Injured Spouse Form

What is the Injured Spouse Form

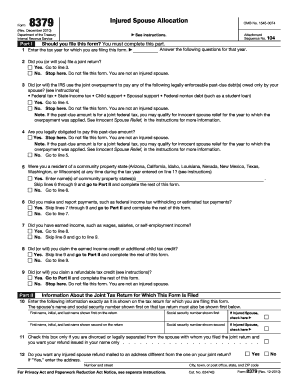

The injured spouse form, officially known as Form 8379, is a tax document used by married couples in the United States. This form allows one spouse to claim their share of a tax refund if the other spouse has outstanding debts, such as student loans or child support obligations. By filing this form, the injured spouse can ensure that their portion of the refund is protected from being applied to these debts. This form is particularly relevant for couples who file jointly but want to safeguard their tax refund from being withheld due to the financial issues of one partner.

How to use the Injured Spouse Form

To effectively use the injured spouse form, one must first determine eligibility. The injured spouse should complete Form 8379 and attach it to their joint tax return. It is important to provide accurate information regarding income, tax withheld, and any debts owed by the other spouse. Once the form is completed, it can be submitted either electronically or via mail, depending on how the couple files their taxes. If filing electronically, ensure that the software being used supports the submission of Form 8379. For paper submissions, include the form with the tax return and mail it to the appropriate IRS address.

Steps to complete the Injured Spouse Form

Completing the injured spouse form involves several key steps:

- Obtain Form 8379 from the IRS website or through tax preparation software.

- Fill in your personal information, including your name, Social Security number, and address.

- Provide details about your spouse, including their name and Social Security number.

- Complete the income section, detailing your income and any taxes withheld.

- Indicate any debts owed by your spouse that may affect the refund.

- Review the form for accuracy and completeness.

- Submit the form with your joint tax return or file it separately if necessary.

Legal use of the Injured Spouse Form

The injured spouse form is legally recognized by the IRS and provides a mechanism for protecting a taxpayer's refund from being applied to a spouse's debts. To ensure legal compliance, it is essential to follow IRS guidelines when completing and submitting the form. This includes accurately reporting all required information and adhering to filing deadlines. The form must be filed within the appropriate timeframe, typically within three years of the original tax return due date. Failure to comply with these regulations may result in the loss of the right to claim the refund.

IRS Guidelines

The IRS provides specific guidelines for the use of the injured spouse form. According to IRS rules, the injured spouse must have reported income on the joint tax return and must not be legally responsible for the debts of the other spouse. Additionally, the IRS requires that the form be filed along with the tax return for timely processing. It is advisable to keep copies of all submitted documents for personal records. The IRS may take up to 14 weeks to process the form, so patience is necessary while awaiting the refund.

Eligibility Criteria

To qualify as an injured spouse, certain criteria must be met. The injured spouse must have earned income that is reported on the joint tax return. They must not be legally liable for the debts of the other spouse, which may include federal tax obligations, child support, or student loans. If these conditions are satisfied, the injured spouse can file Form 8379 to claim their share of the tax refund. It is important to review the eligibility requirements carefully to ensure proper filing and avoid delays in receiving the refund.

Quick guide on how to complete injured spouse form

Handle Injured Spouse Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Manage Injured Spouse Form on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

Ways to modify and electronically sign Injured Spouse Form with ease

- Obtain Injured Spouse Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and press the Done button to preserve your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Injured Spouse Form and ensure outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the injured spouse form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the injured spouse form and who should use it?

The injured spouse form is a tax form that allows individuals to claim their share of a refund when their spouse's debts might reduce or eliminate it. If you’re married and your refund is being withheld due to your spouse's financial obligations, this form can be beneficial for you. It's designed to protect your tax refund from being used to pay your spouse's debts.

-

How can airSlate SignNow help me complete the injured spouse form?

With airSlate SignNow, you can easily fill out and eSign your injured spouse form online. Our platform provides user-friendly templates and intuitive tools, allowing you to complete all necessary sections quickly. Once completed, you can securely send the form to the IRS without any hassle.

-

Are there any costs associated with using airSlate SignNow for the injured spouse form?

airSlate SignNow offers competitive pricing plans that are designed to fit various budgets. While creating, signing, and sending your injured spouse form online may come with a subscription fee, the ease of use and convenience can save you time and potential errors down the line. Explore our pricing plans to choose the best option for your needs.

-

What features does airSlate SignNow provide for the injured spouse form?

AirSlate SignNow provides a variety of features for managing your injured spouse form efficiently. Key features include customizable templates, real-time collaboration, secure cloud storage, and easy eSigning capabilities. Additionally, you can track the status of your document to ensure timely submission.

-

Is my information secure when I use airSlate SignNow for the injured spouse form?

Absolutely! AirSlate SignNow prioritizes your security and employs advanced encryption protocols to protect your information while completing the injured spouse form. Our platform is compliant with industry standards, ensuring that your personal and financial details remain confidential.

-

Can I integrate airSlate SignNow with other tools to manage the injured spouse form?

Yes, airSlate SignNow offers extensive integration capabilities with various applications and third-party tools. Whether you use CRM systems, cloud storage services, or productivity software, you can seamlessly manage your injured spouse form alongside your other business processes. This integration enhances workflow efficiency.

-

What are the benefits of using airSlate SignNow for the injured spouse form?

Using airSlate SignNow for your injured spouse form simplifies the entire process, making it quicker and more efficient. The benefits include easy access to forms, the ability to eSign documents from anywhere, and reduced chances of error through guided inputs. This streamlined process can save you signNow time and stress during tax season.

Get more for Injured Spouse Form

- North dakota consideration statement form

- Bca pool league team roster sheet leaguesys net form

- College park family care medical records form

- Sample residential lease agreement form

- Amfi nism transmission annexures form

- Odot laboratory certification application packet form

- Commercial warrant of removalorden de desalojo de una form

- Commercial warrant of removalorden de desalojo de una propiedad comercial commercial warrant of removalorden de desalojo de una form

Find out other Injured Spouse Form

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy