Mortgage Loan Application Form

What is the mortgage loan application?

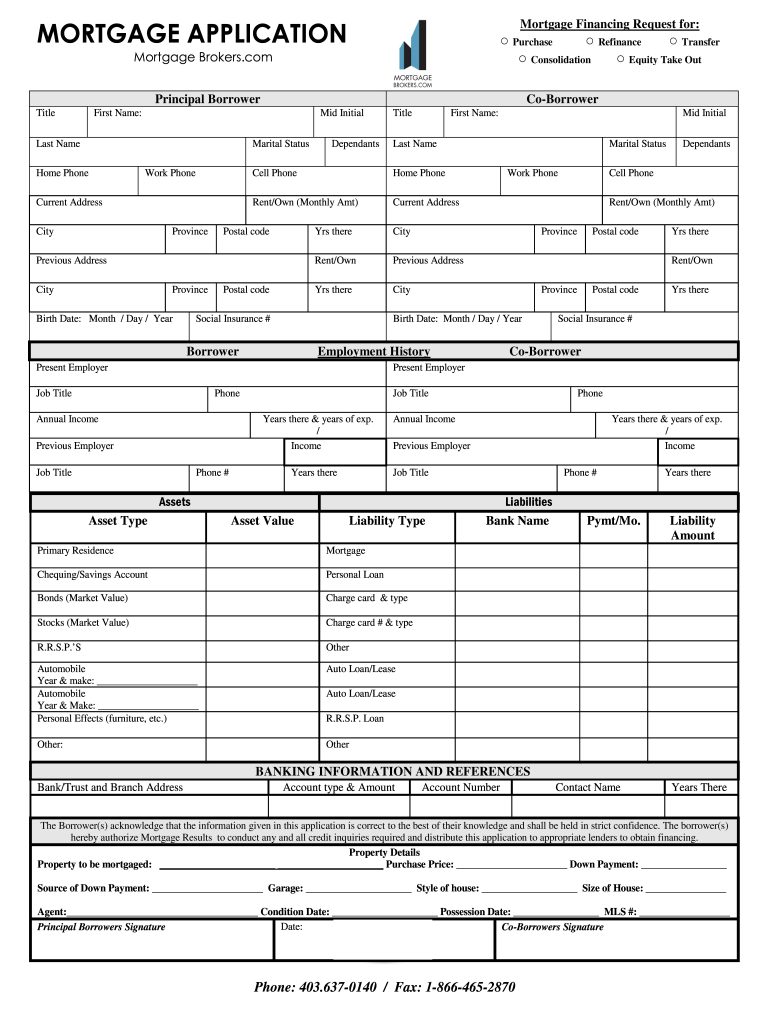

The mortgage loan application is a formal request submitted by an individual or entity seeking to borrow money for purchasing real estate. This application typically includes detailed personal and financial information, allowing lenders to assess the borrower's creditworthiness and ability to repay the loan. The application may require information such as income, employment history, debts, and assets.

Key elements of the mortgage loan application

Understanding the key elements of the mortgage loan application is crucial for a smooth process. The primary components usually include:

- Personal Information: Name, address, Social Security number, and contact details.

- Employment Details: Current employer, job title, length of employment, and income.

- Financial Information: Monthly debts, assets, and liabilities.

- Property Information: Details about the property being purchased, including its address and purchase price.

Steps to complete the mortgage loan application

Completing a mortgage loan application involves several steps to ensure accuracy and completeness. Here’s a general outline of the process:

- Gather necessary documents, including proof of income, tax returns, and bank statements.

- Fill out the application form with accurate personal and financial information.

- Review the application for any errors or omissions.

- Submit the application to the lender, either online or in person.

Required documents for the mortgage loan application

When applying for a mortgage, specific documents are typically required to verify your financial situation. Commonly required documents include:

- Proof of income (pay stubs, W-2 forms, or tax returns).

- Bank statements for the last two to three months.

- Identification (driver's license or passport).

- Credit history report.

Legal use of the mortgage loan application

The legal use of the mortgage loan application is governed by various regulations to ensure that the process is fair and transparent. It is essential to comply with the laws surrounding eSignatures and document handling. Using a compliant platform for submitting your application can help ensure that your application is legally binding and secure.

Form submission methods

Mortgage loan applications can be submitted through various methods, catering to different preferences and needs. Common submission methods include:

- Online Submission: Many lenders offer online platforms for completing and submitting applications.

- Mail: Applicants can print the completed form and send it via postal service.

- In-Person: Some borrowers may prefer to submit their applications directly at a lender's branch.

Quick guide on how to complete mortgage loan application

Complete Mortgage Loan Application effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly alternative to conventional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any holdups. Manage Mortgage Loan Application on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to modify and eSign Mortgage Loan Application effortlessly

- Locate Mortgage Loan Application and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method for submitting your form, be it via email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Mortgage Loan Application and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage loan application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for submitting my Canada mortgage application information using airSlate SignNow?

To submit your Canada mortgage application information with airSlate SignNow, you first need to create an account and upload your documents. Our platform allows you to easily eSign and send your mortgage application for review. Once submitted, you can track the status and get notifications when your documents are processed.

-

How secure is airSlate SignNow for handling my Canada mortgage application information?

airSlate SignNow prioritizes the security of your Canada mortgage application information by using advanced encryption protocols. All data is securely stored, ensuring that your sensitive information remains confidential. We also comply with industry standards to protect your documents during the signing process.

-

Are there any costs associated with using airSlate SignNow for Canada mortgage application information?

Using airSlate SignNow is cost-effective for managing your Canada mortgage application information. We offer various pricing plans tailored to meet business needs, ensuring you get value without overspending. You can choose a plan that suits your volume of document handling and eSigning.

-

What features does airSlate SignNow provide for Canada mortgage application information management?

airSlate SignNow offers robust features for managing Canada mortgage application information, including customizable templates, real-time tracking, and automated reminders. These features streamline the eSigning process and enhance collaboration between parties involved. Our platform is designed for efficiency and ease of use.

-

Can I integrate airSlate SignNow with other tools to manage my Canada mortgage application information?

Yes, airSlate SignNow provides seamless integrations with various applications, enabling you to manage your Canada mortgage application information efficiently. You can connect tools like CRM systems, document management software, and cloud storage services. This flexibility helps maintain a smooth workflow.

-

What makes airSlate SignNow a good choice for Canada mortgage application information processing?

airSlate SignNow is an excellent choice for processing Canada mortgage application information due to its user-friendly interface and comprehensive features. It simplifies the eSigning process while ensuring compliance and security. Businesses of all sizes benefit from our cost-effective solutions that enhance productivity.

-

How can I get support while using airSlate SignNow for my Canada mortgage application information?

Our dedicated support team is available to assist you with any questions regarding your Canada mortgage application information on airSlate SignNow. You can signNow us via email, chat, or phone, ensuring prompt resolution of your inquiries. We also provide extensive online resources and tutorials for self-help.

Get more for Mortgage Loan Application

Find out other Mortgage Loan Application

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free