Dtf 96 Form

What is the Dtf 96

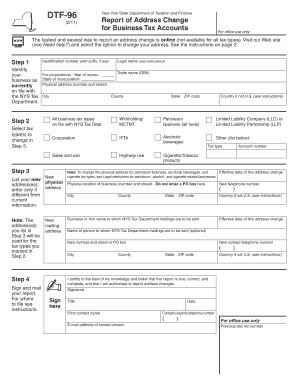

The Dtf 96 form, officially known as the New York State Department of Taxation and Finance form, is primarily used for claiming a refund of New York State sales and use tax. This form is essential for individuals and businesses that have overpaid taxes or have exemptions that qualify them for a refund. Understanding the purpose of the Dtf 96 is crucial for ensuring compliance with state tax regulations and for effectively managing tax liabilities.

How to use the Dtf 96

Using the Dtf 96 form involves several steps to ensure that all necessary information is accurately provided. First, gather all relevant documentation, including receipts and records of tax payments. Next, complete the form by filling in your personal or business information, detailing the reasons for the refund, and including the total amount claimed. After verifying the accuracy of your entries, submit the form to the New York State Department of Taxation and Finance either online or via mail, depending on your preference.

Steps to complete the Dtf 96

Completing the Dtf 96 form requires careful attention to detail. Follow these steps:

- Obtain the Dtf 96 form from the New York State Department of Taxation and Finance website or a local office.

- Fill in your name, address, and taxpayer identification number at the top of the form.

- Provide details of the sales and use tax overpayments, including dates and amounts.

- Attach any necessary documentation that supports your claim, such as invoices or payment records.

- Review the completed form for accuracy before submission.

Legal use of the Dtf 96

The Dtf 96 form must be used in accordance with New York State tax laws. It is legally binding when properly completed and submitted. To ensure that your claim is valid, it is important to adhere to the guidelines set forth by the New York State Department of Taxation and Finance. This includes providing accurate information and supporting documentation. Failure to comply with these regulations may result in delays or denials of your refund request.

Required Documents

When filing the Dtf 96 form, certain documents are required to substantiate your claim. These may include:

- Proof of tax payments, such as receipts or bank statements.

- Invoices that detail the transactions for which you are claiming a refund.

- Any correspondence related to tax assessments or disputes.

Having these documents ready will facilitate a smoother filing process and help ensure that your request is processed efficiently.

Form Submission Methods

The Dtf 96 form can be submitted through multiple methods, providing flexibility for taxpayers. You can choose to file the form online via the New York State Department of Taxation and Finance website, which may offer quicker processing times. Alternatively, you can print the completed form and mail it to the appropriate address listed on the form. In-person submissions may also be possible at local tax offices, allowing for direct interaction with tax officials.

Quick guide on how to complete dtf 96

Effortlessly Complete Dtf 96 on Any Device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to standard printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Dtf 96 on any device using airSlate SignNow's Android or iOS apps and enhance any document-based process today.

The Easiest Way to Modify and eSign Dtf 96

- Obtain Dtf 96 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight necessary parts of the documents or redact sensitive information using tools that airSlate SignNow offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Dtf 96 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf 96

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new york form dtf 96?

The new york form dtf 96 is a document used for claiming refunds or credits of New York State sales and use tax. It is typically required for businesses making tax-relevant claims. Understanding this form is essential for compliance and tax savings.

-

How can airSlate SignNow help me with the new york form dtf 96?

AirSlate SignNow provides an easy-to-use platform to electronically sign and send the new york form dtf 96. Our solution streamlines the process, allowing you to complete your forms quickly and securely without the hassle of printing and mailing.

-

What is the pricing structure for using airSlate SignNow for the new york form dtf 96?

AirSlate SignNow offers various pricing plans to cater to different business needs, starting from a cost-effective monthly subscription. By using our platform for new york form dtf 96, you can save not just on software fees but also time and resources that would otherwise be spent on traditional methods.

-

Are there any integrations available for the new york form dtf 96 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for the new york form dtf 96. You can connect with popular tools such as Google Drive and Dropbox to simplify document management and storage.

-

What features does airSlate SignNow offer for managing the new york form dtf 96?

AirSlate SignNow offers features such as cloud storage, customizable templates, and multi-signature support, specifically designed to enhance your experience with the new york form dtf 96. These features help ensure compliance and improve the efficiency of your document processes.

-

Can I track the status of my new york form dtf 96 once sent with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of your submitted new york form dtf 96. Our platform provides real-time updates, so you'll know when your document is viewed, signed, or completed.

-

Is it safe to use airSlate SignNow for the new york form dtf 96?

Yes, airSlate SignNow employs industry-leading security measures to protect your documents, including the new york form dtf 96. Our encryption and data protection protocols ensure that your sensitive information remains confidential throughout the signing process.

Get more for Dtf 96

- Dshs 18 607 form

- Rtc annual meetings form

- Workman ht form

- Ielts enquiry on results form part a britishcouncil org br britishcouncil org

- Printable missouri form mo atc adoption tax credit

- Rose scott l licensee information oklahoma medical board medicalboard georgia

- Iowa in home health related care form

- Acute care physical therapy evaluation template form

Find out other Dtf 96

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free