Printable Missouri Form MO ATC Adoption Tax Credit

What is the Printable Missouri Form MO ATC Adoption Tax Credit

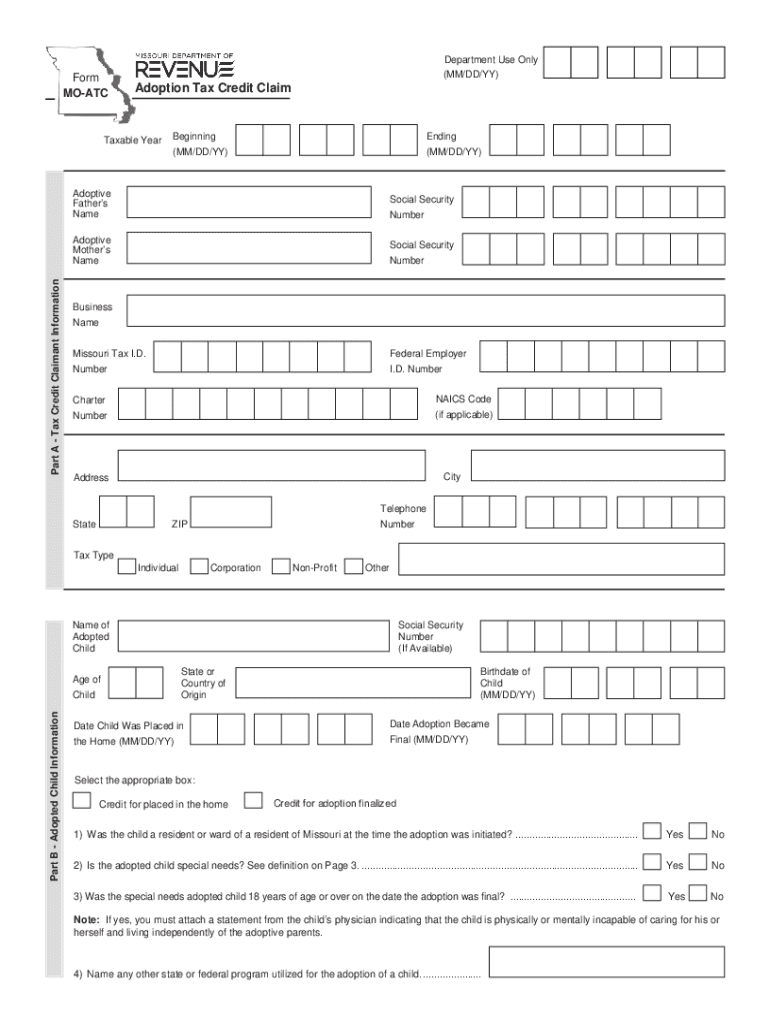

The Printable Missouri Form MO ATC is a tax credit application specifically designed for individuals and families who have adopted children. This form allows eligible taxpayers to claim a credit against their state income tax for qualified adoption expenses incurred during the adoption process. The adoption tax credit aims to alleviate some of the financial burdens associated with adoption, making it more accessible for families to provide loving homes to children in need.

How to use the Printable Missouri Form MO ATC Adoption Tax Credit

Using the Printable Missouri Form MO ATC involves several steps. First, you need to gather all necessary documentation related to your adoption expenses. Next, download and print the form from the Missouri Department of Revenue website. Fill out the form carefully, ensuring that all required information is provided, including your personal details and the specifics of the adoption. Once completed, submit the form along with your tax return to the Missouri Department of Revenue to claim your credit.

Steps to complete the Printable Missouri Form MO ATC Adoption Tax Credit

Completing the Printable Missouri Form MO ATC requires attention to detail. Follow these steps:

- Gather all relevant documents, including adoption agreements and receipts for expenses.

- Download the form from the Missouri Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Detail the adoption expenses you are claiming, ensuring they meet the eligibility criteria.

- Double-check all entries for accuracy.

- Attach any required documentation to support your claim.

- Submit the completed form with your tax return by the filing deadline.

Eligibility Criteria

To qualify for the Missouri Adoption Tax Credit using the MO ATC form, certain eligibility criteria must be met. Applicants must have incurred qualified adoption expenses related to the adoption of a child. The child must be under the age of eighteen at the time of adoption, and the adoption must be finalized. Additionally, the taxpayer must be a resident of Missouri and must not have previously claimed the adoption tax credit for the same adoption. It's essential to review the specific requirements to ensure compliance.

Required Documents

When applying for the Missouri Adoption Tax Credit, you must provide specific documents to support your claim. These typically include:

- Adoption agreement or court order finalizing the adoption.

- Receipts or invoices for all qualified adoption expenses.

- Proof of residency in Missouri, such as a utility bill or lease agreement.

- Any additional documentation requested by the Missouri Department of Revenue.

Form Submission Methods

The Printable Missouri Form MO ATC can be submitted through various methods. Taxpayers have the option to file online, by mail, or in person. For online submissions, ensure you have the necessary digital files ready for upload. If mailing the form, it should be sent to the appropriate address provided by the Missouri Department of Revenue. In-person submissions can be made at local revenue offices, where staff can assist with the process if needed.

Quick guide on how to complete printable missouri form mo atc adoption tax credit

Effortlessly Prepare Printable Missouri Form MO ATC Adoption Tax Credit on Any Device

The management of online documents has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your paperwork without delays. Manage Printable Missouri Form MO ATC Adoption Tax Credit on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and eSign Printable Missouri Form MO ATC Adoption Tax Credit with Ease

- Find Printable Missouri Form MO ATC Adoption Tax Credit and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or a shareable link, or download it to your computer.

Say goodbye to lost or misfiled documents, frustrating form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Printable Missouri Form MO ATC Adoption Tax Credit and guarantee outstanding communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable missouri form mo atc adoption tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to mo atc?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and eSign documents effortlessly. The term 'mo atc' refers to a specific integration with additional functionalities, enhancing the capabilities of SignNow for seamless document management.

-

How does the pricing structure of airSlate SignNow work?

airSlate SignNow offers various pricing plans designed to fit businesses of all sizes. For those interested in 'mo atc,' there are specific plans that include advanced features, ensuring that you get value through flexible options. It’s best to review the pricing page to find the plan that suits your needs.

-

What features does airSlate SignNow offer for effective document management?

airSlate SignNow includes an array of features such as secure eSigning, document templates, and automated workflows. With the addition of 'mo atc,' users gain access to enhanced tools for collaboration, tracking, and integrating with other platforms, making it a comprehensive solution.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow boasts numerous integrations with popular applications like Google Drive, Salesforce, and Microsoft Office. By utilizing 'mo atc,' you can further improve your workflow by connecting with additional software, streamlining your business processes.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow allows businesses to speed up the document signing process while ensuring security and compliance. The 'mo atc' feature not only enhances these benefits but also allows users to customize their document workflows, improving overall efficiency.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises. The 'mo atc' feature helps small businesses scale their operations by providing them with affordable, powerful tools for eSigning and document management.

-

How secure is the document signing process with airSlate SignNow?

airSlate SignNow prioritizes security by employing industry-standard encryption protocols for data protection. When using 'mo atc,' you can experience even more robust security measures, ensuring that your sensitive documents are safe from unauthorized access.

Get more for Printable Missouri Form MO ATC Adoption Tax Credit

Find out other Printable Missouri Form MO ATC Adoption Tax Credit

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement