Ar Tx Border City Exemption Form

What is the Ar Tx Border City Exemption Form

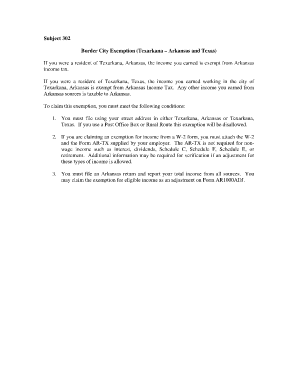

The Ar Tx Border City Exemption Form is a tax-related document designed for residents of specific border cities in Arkansas and Texas. This form allows eligible individuals to claim an exemption from certain state income taxes, recognizing the unique economic circumstances of those living in border areas. It is particularly relevant for residents of Texarkana, where individuals may work in one state and live in another, thus creating a need for this exemption to avoid double taxation.

How to use the Ar Tx Border City Exemption Form

Using the Ar Tx Border City Exemption Form involves several steps to ensure proper completion and submission. First, gather all necessary personal information, including your Social Security number and income details. Next, accurately fill out the form, ensuring that all sections are completed according to the instructions provided. Once filled out, the form can be submitted electronically or via mail, depending on your preference and the guidelines set by the state tax authority.

Steps to complete the Ar Tx Border City Exemption Form

Completing the Ar Tx Border City Exemption Form requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source, ensuring you have the most current version.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your income and the specific exemption you are claiming.

- Review the form for accuracy, ensuring all information is correct and complete.

- Sign and date the form to validate your submission.

Eligibility Criteria

To qualify for the Ar Tx Border City Exemption, applicants must meet specific criteria. Generally, you must be a resident of a designated border city, such as Texarkana, and have income derived from employment in either Arkansas or Texas. Additionally, you must not have claimed the exemption in any other state for the same tax year. It is essential to review the eligibility requirements thoroughly to ensure compliance and avoid potential penalties.

Required Documents

When applying for the Ar Tx Border City Exemption, certain documents may be required to support your claim. These typically include:

- A completed Ar Tx Border City Exemption Form.

- Proof of residency in a border city, such as a utility bill or lease agreement.

- Income documentation, such as W-2 forms or pay stubs, to verify your earnings.

Form Submission Methods

The Ar Tx Border City Exemption Form can be submitted through various methods, offering flexibility to applicants. You can choose to file electronically via the state’s tax portal, which may expedite processing times. Alternatively, you can print the completed form and mail it to the appropriate tax authority. In-person submissions may also be possible at designated tax offices, providing another option for those who prefer face-to-face interactions.

Quick guide on how to complete ar tx border city exemption form

Complete Ar Tx Border City Exemption Form effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any holdups. Manage Ar Tx Border City Exemption Form on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to edit and eSign Ar Tx Border City Exemption Form with ease

- Find Ar Tx Border City Exemption Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device of your preference. Edit and eSign Ar Tx Border City Exemption Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar tx border city exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AR TX border city exemption form?

The AR TX border city exemption form is a document that allows eligible businesses in border cities to apply for certain tax exemptions. By utilizing the airSlate SignNow platform, businesses can easily eSign and submit this form online, streamlining the process and ensuring compliance.

-

How can airSlate SignNow help me complete the AR TX border city exemption form?

With airSlate SignNow, you can conveniently fill out and eSign the AR TX border city exemption form from any device. Our user-friendly interface simplifies the document signing process, allowing you to save time and resources while ensuring accuracy.

-

Is there a cost associated with using airSlate SignNow for the AR TX border city exemption form?

airSlate SignNow offers flexible pricing plans to suit various business needs, including options for eSigning the AR TX border city exemption form. In addition, our cost-effective solution eliminates the need for costly paper-based processes, making it an attractive choice for businesses.

-

What features does airSlate SignNow provide for managing the AR TX border city exemption form?

airSlate SignNow provides features like customizable templates, automated workflows, and secure cloud storage, specifically for managing your AR TX border city exemption form. These features enhance efficiency and promote collaboration within your team while ensuring that your documents are easily accessible.

-

Can I integrate airSlate SignNow with other software for AR TX border city exemption form management?

Yes, airSlate SignNow can seamlessly integrate with various third-party applications, allowing you to manage the AR TX border city exemption form alongside your existing workflows. This integration capability enhances productivity by centralizing document management within your preferred software ecosystem.

-

What are the benefits of using airSlate SignNow for the AR TX border city exemption form?

Using airSlate SignNow for the AR TX border city exemption form offers several benefits, including increased efficiency, reduced paper usage, and improved accuracy. This service not only expedites the signing process but also ensures that your documents are legally binding and secure.

-

Is airSlate SignNow compliant with legal standards for the AR TX border city exemption form?

Absolutely! airSlate SignNow is compliant with various legal standards for electronic signatures, ensuring that your AR TX border city exemption form meets all necessary regulations. By leveraging our platform, you can confidently submit forms that hold legal standing in your jurisdiction.

Get more for Ar Tx Border City Exemption Form

Find out other Ar Tx Border City Exemption Form

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now