Do Not Use This Voucher to Make a Payment for an Amended Return Form

What is the Do Not Use This Voucher To Make A Payment For An Amended Return

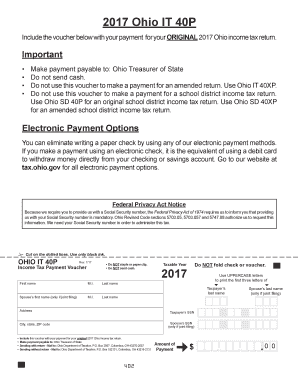

The "Do Not Use This Voucher To Make A Payment For An Amended Return" form serves as a crucial document for taxpayers who need to amend their tax returns. This form is specifically designed to notify the Internal Revenue Service (IRS) that a previous payment should not be applied to an amended return. It ensures that the IRS processes the amended return correctly, preventing any confusion regarding payment allocation. Understanding this form's purpose is essential for maintaining accurate tax records and ensuring compliance with IRS regulations.

How to Use the Do Not Use This Voucher To Make A Payment For An Amended Return

Using the "Do Not Use This Voucher To Make A Payment For An Amended Return" form involves several straightforward steps. First, ensure that you have completed your amended return accurately. Next, fill out the voucher with the necessary details, including your name, Social Security number, and the tax year for which you are amending your return. It is important to clearly indicate that this voucher should not be used for payment to avoid any misapplication of funds. After completing the form, submit it alongside your amended return to the IRS, ensuring that all documents are sent to the correct address.

Steps to Complete the Do Not Use This Voucher To Make A Payment For An Amended Return

Completing the "Do Not Use This Voucher To Make A Payment For An Amended Return" form requires careful attention to detail. Follow these steps:

- Obtain the form from the IRS website or your tax preparer.

- Fill in your personal information, including your name and Social Security number.

- Specify the tax year related to your amended return.

- Clearly state that this voucher should not be used for payment.

- Review the form for accuracy before submission.

- Include the voucher with your amended return when mailing it to the IRS.

Legal Use of the Do Not Use This Voucher To Make A Payment For An Amended Return

The legal use of the "Do Not Use This Voucher To Make A Payment For An Amended Return" form is governed by IRS guidelines. This form is legally recognized as a means to communicate specific instructions regarding payment allocation for amended returns. To ensure its legal validity, it must be filled out completely and submitted in conjunction with the amended return. Adhering to these guidelines helps prevent potential disputes with the IRS and ensures that your tax obligations are met correctly.

Key Elements of the Do Not Use This Voucher To Make A Payment For An Amended Return

Several key elements are essential for the effective use of the "Do Not Use This Voucher To Make A Payment For An Amended Return" form:

- Taxpayer Information: Accurate personal details, including name and Social Security number.

- Tax Year: The specific year for which the amended return is filed.

- Clear Instructions: A statement indicating that the voucher should not be used for payment.

- Submission: Proper inclusion of the form with the amended return when filing.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the "Do Not Use This Voucher To Make A Payment For An Amended Return" form. It is crucial to follow these guidelines to ensure compliance and avoid penalties. The IRS states that this form must accompany the amended return and should clearly articulate the taxpayer's intentions regarding payment. Familiarizing yourself with these guidelines can help streamline the amendment process and ensure that your tax filings are accurate and complete.

Quick guide on how to complete do not use this voucher to make a payment for an amended return

Prepare Do Not Use This Voucher To Make A Payment For An Amended Return seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily find the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Do Not Use This Voucher To Make A Payment For An Amended Return across any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Do Not Use This Voucher To Make A Payment For An Amended Return effortlessly

- Obtain Do Not Use This Voucher To Make A Payment For An Amended Return and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or errors requiring new document printouts. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Do Not Use This Voucher To Make A Payment For An Amended Return and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I make an online payment check out form directly to my bank if I do not like PayPal?

I cannot tell if you are a developer creating an online payment form or a consumer asking about the check-out and payment process in general. I will answer for the consumer's perspective: Short answer: debit cards issued by your bank offer the best compromise between directness, convenience, and security when paying online. If the website doesn't offer fields to input bank account and routing information, you cannot directly charge your bank account for a purchase from an online check out form. This is usually a good thing. Do not provide your bank account information to arbitrary merchants online. You may compromise your security by doing so because many banks have little protection against fraud from direct withdrawals. If you must pay using your bank account, try calling the company. Their phone representatives might have access to payment methods that are unavailable online, and they can process your order over the phone. Again, do this only if you trust the company. Although PayPal enables you to "connect" your bank account, you never directly pay from that account when you check out with PayPal. The merchant never accesses your account themselves. PayPal withdraws the order amount from your account and disburses your payment to the merchant.Similarly, debit cards provide what seems to be direct access to you bank account, but there is still a layer in between: the debit processing network. Some debit card providers offer similar protection against fraudulent transactions as the protection credit cards typically include.Arguably, payments by check (cheque) and "direct debit" can be considered indirect as well (in the US, at least), because these transactions must pass through the ACH network. Withdrawing the cash at your own bank in person would be the only true direct method. Similar wire transfer systems of payment exist as well that enable transfer of money electronically. However, ACH and wire transfers are seldom used for online payments unless the value of the product is quite large. Both offer almost no protection against fraud. Here's a quick, (very) simplified illustration of the path of these payment methods: Merchant > Check (ACH) > Your Bank

Create this form in 5 minutes!

How to create an eSignature for the do not use this voucher to make a payment for an amended return

How to make an eSignature for your Do Not Use This Voucher To Make A Payment For An Amended Return in the online mode

How to create an electronic signature for your Do Not Use This Voucher To Make A Payment For An Amended Return in Google Chrome

How to generate an eSignature for putting it on the Do Not Use This Voucher To Make A Payment For An Amended Return in Gmail

How to make an eSignature for the Do Not Use This Voucher To Make A Payment For An Amended Return right from your smart phone

How to create an eSignature for the Do Not Use This Voucher To Make A Payment For An Amended Return on iOS devices

How to create an eSignature for the Do Not Use This Voucher To Make A Payment For An Amended Return on Android devices

People also ask

-

What does the phrase 'Do Not Use This Voucher To Make A Payment For An Amended Return' mean?

The statement 'Do Not Use This Voucher To Make A Payment For An Amended Return' indicates that certain vouchers or payment methods are not applicable for amended tax returns. It’s crucial to follow this instruction to avoid complications with tax filings. Ensure you use the correct payment method to avoid delays or rejections.

-

How does airSlate SignNow simplify document signing for tax forms?

airSlate SignNow streamlines the eSigning process for tax documents, ensuring compliance and efficiency. You can easily send, receive, and sign documents without worrying about instructions like 'Do Not Use This Voucher To Make A Payment For An Amended Return.' Our platform is user-friendly, making tax season less stressful.

-

Is airSlate SignNow compatible with other software I use for tax preparation?

Yes, airSlate SignNow integrates seamlessly with various tax preparation software. This compatibility allows you to manage your documents and signatures without worrying about issues like 'Do Not Use This Voucher To Make A Payment For An Amended Return.' You can enhance your workflow by utilizing our integration capabilities.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to meet various business needs. By leveraging our services, you can avoid common pitfalls, such as those related to the phrase 'Do Not Use This Voucher To Make A Payment For An Amended Return.' Check our website for detailed pricing information based on your usage.

-

Can I customize the documents I send with airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize documents to fit your specific needs. This feature is especially helpful for ensuring compliance and avoiding mistakes related to instructions like 'Do Not Use This Voucher To Make A Payment For An Amended Return.' Tailor your documents to streamline the signing process.

-

What benefits does airSlate SignNow offer for businesses?

Using airSlate SignNow provides numerous benefits, including enhanced efficiency, reduced paperwork, and secure document management. By adopting our solution, you mitigate risks associated with errors such as 'Do Not Use This Voucher To Make A Payment For An Amended Return.' Our platform is designed to make your document workflows smoother.

-

Is it easy to track the status of documents sent via airSlate SignNow?

Yes, airSlate SignNow offers robust tracking features that allow you to monitor the status of your documents in real-time. This capability helps you ensure that all signatures are collected properly and reduces the risk of issues related to payment vouchers like 'Do Not Use This Voucher To Make A Payment For An Amended Return.' Stay updated with our tracking system.

Get more for Do Not Use This Voucher To Make A Payment For An Amended Return

Find out other Do Not Use This Voucher To Make A Payment For An Amended Return

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe