Maine W4 Form

What is the Maine W4 Form

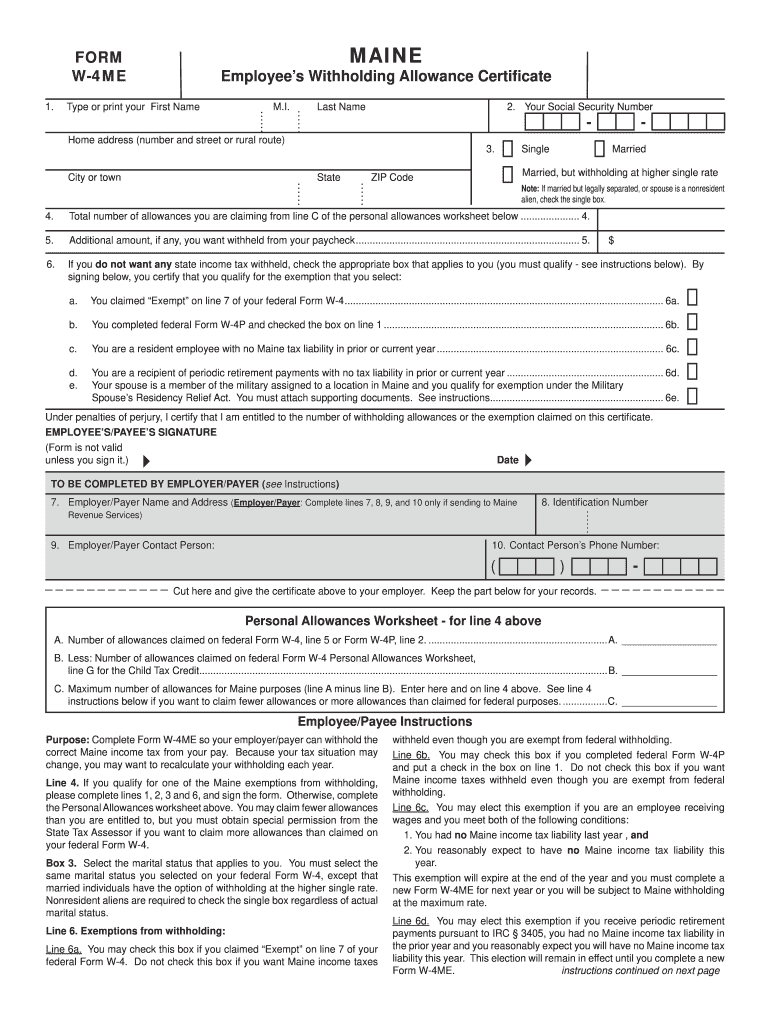

The Maine W4 form is a state-specific document used by employees to determine the amount of state income tax to withhold from their paychecks. This form is essential for ensuring that the correct amount of taxes is deducted based on individual circumstances, such as marital status and the number of dependents. It is similar to the federal W-4 form but tailored to meet Maine's tax regulations.

How to use the Maine W4 Form

To use the Maine W4 form effectively, employees must complete it accurately and submit it to their employer. The form allows individuals to specify their filing status, allowances, and any additional amounts they wish to have withheld. Employers use this information to calculate the appropriate state tax deductions from each paycheck. It is advisable to review and update the form whenever there are significant life changes, such as marriage or the birth of a child.

Steps to complete the Maine W4 Form

Completing the Maine W4 form involves several straightforward steps:

- Download the form: Obtain the Maine W4 form from the Maine Revenue Services website or your employer.

- Fill in personal information: Provide your name, address, and Social Security number.

- Select your filing status: Choose between single, married, or head of household.

- Claim allowances: Indicate the number of allowances you are entitled to based on your situation.

- Additional withholding: If desired, specify any extra amount to be withheld from your paycheck.

- Sign and date: Ensure that you sign and date the form before submitting it to your employer.

Legal use of the Maine W4 Form

The Maine W4 form is legally binding when completed and submitted correctly. It complies with state tax laws, ensuring that employers withhold the correct amount of state income tax from employees' wages. To maintain its legal validity, the form should be filled out accurately, and any changes in personal circumstances should be promptly updated on the form. Employers are required to keep this form on file for their records.

Key elements of the Maine W4 Form

Key elements of the Maine W4 form include:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Allowances: The number of allowances claimed affects tax withholding.

- Additional Withholding: An option to specify any extra amount to be withheld.

- Signature: Required to validate the form.

Form Submission Methods (Online / Mail / In-Person)

The Maine W4 form can be submitted to employers through various methods. Typically, employees provide the completed form directly to their HR or payroll department in person. Some employers may allow electronic submission via email or secure online portals. It is important to confirm the preferred submission method with your employer to ensure timely processing.

Quick guide on how to complete maine w4 form

Complete Maine W4 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Maine W4 Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Maine W4 Form with ease

- Find Maine W4 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to secure your changes.

- Select how you wish to send your form – via email, SMS, invite link, or download it to your computer.

Forget about misplaced or lost files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Maine W4 Form to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maine w4 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maine State W4 form and why is it important?

The Maine State W4 form is a vital document for employees to determine the amount of state income tax to withhold from their paychecks. It ensures compliance with Maine tax laws and helps you avoid over- or under-withholding. Understanding the Maine State W4 is crucial for accurate tax filing.

-

How can airSlate SignNow help with completing the Maine State W4?

airSlate SignNow simplifies the process of completing the Maine State W4 by providing an intuitive digital platform for e-signatures. With our solution, you can easily fill out, sign, and share your Maine State W4 online, saving time and reducing paperwork. This ensures you stay compliant with state tax regulations.

-

What are the pricing options for using airSlate SignNow for the Maine State W4?

airSlate SignNow offers various pricing plans to fit businesses of all sizes, ensuring that completing your Maine State W4 is both affordable and efficient. We provide a free trial, allowing you to explore our features before committing to a subscription. Contact us for detailed pricing tailored to your needs.

-

What features does airSlate SignNow provide for managing the Maine State W4?

Our platform offers features like customizable templates, bulk sending options, and secure storage to efficiently manage your Maine State W4. Additionally, our user-friendly interface makes completing and signing the form effortless. You can access your documents anytime, anywhere, ensuring seamless management.

-

Is airSlate SignNow compliant with Maine state regulations for the W4 form?

Yes, airSlate SignNow is fully compliant with Maine state regulations for the W4 form. We ensure that our document templates adhere to the latest legal standards, providing a reliable way to complete and submit your Maine State W4. You can trust our solution for your documentation needs.

-

Can I integrate airSlate SignNow with other software for my Maine State W4 processing?

Absolutely! airSlate SignNow supports integration with various business applications, enhancing your workflow for processing the Maine State W4. Whether you use HR software or payroll systems, our integration options facilitate seamless document management and e-signature processes.

-

What are the benefits of using airSlate SignNow over traditional methods for the Maine State W4?

Using airSlate SignNow for your Maine State W4 offers numerous benefits over traditional methods, including time-saving e-signatures, reduced paper usage, and improved accuracy. Our platform allows for quick edits and sharing, making the entire process efficient. Additionally, you'll have secure access to your documents at all times.

Get more for Maine W4 Form

- Microneedling consent form 410392574

- Formulaire m2 dissolution

- Federal perkins loan master promissory note mpn pdf admissions rpi form

- Chapter 12 test form 2b geometry answers

- Employee warning employee warning form

- Pakistan nursing council islamabad park road nih form

- Cares utility assistance application form

- Imfpa agreement template form

Find out other Maine W4 Form

- Electronic signature Form for Legal Free

- How To Electronic signature Form for Legal

- Electronic signature Word for Legal Safe

- Electronic signature PPT for Legal Safe

- Electronic signature Form for Legal Fast

- How Can I Electronic signature Form for Legal

- Electronic signature PDF for Procurement Online

- Electronic signature Form for Legal Simple

- Electronic signature PDF for Procurement Computer

- Electronic signature PDF for Procurement Mobile

- Electronic signature Form for Legal Easy

- Electronic signature Form for Legal Safe

- How Can I Electronic signature PDF for Procurement

- Can I Electronic signature PDF for Procurement

- How Do I Electronic signature Word for Procurement

- Electronic signature Word for Procurement Mobile

- Electronic signature Presentation for Legal Now

- Electronic signature Presentation for Legal Later

- Electronic signature Document for Procurement Mobile

- How To Electronic signature Document for Procurement