Form 60 for Nri

What is the Form 60 for NRI

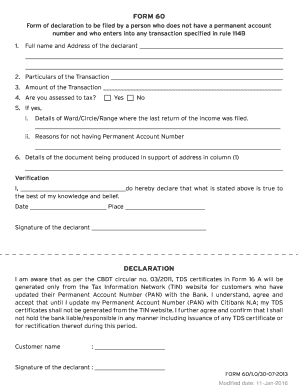

The Form 60 for NRI (Non-Resident Indian) is a declaration form used primarily for individuals who do not possess a Permanent Account Number (PAN) in India. This form is essential for various financial transactions, including opening bank accounts, making investments, or applying for loans. By submitting Form 60, NRIs can comply with Indian tax regulations while ensuring that their identity is verified for these financial activities.

How to use the Form 60 for NRI

Using the Form 60 for NRI involves several key steps. First, ensure that you have the necessary identification documents ready, such as proof of identity and address. Next, fill out the form accurately, providing all required details, including your name, address, and other personal information. After completing the form, submit it to the relevant financial institution or authority along with any supporting documents. It is crucial to keep a copy of the submitted form for your records.

Steps to complete the Form 60 for NRI

Completing the Form 60 for NRI involves the following steps:

- Download the Form 60 from a reliable source.

- Fill in your personal details, including your name, address, and contact information.

- Provide the reason for submitting the form and any relevant financial details.

- Sign the form to validate your declaration.

- Attach necessary identification documents as required.

- Submit the completed form to your financial institution or relevant authority.

Legal use of the Form 60 for NRI

The legal use of the Form 60 for NRI is governed by Indian tax laws. This form serves as a declaration to ensure compliance with the Income Tax Act, allowing NRIs to engage in financial transactions without a PAN. It is essential that the information provided in the form is accurate and truthful, as any discrepancies may lead to legal consequences or penalties. Financial institutions rely on this form to verify the identity of NRIs and to ensure adherence to regulatory requirements.

Required Documents

When submitting the Form 60 for NRI, certain documents are typically required to support your application. These may include:

- Proof of identity (such as a passport or voter ID).

- Proof of address (like utility bills or rental agreements).

- Any additional documentation requested by the financial institution.

Form Submission Methods

The Form 60 for NRI can be submitted through various methods, depending on the requirements of the financial institution. Common submission methods include:

- Online submission via the institution's website or portal.

- Mailing the completed form and documents to the designated address.

- In-person submission at the nearest branch of the financial institution.

Quick guide on how to complete form 60 for nri

Effortlessly Prepare Form 60 For Nri on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Handle Form 60 For Nri on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to effortlessly modify and eSign Form 60 For Nri

- Locate Form 60 For Nri and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, and errors requiring the printing of new copies. airSlate SignNow simplifies your document management needs in just a few clicks from any device you choose. Modify and eSign Form 60 For Nri to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 60 for nri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 60 India?

Form 60 India is a declaration form used in financial transactions where individuals do not possess a Permanent Account Number (PAN). It helps the government track financial transactions and ensures compliance with tax regulations. Understanding Form 60 India is essential for managing tax-related responsibilities effectively.

-

How can airSlate SignNow assist with Form 60 in India?

airSlate SignNow simplifies the process of filling and signing Form 60 India electronically. With our platform, users can easily create, send, and eSign the form, ensuring a hassle-free experience. This not only speeds up the submission process but also enhances compliance with regulations.

-

Is airSlate SignNow cost-effective for managing Form 60 India?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 60 India. Our competitive pricing plans are designed for businesses of all sizes, providing value without compromising on features. By streamlining document management, you can save time and resources when using Form 60 India.

-

What features does airSlate SignNow offer for Form 60 India?

airSlate SignNow includes features such as templates for Form 60 India, secure eSigning, and real-time tracking. Users can easily create customized forms and ensure they are securely stored and accessible. These features ensure that managing Form 60 India is smooth and efficient.

-

Can I integrate airSlate SignNow with other tools for Form 60 India?

Absolutely! airSlate SignNow seamlessly integrates with various business tools such as CRM systems and document management software. This integration facilitates the efficient handling of Form 60 India alongside other financial documents. By using our platform, you can optimize your workflow and enhance productivity.

-

What are the main benefits of using airSlate SignNow for Form 60 India?

Using airSlate SignNow for Form 60 India offers several benefits including streamlined operations, improved compliance, and enhanced security. Our platform makes it easy to manage and sign documents, minimizing the risk of errors. Additionally, users can access the platform from anywhere, making it highly convenient.

-

Is airSlate SignNow secure for handling Form 60 India?

Yes, airSlate SignNow employs advanced security measures to protect sensitive data, making it a secure choice for handling Form 60 India. We utilize encryption and secure servers to ensure all documents are protected from unauthorized access. You can confidently manage your Form 60 India with us.

Get more for Form 60 For Nri

- Name change maricopa county form

- Running club permission slip keeth elementary school keeth scps k12 fl form

- Sc cdl 18 fillable form

- Nfpa 13 pdf form

- Out of state nurse application illinois department of public health idph state il form

- Group term life insurance beneficiary designation erie county form

- Pd 102r 92 form

- Msf employer documents amp forms montana state fund

Find out other Form 60 For Nri

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT