Tc 131 Form

What is the TC 131?

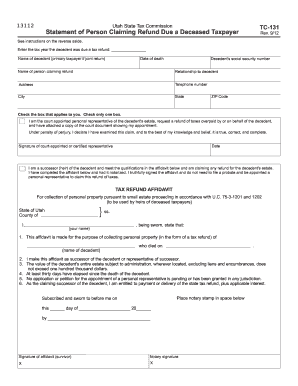

The TC 131 form, also known as the Utah TC 131, is a document used in the state of Utah primarily for tax purposes. It is designed to assist taxpayers in reporting specific financial information to the state tax authority. This form is crucial for individuals and businesses alike, as it helps ensure compliance with state tax regulations and facilitates accurate tax reporting.

How to use the TC 131

Using the TC 131 form involves several key steps. First, gather all necessary financial information, including income details and deductions. Next, download or print the form from an official source. Fill out the form accurately, ensuring that all required fields are completed. Once finished, review the form for any errors before submitting it to the appropriate tax authority. It is important to keep a copy of the completed form for your records.

Steps to complete the TC 131

Completing the TC 131 form requires attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the TC 131 form.

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income accurately in the designated sections.

- Include any applicable deductions or credits.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the TC 131

The TC 131 form is legally binding when completed and submitted according to state regulations. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or legal consequences. The form must be submitted by the designated deadline to avoid late fees and ensure compliance with state tax laws.

Key elements of the TC 131

Several key elements are integral to the TC 131 form. These include:

- Personal Information: Essential details such as name, address, and Social Security number.

- Income Reporting: Sections dedicated to reporting various sources of income.

- Deductions and Credits: Areas to claim any eligible deductions or tax credits.

- Signature: A signature line to affirm the accuracy of the information provided.

Form Submission Methods

The TC 131 form can be submitted through various methods, ensuring flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to submit their forms electronically through the state tax authority's website.

- Mail: The form can be printed and mailed to the appropriate tax office.

- In-Person: Taxpayers may also choose to deliver the form in person at designated tax offices.

Quick guide on how to complete tc 131

Complete Tc 131 effortlessly on any device

Web-based document management has become favored by companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the proper format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Tc 131 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The easiest way to modify and electronically sign Tc 131 with ease

- Find Tc 131 and select Get Form to commence.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Tc 131 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 131

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tc 131 and how does it relate to airSlate SignNow?

tc 131 is a classification in the legal document management process that refers to particular types of forms used in transactions. airSlate SignNow supports compliance with tc 131, ensuring that your eSignatures meet the necessary legal requirements for secure document handling.

-

How does airSlate SignNow handle tc 131 forms?

airSlate SignNow simplifies the management of tc 131 forms by offering an intuitive interface for creating, signing, and sending documents. This ensures that businesses can effortlessly manage compliance while accelerating their workflows.

-

What are the pricing plans for using airSlate SignNow with tc 131 documents?

Our pricing plans for airSlate SignNow are designed to cater to businesses of all sizes, starting with a free trial. The plans are structured to provide great value by allowing users to efficiently handle tc 131 documents without compromising on features or support.

-

Can I integrate airSlate SignNow with other applications while using tc 131?

Yes, airSlate SignNow offers seamless integrations with a wide range of applications. This allows you to streamline your workflow and manage tc 131 forms directly alongside your other essential business tools.

-

What are the benefits of using airSlate SignNow for tc 131 processes?

Using airSlate SignNow for tc 131 processes means enhanced efficiency, security, and ease of use. The platform allows for rapid eSigning of documents while maintaining compliance, which saves time and reduces errors in your paperwork.

-

Is airSlate SignNow suitable for small businesses managing tc 131 documents?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it a great solution for small businesses dealing with tc 131 documents. With our simple onboarding process, small teams can quickly adapt and start managing their documents effectively.

-

How does airSlate SignNow ensure the security of tc 131 documents?

airSlate SignNow employs advanced encryption and secure cloud storage to protect your tc 131 documents. Our robust security measures ensure that your data remains confidential and is only accessible to authorized users.

Get more for Tc 131

- Parcel2go api form

- 67042 public relations work experience logbook form

- Beverly hills structural observation form

- First report of injury maine form

- Pickett and hatcher form

- Credit application form archibald new amp used cars kaitaia northland archibaldcars co

- Superlife account number form

- State sector retirement savings scheme members guide form

Find out other Tc 131

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free