Great American Annuity Forms

What is the Great American Annuity Forms

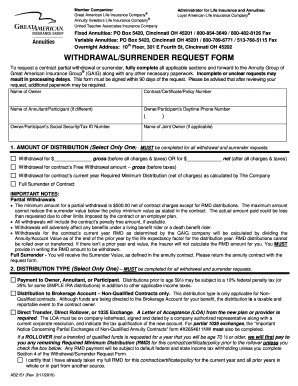

The Great American Annuity forms are essential documents used for various transactions and requests related to annuities offered by the Great American Life Insurance Company. These forms facilitate processes such as withdrawals, surrenders, and changes in beneficiary designations. Understanding these forms is crucial for policyholders to manage their annuity contracts effectively.

How to use the Great American Annuity Forms

Using the Great American Annuity forms involves several straightforward steps. First, identify the specific form you need based on your transaction type, such as the withdrawal or surrender request. Next, gather any necessary information, including your contract number and personal identification details. Complete the form accurately, ensuring all required fields are filled out. Finally, submit the form through the designated method, whether online, by mail, or in person, ensuring you keep a copy for your records.

Steps to complete the Great American Annuity Forms

Completing the Great American Annuity forms requires careful attention to detail. Follow these steps:

- Obtain the correct form from the Great American Life Insurance Company website or customer service.

- Fill in your personal information, including your name, address, and policy number.

- Provide details specific to your request, such as the amount you wish to withdraw or surrender.

- Sign and date the form, ensuring that your signature matches the one on file with the company.

- Review the completed form for accuracy before submission.

Legal use of the Great American Annuity Forms

The legal use of the Great American Annuity forms is governed by specific regulations that ensure their validity. To be considered legally binding, the forms must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This compliance guarantees that electronic signatures and submissions are recognized as valid, provided that the forms are completed correctly and submitted through authorized channels.

Key elements of the Great American Annuity Forms

Key elements of the Great American Annuity forms include:

- Policyholder Information: Essential personal details of the annuity holder.

- Transaction Type: Specification of whether the form is for a withdrawal, surrender, or other requests.

- Signature: Required for authentication, ensuring the request is legitimate.

- Date: The date of submission, which may affect processing times.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Great American Annuity forms can be done through various methods. Options include:

- Online Submission: Many forms can be completed and submitted electronically through the Great American Life Insurance Company website.

- Mail: Completed forms can be printed and sent via postal service to the designated address provided on the form.

- In-Person: Policyholders may also choose to submit their forms in person at a local office or authorized representative.

Quick guide on how to complete great american annuity forms

Complete Great American Annuity Forms effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to access the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents promptly without delays. Handle Great American Annuity Forms on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Great American Annuity Forms without breaking a sweat

- Find Great American Annuity Forms and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Great American Annuity Forms and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the great american annuity forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a great american annuity?

A great american annuity is a financial product offered by Great American Insurance Company, designed to provide a steady stream of income during retirement. It allows policyholders to grow their savings through tax-deferred growth and offers various payout options. Additionally, this type of annuity can be customized to suit individual retirement needs.

-

How does the pricing for great american annuity work?

The pricing for a great american annuity typically involves an initial investment amount and may include annual fees based on the chosen plan. Factors such as the type of annuity, payout options, and additional riders can affect the overall cost. It's important to review the specific terms and benefits during the purchase process to understand any associated charges.

-

What are the key features of great american annuity?

Key features of the great american annuity include flexible premium payments, multiple investment options, and a range of payout structures that can be tailored to your retirement goals. Additionally, many great american annuities offer optional riders, such as long-term care benefits or death benefits, which enhance the policy's value and security.

-

What are the benefits of investing in a great american annuity?

Investing in a great american annuity offers benefits like guaranteed income for life, tax-deferred growth, and potential protection against market volatility. This financial product can also help ensure that your retirement savings last longer, providing peace of mind. Furthermore, the customizable nature of great american annuities allows you to structure your investment based on personal preferences.

-

Can I integrate the great american annuity with my existing retirement plans?

Yes, the great american annuity can often be integrated with existing retirement plans, such as 401(k)s or IRAs. This integration helps you create a comprehensive retirement strategy that maximizes your savings and income. It's advisable to consult with a financial advisor to determine the best approach for incorporating a great american annuity into your overall retirement plan.

-

Are there any withdrawal penalties associated with great american annuity?

Yes, there may be withdrawal penalties associated with the great american annuity, particularly if you withdraw funds before the specified surrender period. These penalties can vary depending on the terms of the annuity contract. Understanding the withdrawal rules and timelines outlined in your policy is crucial for effective financial planning.

-

How does a great american annuity compare to other investment options?

Compared to other investment options, a great american annuity provides unique benefits such as guaranteed income and tax-deferred growth that are not typically available with traditional investments. While stocks and mutual funds may offer higher potential returns, they also come with greater risk. Conversely, the great american annuity can act as a stable foundation in your investment portfolio, especially for retirement.

Get more for Great American Annuity Forms

Find out other Great American Annuity Forms

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy