Form 10f Filled Sample

What is the Form 10f Filled Sample

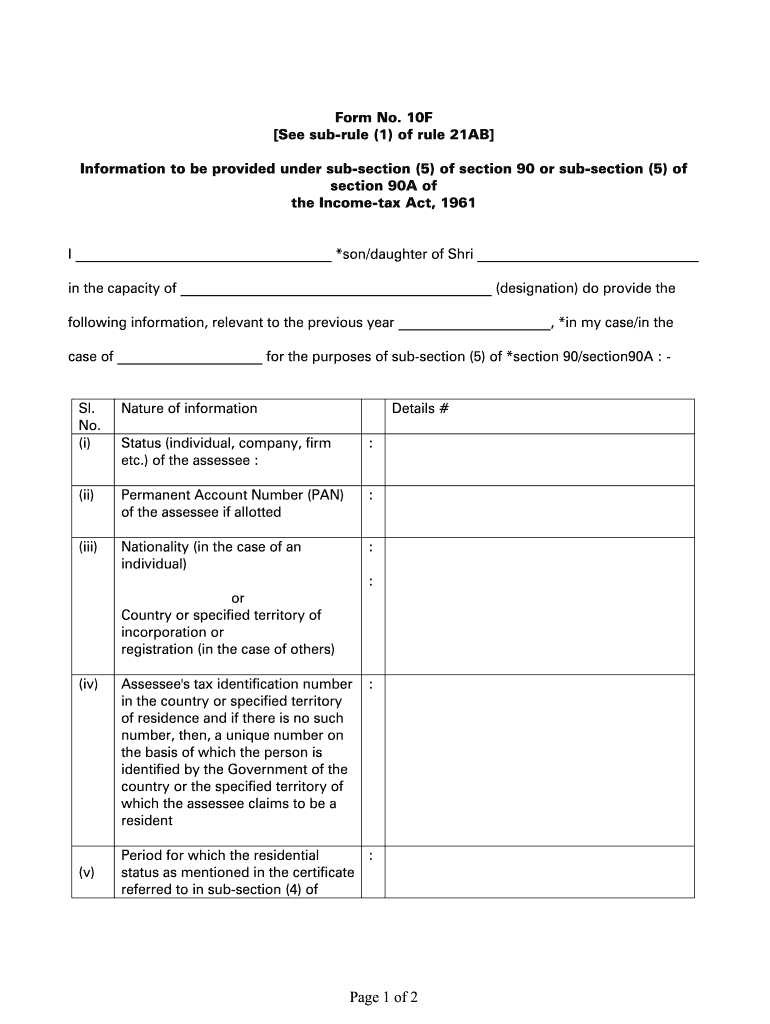

The Form 10f is a document used primarily for tax purposes, specifically for non-resident taxpayers in India. It serves as a declaration to claim benefits under the Double Taxation Avoidance Agreement (DTAA) between India and the taxpayer's country of residence. The form includes essential information such as the taxpayer's name, address, and details of income earned in India. By filling out this form accurately, individuals can avoid double taxation on the same income.

How to use the Form 10f Filled Sample

To effectively use the Form 10f filled sample, one should first ensure that all required fields are completed accurately. This includes entering personal details, the nature of income, and the relevant tax treaty provisions. Once filled, the form should be submitted to the Indian tax authorities or the entity from which the income is being received. It is advisable to keep a copy of the filled form for personal records and future reference.

Steps to complete the Form 10f Filled Sample

Completing the Form 10f involves several key steps:

- Begin by entering your personal information, including your name and address.

- Provide details of the income earned in India, specifying the nature of this income.

- Indicate your country of residence and the relevant provisions of the DTAA.

- Sign and date the form to validate the information provided.

- Submit the completed form to the appropriate tax authority or income source.

Legal use of the Form 10f Filled Sample

The legal use of the Form 10f is crucial for non-resident taxpayers to ensure compliance with tax regulations. By submitting this form, taxpayers can claim relief from double taxation, which is a right under international tax treaties. It is essential to ensure that the information provided is accurate and truthful, as any discrepancies may lead to penalties or legal issues.

Required Documents

When submitting the Form 10f, certain documents may be required to support the claims made. These typically include:

- A valid tax residency certificate from your country of residence.

- Proof of income earned in India, such as tax statements or payment receipts.

- Any additional documentation that may be requested by the Indian tax authorities.

Form Submission Methods (Online / Mail / In-Person)

The Form 10f can be submitted through various methods, depending on the requirements of the Indian tax authorities. Common submission methods include:

- Online submission through the official tax portal, if available.

- Mailing a physical copy of the form to the relevant tax office.

- In-person submission at designated tax offices or authorized centers.

Quick guide on how to complete form 10f filled sample

Easily Prepare Form 10f Filled Sample on Any Device

Digital document management has gained popularity among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed papers, as you can find the appropriate form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Form 10f Filled Sample on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The Best Way to Modify and eSign Form 10f Filled Sample Effortlessly

- Find Form 10f Filled Sample and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to share your form, by email, text (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Modify and eSign Form 10f Filled Sample and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 10f filled sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 10f是什么?

Form 10F是一种用于外籍人士在印度享受税收优惠的声明。了解form 10f是什么能帮助您在与印度税务机关的交互中有效地申请减免税及其他优惠。使用airSlate SignNow,您可以轻松管理和签署form 10F,确保合规。

-

How does airSlate SignNow help with form 10f是什么?

airSlate SignNow makes the process of handling form 10f是什么 seamless by allowing users to upload, edit, and eSign documents securely online. It simplifies compliance with Indian tax regulations and ensures that the documentation process is efficient and organized. With our user-friendly interface, you can easily submit your form 10F and keep track of all your signed documents.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to accommodate different businesses, including individuals needing to manage form 10f是什么. Our plans are affordable and provide robust features for document management and eSigning. Additionally, we offer a free trial for you to explore the platform's capabilities before committing to a plan.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow has a mobile app that enables users to handle form 10f是什么 on the go. The app provides all the essential features to create, sign, and send documents directly from your mobile device. This flexibility ensures that you can manage your important tax documents no matter where you are.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow includes features like document templates, automated workflows, and secure cloud storage, all beneficial when dealing with form 10f是什么. These features help streamline the signing process and ensure that all your important documents are easily accessible and organized. With real-time notifications, you can stay updated on the status of your documents.

-

Can airSlate SignNow integrate with other software solutions?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, enhancing efficiency when handling form 10f是什么. Whether you're using CRM systems, cloud storage services, or accounting software, our integrations ensure that your document workflows are streamlined and connected. This flexibility allows for a smoother workflow across different business processes.

-

What are the benefits of using airSlate SignNow for e-signatures?

Using airSlate SignNow for e-signatures brings several benefits, such as increased speed, enhanced security, and ease of use, especially for form 10f是什么. You can gather signatures quickly from multiple parties, ensuring that your tax-related documents are processed without delay. Moreover, our platform complies with industry standards to guarantee the security of your sensitive documents.

Get more for Form 10f Filled Sample

Find out other Form 10f Filled Sample

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed