Blank Form 114

What is the Blank Form 114

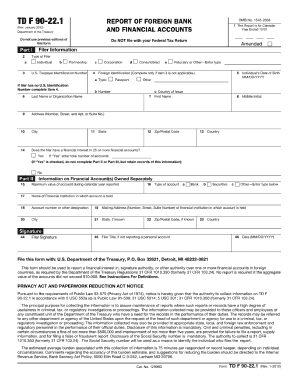

The blank form 114, also known as the FinCEN Form 114, is a critical document used for reporting foreign bank and financial accounts. This form is required by the Financial Crimes Enforcement Network (FinCEN) for U.S. citizens and residents who have a financial interest in or signature authority over one or more foreign financial accounts, with an aggregate value exceeding ten thousand dollars at any time during the calendar year. The form is part of the Bank Secrecy Act regulations aimed at preventing money laundering and other financial crimes.

How to Use the Blank Form 114

To use the blank form 114 effectively, individuals must first gather all necessary information regarding their foreign financial accounts. This includes account numbers, the names and addresses of the financial institutions, and the maximum value of each account during the reporting period. Once the required information is collected, users can fill out the form accurately, ensuring all details are correct to avoid penalties. After completion, the form must be electronically filed through the BSA E-Filing System, as paper submissions are not accepted.

Steps to Complete the Blank Form 114

Completing the blank form 114 involves several key steps:

- Gather information about all foreign accounts, including account numbers and financial institution details.

- Access the FinCEN Form 114 online through the BSA E-Filing System.

- Fill out the form, ensuring accuracy in all fields, including your personal information and account details.

- Review the completed form for any errors or omissions.

- Submit the form electronically before the filing deadline.

Legal Use of the Blank Form 114

The legal use of the blank form 114 is governed by the Bank Secrecy Act, which mandates that U.S. persons report foreign financial accounts to prevent money laundering and tax evasion. Failure to file the form when required can result in significant penalties, including fines and potential criminal charges. It is essential for filers to understand their obligations under this law and ensure compliance to avoid legal repercussions.

Filing Deadlines / Important Dates

The filing deadline for the blank form 114 is typically April 15 of the following year, aligning with the U.S. tax filing deadline. However, an automatic extension is available until October 15 if the form is filed electronically. It is crucial for individuals to adhere to these deadlines to avoid late penalties and ensure compliance with federal regulations.

Penalties for Non-Compliance

Non-compliance with the requirements to file the blank form 114 can lead to severe penalties. Civil penalties can reach up to ten thousand dollars per violation, while willful violations may incur fines of up to one hundred thousand dollars or fifty percent of the account balance at the time of the violation, whichever is greater. Additionally, criminal penalties may apply in cases of willful neglect or fraud, emphasizing the importance of timely and accurate filing.

Quick guide on how to complete blank form 114 278837

Complete Blank Form 114 effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, alter, and eSign your documents quickly without delays. Handle Blank Form 114 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Blank Form 114 without any hassle

- Find Blank Form 114 and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for such tasks.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or via an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Blank Form 114 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank form 114 278837

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a blank form 114?

A blank form 114 is a standardized document used by businesses for various administrative tasks. It provides a structured format to capture necessary information efficiently. With airSlate SignNow, you can easily fill out and eSign blank form 114, streamlining your workflows.

-

How can I fill out the blank form 114 using airSlate SignNow?

Filling out the blank form 114 with airSlate SignNow is simple. You just need to upload the form to our platform, fill in the required fields, and add your electronic signature. Our intuitive interface makes it easy to manage and complete the form in minutes.

-

Is there a cost associated with using blank form 114 on airSlate SignNow?

AirSlate SignNow offers various pricing plans, which include features for managing blank form 114. While we have a free trial option, ongoing access may require a monthly subscription depending on the level of features you choose. Review our pricing page for specific details.

-

What are the key features of airSlate SignNow for blank form 114?

AirSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for blank form 114. Additionally, you can collaborate with team members in real-time to fill out the form efficiently. These functionalities enhance productivity and save time.

-

Can I integrate airSlate SignNow with other software for managing blank form 114?

Yes, airSlate SignNow offers integrations with popular software platforms, such as Google Drive, Dropbox, and CRM tools. This allows for seamless document management when working with blank form 114. You can easily import, export, and manage your forms across different applications.

-

What are the benefits of using airSlate SignNow for blank form 114?

Using airSlate SignNow for blank form 114 simplifies the documentation process. It enhances security through encrypted signatures and reduces turnaround time through automated workflows. These benefits help ensure compliance and improve operational efficiency.

-

How secure is my data when using airSlate SignNow for blank form 114?

AirSlate SignNow takes data security seriously, especially when handling sensitive documents like blank form 114. We implement advanced encryption protocols and comply with industry standards to protect your information from unauthorized access. You can trust us to keep your data safe.

Get more for Blank Form 114

Find out other Blank Form 114

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF