Microfinance Loan Application Form PDF

What is the Microfinance Loan Application Form PDF

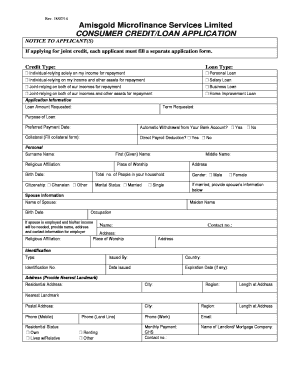

The microfinance loan application form PDF is a standardized document used by individuals or small businesses seeking financial assistance through microfinance institutions. This form collects essential information about the applicant's financial status, purpose of the loan, and repayment plan. It is designed to facilitate the evaluation process for lenders, ensuring that they have the necessary details to assess the applicant's eligibility for a microfinance loan.

Key Elements of the Microfinance Loan Application Form PDF

Understanding the key elements of the microfinance loan application form PDF is crucial for successful completion. Common sections include:

- Personal Information: Name, address, contact details, and social security number.

- Financial Information: Current income, expenses, and existing debts.

- Loan Details: Amount requested, purpose of the loan, and proposed repayment terms.

- References: Personal or professional references who can vouch for the applicant's credibility.

Completing these sections accurately helps streamline the approval process and increases the chances of obtaining the loan.

Steps to Complete the Microfinance Loan Application Form PDF

Filling out the microfinance loan application form PDF involves several key steps:

- Gather Required Documents: Collect financial statements, identification, and any other necessary documentation.

- Fill Out Personal Information: Provide accurate personal and financial details as requested.

- Detail Loan Purpose: Clearly explain why the loan is needed and how it will be used.

- Review and Sign: Carefully review the completed form for accuracy before signing it electronically.

Following these steps ensures that the application is complete and ready for submission.

Legal Use of the Microfinance Loan Application Form PDF

The microfinance loan application form PDF is legally binding when completed and signed according to applicable laws. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, provided that the signer has consented to use electronic documents. It is important to ensure compliance with these regulations to avoid any legal issues during the loan application process.

How to Obtain the Microfinance Loan Application Form PDF

The microfinance loan application form PDF can typically be obtained directly from the microfinance institution's website or by contacting their customer service. Many institutions provide downloadable versions of the form, allowing applicants to fill it out at their convenience. It is advisable to use the most current version of the form to ensure compliance with the lender's requirements.

Form Submission Methods

Once the microfinance loan application form PDF is completed, there are several methods for submission:

- Online Submission: Many microfinance institutions offer an online portal for electronic submission.

- Mail: Applicants can print the completed form and send it via postal service.

- In-Person: Some institutions allow applicants to submit forms directly at their offices.

Choosing the right submission method can affect processing times, so it is important to consider the options available.

Quick guide on how to complete microfinance loan application form pdf 267338214

Effortlessly Prepare Microfinance Loan Application Form Pdf on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the features needed to create, modify, and electronically sign your documents swiftly without delays. Manage Microfinance Loan Application Form Pdf on any device through airSlate SignNow’s Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and eSign Microfinance Loan Application Form Pdf without hassle

- Locate Microfinance Loan Application Form Pdf and click Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Mark important sections of the documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred delivery method for the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tedious document searches, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Microfinance Loan Application Form Pdf and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the microfinance loan application form pdf 267338214

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a microfinance loan form?

A microfinance loan form is a document used to apply for small loans intended for individuals or businesses who lack access to traditional banking services. This form typically collects essential personal and financial information to assess eligibility for microfinance funding. Utilizing airSlate SignNow, you can easily fill out and send your microfinance loan form electronically.

-

How does airSlate SignNow simplify the microfinance loan form process?

airSlate SignNow streamlines the microfinance loan form process by enabling users to create, send, and eSign documents effortlessly. The platform offers templates and intuitive tools that make filling out forms quick and straightforward. This efficiency saves time and ensures that your microfinance loan requests are submitted without delays.

-

What features does airSlate SignNow offer for handling microfinance loan forms?

airSlate SignNow provides features such as customizable templates, secure eSigning, and automated workflows for managing microfinance loan forms. Users can track the status of their forms in real-time and receive notifications upon completion. These features enhance productivity and ensure a smooth process for borrowers and lenders alike.

-

Is there a cost associated with using the microfinance loan form on airSlate SignNow?

Yes, there are various pricing plans for using airSlate SignNow, which cater to different business needs. While the basic options are cost-effective, they provide access to essential features for handling microfinance loan forms. You can choose a plan based on the volume of documents you process or the level of service required.

-

Can I integrate airSlate SignNow with other tools for managing microfinance loan forms?

Absolutely! airSlate SignNow supports integration with various popular applications, which can help in managing microfinance loan forms and workflows. This functionality allows users to connect with CRM systems, payment platforms, and more, ensuring a seamless process that optimizes data management and enhances communication.

-

What are the benefits of using airSlate SignNow for microfinance loan forms?

Using airSlate SignNow for microfinance loan forms offers numerous benefits, including increased efficiency, enhanced security, and improved customer experience. The platform allows for quicker turnaround times, reducing the administrative burden associated with paperwork. Additionally, it ensures compliance with legal standards by maintaining a secure and encrypted environment for all documents.

-

How can I ensure my microfinance loan form is completed accurately?

To ensure your microfinance loan form is completed accurately, utilize the customizable templates provided by airSlate SignNow. These templates guide you through the required fields and help you avoid missing crucial information. Additionally, the platform's eSigning feature allows for immediate verification, ensuring all parties are confirmed before submission.

Get more for Microfinance Loan Application Form Pdf

- And disability services dads state tx form

- Solutions grade 7 worksheet form

- Podcast lesson plans pdf form

- Distance formula worksheet

- Pbgc form 700 422121081

- I am poem form

- Backflow device test form 06 doc

- Special permission slip for flag football playerscoaches the purpose of flag football is to promote school and class spirit form

Find out other Microfinance Loan Application Form Pdf

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement