Form 1464

What is the Form 1464

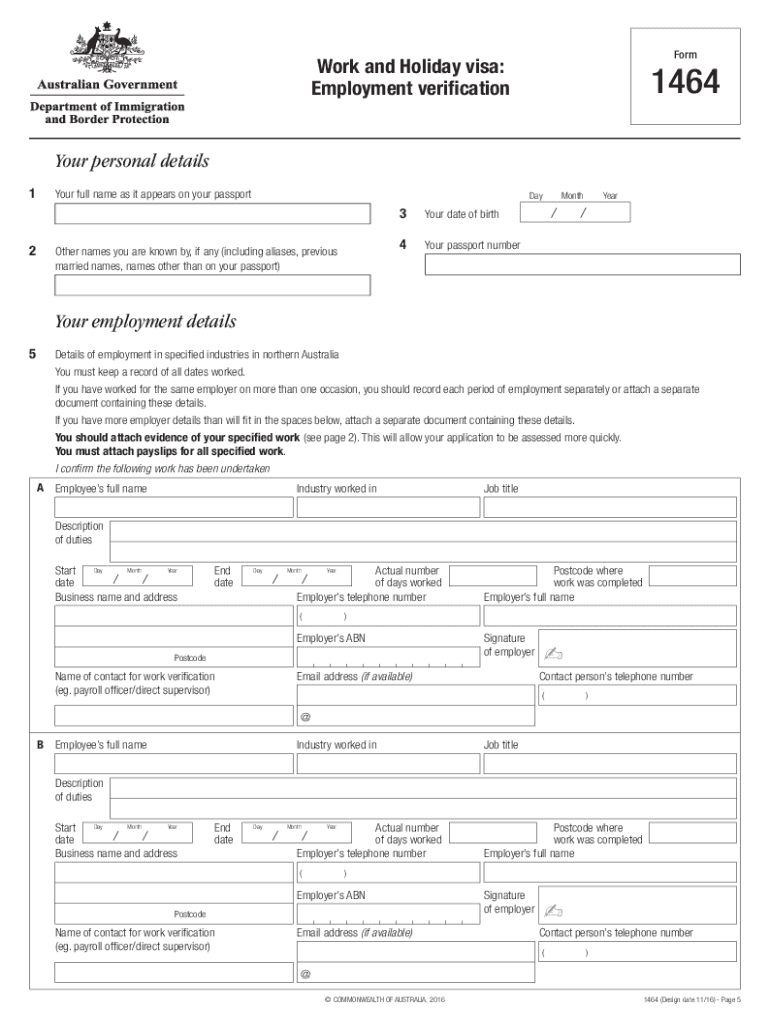

The Form 1464, commonly referred to as the employment verification form, is utilized primarily for individuals applying for a working holiday visa in Australia. This form serves as a crucial document that verifies employment status and is often required by immigration authorities to ensure that applicants meet specific eligibility criteria. Understanding the purpose and requirements of the Form 1464 is essential for anyone seeking to work while traveling in Australia.

How to use the Form 1464

Using the Form 1464 involves several steps to ensure accurate completion and submission. Applicants must first gather all necessary information related to their employment, including job title, employer details, and duration of employment. Once all information is compiled, the form can be filled out electronically or printed for manual completion. After filling out the form, it should be submitted as part of the visa application process, along with any other required documentation.

Steps to complete the Form 1464

Completing the Form 1464 requires attention to detail to avoid any errors that could delay the application process. Here are the steps to follow:

- Gather necessary employment information, including employer name, address, and contact details.

- Provide personal information such as your full name, address, and date of birth.

- Clearly state your job title and the nature of your employment.

- Indicate the duration of your employment and any relevant dates.

- Review the form for accuracy before submission to ensure all fields are completed correctly.

Legal use of the Form 1464

The Form 1464 is legally binding when filled out correctly and submitted as part of the visa application process. It is essential to comply with all legal requirements surrounding the form, including providing truthful and accurate information. Misrepresentation or failure to provide necessary details can lead to penalties or denial of the visa application. Ensuring compliance with regulations is crucial for a successful application.

Required Documents

When submitting the Form 1464, applicants must also provide supporting documents to validate their employment status. These documents typically include:

- A copy of the employment contract or offer letter.

- Recent pay stubs or tax documents that confirm employment.

- Identification documents, such as a passport or driver's license.

Having these documents ready can streamline the application process and help avoid delays.

Eligibility Criteria

To use the Form 1464 effectively, applicants must meet specific eligibility criteria for the working holiday visa. These criteria generally include:

- Being between the ages of eighteen and thirty years.

- Holding a valid passport from an eligible country.

- Having sufficient funds to support oneself during the stay in Australia.

Meeting these criteria is essential for the approval of the working holiday visa application.

Quick guide on how to complete form 1464

Complete Form 1464 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as a perfect environmentally-friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without delays. Handle Form 1464 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Form 1464 with ease

- Find Form 1464 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and click the Done button to save your changes.

- Select your preferred method to send your form—via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 1464 and guarantee clear communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1464

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1464 and how can airSlate SignNow help with it?

Form 1464 is a document used for various purposes within organizations, such as agreements and contracts. airSlate SignNow allows businesses to easily upload, send, and electronically sign form 1464, streamlining the process and ensuring secure compliance.

-

What features does airSlate SignNow offer for managing form 1464?

airSlate SignNow offers a range of features for managing form 1464, including customizable templates, automated workflows, and real-time tracking. These features help simplify document management and enhance collaboration within teams.

-

Is airSlate SignNow a cost-effective solution for using form 1464?

Yes, airSlate SignNow provides a cost-effective solution for handling form 1464. With various pricing plans available, businesses can select an option that suits their budget while benefiting from the wide range of features that improve efficiency.

-

Can form 1464 be integrated with other applications using airSlate SignNow?

Absolutely! airSlate SignNow can seamlessly integrate with various applications, enabling users to automatically send and manage form 1464 across different platforms. This integration enhances productivity and ensures a smoother workflow.

-

How does airSlate SignNow ensure the security of form 1464?

airSlate SignNow prioritizes security with advanced encryption protocols and compliance with industry standards. When working with form 1464, businesses can be assured that their sensitive information is well-protected throughout the signing process.

-

Can I track the status of form 1464 sent through airSlate SignNow?

Yes, airSlate SignNow provides real-time updates and tracking for form 1464. Users can easily monitor the status of their documents, ensuring they know when recipients have viewed and signed the form.

-

How user-friendly is the process of sending form 1464 with airSlate SignNow?

Sending form 1464 with airSlate SignNow is incredibly user-friendly and intuitive. With a simple interface, even those with minimal technical skills can quickly navigate the platform and send documents for eSignature in just a few clicks.

Get more for Form 1464

Find out other Form 1464

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter