How to Fill Out Mineral Rights Disclosure Form

Understanding the mineral rights disclosure form

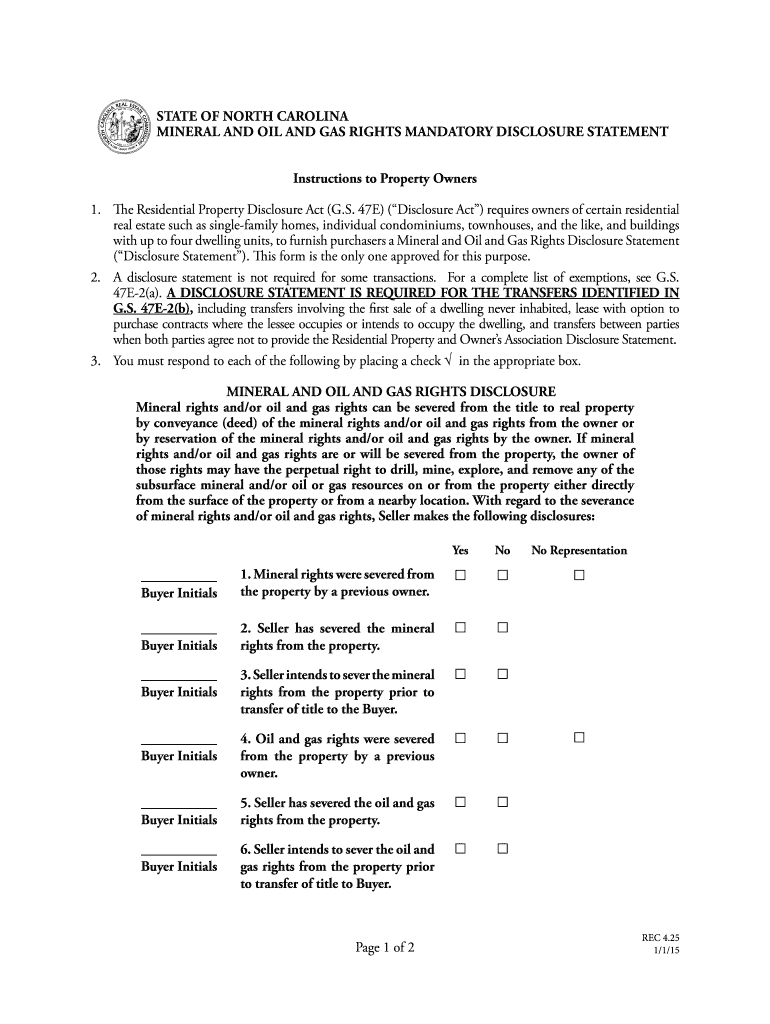

The mineral rights disclosure form is a legal document that outlines the ownership and rights associated with mineral resources beneath a property. This form is essential for property owners who wish to convey their mineral rights or disclose them during real estate transactions. It typically includes details about the type of minerals, ownership percentages, and any existing leases or agreements related to the mineral rights. Understanding this form is crucial for ensuring transparency and compliance with state regulations.

Steps to complete the mineral rights disclosure form

Filling out the mineral rights disclosure form involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant property information, including the legal description and current ownership details. Next, identify the specific minerals involved, such as oil, gas, or other natural resources. It is also important to disclose any existing agreements or leases that may affect the mineral rights. Finally, review the completed form for accuracy and ensure all required signatures are included before submission.

Key elements of the mineral rights disclosure form

The mineral rights disclosure form contains several critical elements that must be accurately filled out. These include:

- Property Description: A detailed description of the property, including its legal boundaries.

- Mineral Ownership: Information about the types of minerals owned and their respective ownership percentages.

- Existing Agreements: Any leases or contracts that may impact the mineral rights.

- Signatures: Required signatures from all parties involved in the transaction.

Legal use of the mineral rights disclosure form

The mineral rights disclosure form serves a legal purpose in property transactions, ensuring that all parties are aware of the mineral rights involved. In the United States, this form must comply with state laws, which may vary. A properly completed and signed disclosure can protect property owners from future disputes regarding mineral rights and can be crucial in legal proceedings. It is advisable to consult with legal professionals to ensure compliance with local regulations.

State-specific rules for the mineral rights disclosure form

Each state may have unique requirements regarding the mineral rights disclosure form. It is essential to be aware of these state-specific rules, as they can dictate how the form should be filled out and submitted. For instance, some states may require additional documentation or specific language in the form. Checking with local regulatory authorities or legal experts can help ensure that all requirements are met, preventing potential legal issues down the line.

Form submission methods

The mineral rights disclosure form can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online Submission: Many states offer electronic submission options for convenience.

- Mail: The form can often be mailed to the appropriate regulatory agency.

- In-Person: Some jurisdictions may require or allow in-person submission at designated offices.

Quick guide on how to complete how to fill out mineral rights disclosure

Complete How To Fill Out Mineral Rights Disclosure effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as it allows you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents swiftly without delays. Manage How To Fill Out Mineral Rights Disclosure on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign How To Fill Out Mineral Rights Disclosure with ease

- Locate How To Fill Out Mineral Rights Disclosure and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign How To Fill Out Mineral Rights Disclosure and guarantee smooth communication at any stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to fill out mineral rights disclosure

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process of how to fill out mineral rights disclosure using airSlate SignNow?

Filling out a mineral rights disclosure with airSlate SignNow is simple and efficient. Once you access the template, you can easily input and edit your information. The platform guides you step-by-step, ensuring that all required fields are completed correctly.

-

Are there any costs associated with filling out a mineral rights disclosure on airSlate SignNow?

AirSlate SignNow offers various pricing plans tailored to different business needs. You can start with a free trial and explore the features before committing to a plan. This allows you to understand the value of the solution in how to fill out mineral rights disclosure without any upfront costs.

-

Can I integrate airSlate SignNow with other applications while filling out a mineral rights disclosure?

Yes, airSlate SignNow seamlessly integrates with numerous applications and services. This functionality helps streamline the process of how to fill out mineral rights disclosure by allowing you to access relevant data from other platforms directly within SignNow.

-

What features does airSlate SignNow offer for completing a mineral rights disclosure?

AirSlate SignNow includes features such as customizable templates, document editing, and eSignature options, which facilitate the process of how to fill out mineral rights disclosure. These features ensure your document is ready for approval efficiently and accurately.

-

Is it safe to use airSlate SignNow for filling out a mineral rights disclosure?

Absolutely! AirSlate SignNow prioritizes security and compliance, ensuring your documents are protected during the process. When learning how to fill out mineral rights disclosure, you can rest assured that your data is handled with the highest level of security.

-

Can I access my completed mineral rights disclosure from any device?

Yes, airSlate SignNow is cloud-based, allowing you to access your completed mineral rights disclosure from any device with an internet connection. This flexibility is essential for businesses and individuals who need to manage documents on the go while learning how to fill out mineral rights disclosure.

-

Does airSlate SignNow provide support for users struggling with how to fill out mineral rights disclosure?

Yes, airSlate SignNow offers robust customer support to assist you whenever you have questions. Whether you’re unsure about the steps involved in how to fill out mineral rights disclosure, our team is available to provide guidance and resources.

Get more for How To Fill Out Mineral Rights Disclosure

Find out other How To Fill Out Mineral Rights Disclosure

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU