds the same legal validity as a traditional ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow simplifies all your document management needs in just a few clicks from any device of your choice. Modify and eSign Tc 318 Utah to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 318 utah

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tc 318 utah and how can it benefit my business?

TC 318 Utah refers to a specific template or format used in document management and eSign processes. Utilizing airSlate SignNow with tc 318 Utah can streamline your document transactions, reduce errors, and enhance compliance. This can lead to improved efficiency and cost savings for your business.

-

How much does it cost to use airSlate SignNow with tc 318 utah?

The pricing for airSlate SignNow varies based on the plan you choose. There are options suitable for businesses of all sizes, including those who focus on templates like tc 318 Utah. We offer flexible pricing tiers that can accommodate different document and signing needs.

-

What features does airSlate SignNow provide for tc 318 utah signature workflows?

AirSlate SignNow offers a range of features tailored for tc 318 Utah workflows, such as customizable templates, real-time tracking, and automated reminders. These features ensure a smoother signing experience and help manage your documents effectively. You can access your documents anytime, anywhere, leading to increased productivity.

-

Can tc 318 utah integrate with other software tools?

Yes, airSlate SignNow allows for seamless integration with a variety of software applications, enhancing the utility of tc 318 Utah for your business. This includes CRM systems, cloud storage services, and more. These integrations enable a more cohesive workflow and improve your overall document management process.

-

Is airSlate SignNow secure for using tc 318 utah documents?

Absolutely! AirSlate SignNow prioritizes security, employing advanced encryption methods to protect your tc 318 Utah documents during transmission and storage. Our compliance with industry standards ensures that your sensitive information is handled safely, giving you peace of mind as you manage your eSign processes.

-

How does using tc 318 utah save time in document management?

Utilizing airSlate SignNow for tc 318 Utah can signNowly reduce the time spent on document management by automating repetitive tasks such as signing and sending. With our user-friendly interface, you can quickly create, distribute, and receive signed documents. This efficiency allows your team to focus on more strategic initiatives.

-

What support does airSlate SignNow provide for tc 318 utah users?

AirSlate SignNow offers comprehensive customer support for users implementing tc 318 Utah. Our team is available through various channels, including chat, email, and phone, to assist with any questions or challenges. Additionally, there are extensive resources and tutorials available to help you navigate our platform effectively.

Get more for Tc 318 Utah

- Jefferson transit fixed route mits program healthcare professional authorization form

- Johns creek fence permit form

- Form 6781

- Rental listing agreement form

- Exam form chiropractic chiroassistantscom

- Fillable online san joaquin county fbn 042015 docx fax form

- Agent signature permit form city of plantation plantation

- Javelin pdf reader review form

Find out other Tc 318 Utah

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement