Lump Sum Promissory Note Form

What is the Lump Sum Promissory Note

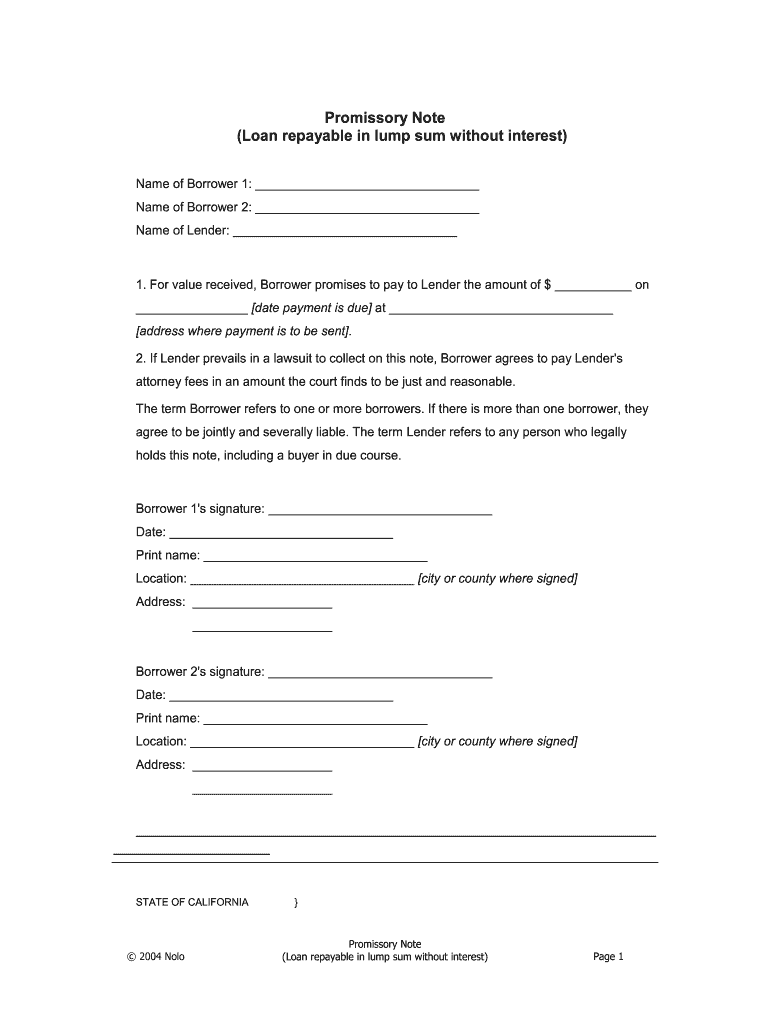

A lump sum promissory note is a financial instrument in which one party promises to pay a specified amount of money to another party at a predetermined date. This type of note is often used in personal loans, business transactions, or real estate dealings. Unlike amortized payments, where the borrower makes regular payments over time, a lump sum payment requires the total amount to be paid in one single transaction. This structure can be beneficial for both lenders and borrowers, as it simplifies the repayment process and provides clarity on the terms of the agreement.

How to use the Lump Sum Promissory Note

Using a lump sum promissory note involves several key steps. First, both parties should agree on the terms, including the amount, interest rate (if applicable), and payment due date. Once these terms are established, the lender and borrower can complete the note, ensuring that all necessary details are included. After signing, both parties should retain copies for their records. This document serves as a legal record of the agreement and can be enforced in a court of law if necessary.

Steps to complete the Lump Sum Promissory Note

Completing a lump sum promissory note involves the following steps:

- Identify the parties involved: Clearly state the names and addresses of both the borrower and the lender.

- Specify the loan amount: Clearly indicate the total sum being borrowed.

- Outline the repayment terms: Include the due date for the lump sum payment, and any applicable interest rate.

- Include signatures: Both parties should sign and date the document to validate the agreement.

- Distribute copies: Ensure that both parties receive a signed copy for their records.

Key elements of the Lump Sum Promissory Note

Several key elements must be included in a lump sum promissory note to ensure its validity:

- Parties involved: Names and addresses of both the borrower and lender.

- Loan amount: The total sum being borrowed.

- Interest rate: If applicable, specify the interest rate and how it is calculated.

- Due date: The exact date by which the lump sum must be repaid.

- Signatures: Signatures of both parties, along with the date of signing.

Legal use of the Lump Sum Promissory Note

The legal use of a lump sum promissory note is governed by state laws, which can vary significantly. For the note to be enforceable, it must meet specific legal requirements, including clarity in terms and proper execution. A well-drafted note can serve as a strong legal document in case of disputes. It is advisable for both parties to consult legal counsel to ensure compliance with applicable laws and to understand their rights and obligations under the agreement.

Examples of using the Lump Sum Promissory Note

Common scenarios for using a lump sum promissory note include:

- Personal loans between friends or family members.

- Business loans for startups or expansions.

- Real estate transactions where a buyer finances a property purchase.

- Settlements in legal disputes where a lump sum payment is agreed upon.

Quick guide on how to complete lump sum promissory note

Complete Lump Sum Promissory Note effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, amend, and eSign your documents promptly without any holdups. Manage Lump Sum Promissory Note on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Lump Sum Promissory Note effortlessly

- Obtain Lump Sum Promissory Note and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Lump Sum Promissory Note to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lump sum promissory note

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an unsecured promissory note lump sum payment?

An unsecured promissory note lump sum payment is a financial agreement where a borrower promises to pay back a specific amount in a single payment, without any collateral. This type of note is often used in personal loans and can be beneficial for individuals seeking quick financing.

-

How does airSlate SignNow enhance the signing process for unsecured promissory note lump sum payment?

airSlate SignNow streamlines the signing process for unsecured promissory note lump sum payments by allowing users to create, send, and eSign documents digitally. This eliminates the need for physical paperwork and ensures a faster turnaround time for obtaining necessary signatures.

-

What are the pricing options for using airSlate SignNow for unsecured promissory note lump sum payment documents?

airSlate SignNow offers flexible pricing options tailored to suit different business needs and scales. Whether you are a small business or a large corporation, you can find a plan that allows you to efficiently manage unsecured promissory note lump sum payments at a cost-effective rate.

-

Are there templates available for creating unsecured promissory note lump sum payments?

Yes, airSlate SignNow provides a range of customizable templates specifically designed for unsecured promissory note lump sum payments. These templates make it easy to fill out, eSign, and manage documents without the hassle of starting from scratch.

-

What integrations does airSlate SignNow offer for unsecured promissory note lump sum payment management?

airSlate SignNow seamlessly integrates with various platforms, including CRM tools and cloud storage solutions, to enhance the management of unsecured promissory note lump sum payments. This flexibility allows businesses to create a cohesive workflow and improve efficiency.

-

How secure are unsecured promissory note lump sum payment documents handled by airSlate SignNow?

All documents processed through airSlate SignNow, including unsecured promissory note lump sum payments, are protected by advanced security measures such as encryption and secure storage. This ensures that sensitive information remains confidential and is legally binding.

-

Can I track the status of my unsecured promissory note lump sum payment documents with airSlate SignNow?

Absolutely! airSlate SignNow allows users to track the status of all their unsecured promissory note lump sum payment documents in real-time. You'll receive notifications regarding the signing process, ensuring you are always informed.

Get more for Lump Sum Promissory Note

- Gcc form

- Certified verification of experience form dekalb county schools dekalb k12 ga

- Pwn pdf form

- Central hudson gas pressure test form

- Americo cancel policy form

- Sample form o motion to augment record on california courts

- Full child custody agreement template form

- Fulfillment service agreement template form

Find out other Lump Sum Promissory Note

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online