Form 712 Rev December Life Insurance Statement 2024-2026

What is the IRS Form 712 Life Insurance Statement?

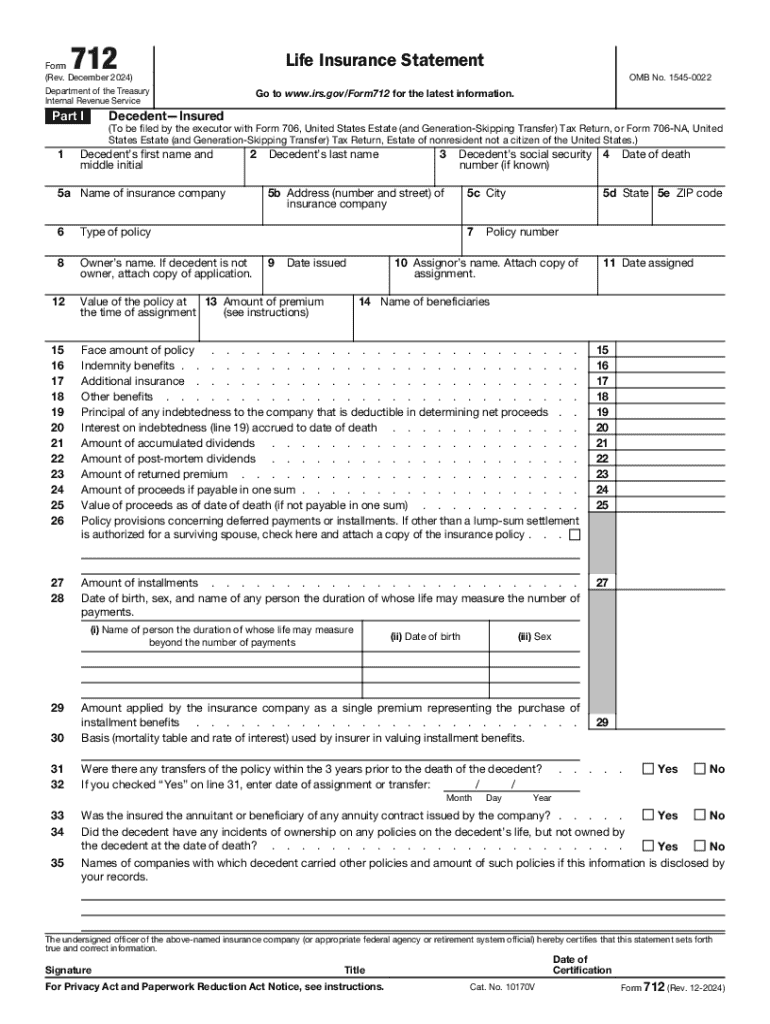

The IRS Form 712, also known as the Life Insurance Statement, is a document used to report the value of a life insurance policy for federal estate tax purposes. This form is essential for beneficiaries and estate executors to accurately disclose the value of life insurance proceeds that may be included in the gross estate of a deceased individual. The form provides detailed information about the policy, including the insured's name, the policy number, and the amount of insurance in force at the time of death.

How to Use the IRS Form 712 Life Insurance Statement

To effectively use the IRS Form 712, individuals must first gather all relevant information regarding the life insurance policy. This includes the name of the insured, the policy number, and the face value of the policy. Once this information is collected, the form can be filled out with the necessary details, ensuring accuracy to avoid potential issues with the IRS. After completing the form, it should be submitted along with the estate tax return, if applicable.

Steps to Complete the IRS Form 712 Life Insurance Statement

Completing the IRS Form 712 involves several key steps:

- Gather necessary information about the life insurance policy, including the insured's details and policy specifics.

- Fill in the form accurately, providing the required information such as the policy number and the face amount.

- Ensure that all entries are correct and reflect the current status of the policy at the time of the insured's death.

- Review the completed form for any errors before submission.

- Submit the form along with the estate tax return to the IRS.

Legal Use of the IRS Form 712 Life Insurance Statement

The IRS Form 712 is legally required for reporting life insurance values in the context of estate taxation. Failure to file this form accurately can lead to penalties or complications during the estate settlement process. It is crucial for executors and beneficiaries to understand the legal implications of this form, as it ensures compliance with federal tax laws and provides transparency regarding the insured's assets.

Key Elements of the IRS Form 712 Life Insurance Statement

Key elements of the IRS Form 712 include:

- The name and address of the insured individual.

- The name of the insurance company and the policy number.

- The face value of the policy at the time of the insured's death.

- The date of death of the insured.

- Any loans against the policy that may affect its value.

Filing Deadlines / Important Dates

When dealing with the IRS Form 712, it is important to be aware of filing deadlines. Generally, the form must be submitted along with the estate tax return, which is typically due nine months after the date of death of the insured. Extensions may be available, but it is essential to adhere to the original deadlines to avoid penalties.

Create this form in 5 minutes or less

Find and fill out the correct form 712 rev december life insurance statement

Create this form in 5 minutes!

How to create an eSignature for the form 712 rev december life insurance statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 712 and why is it important?

IRS Form 712 is a document used to report the value of life insurance policies for estate tax purposes. Understanding this form is crucial for estate planning, as it helps ensure compliance with tax regulations and accurate reporting of assets.

-

How can airSlate SignNow help with IRS Form 712?

airSlate SignNow simplifies the process of completing and eSigning IRS Form 712. Our platform allows users to easily fill out the form, gather necessary signatures, and securely send it, ensuring a smooth and efficient workflow.

-

Is there a cost associated with using airSlate SignNow for IRS Form 712?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions provide access to features that streamline the completion and submission of IRS Form 712, making it a valuable investment.

-

What features does airSlate SignNow offer for managing IRS Form 712?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools enhance the management of IRS Form 712, ensuring that users can efficiently handle their documentation needs.

-

Can I integrate airSlate SignNow with other software for IRS Form 712?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing users to seamlessly incorporate IRS Form 712 into their existing workflows. This flexibility enhances productivity and ensures that all documents are managed in one place.

-

What are the benefits of using airSlate SignNow for IRS Form 712?

Using airSlate SignNow for IRS Form 712 provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform ensures that your documents are handled efficiently, reducing the risk of errors and compliance issues.

-

Is airSlate SignNow user-friendly for completing IRS Form 712?

Yes, airSlate SignNow is designed with user experience in mind. Our intuitive interface makes it easy for anyone to complete IRS Form 712, regardless of their technical expertise, ensuring a hassle-free experience.

Get more for Form 712 Rev December Life Insurance Statement

- How to write a notice to vacate letter to your landlord rentonomics form

- Environmental management permit application leon county form

- Agreement and declaration of real estate business trust massachusetts nominee form

- Free download music sights need sun we why youtube video watch form

- Pdf templates free oklahoma power of attorney forms

- Affidavit forms state specific affidavit templates online

- Idaho small estate affidavit for collection of decedents form

- Registration form nettcp

Find out other Form 712 Rev December Life Insurance Statement

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure