Or Wr Form for

What is the Or Wr Form For

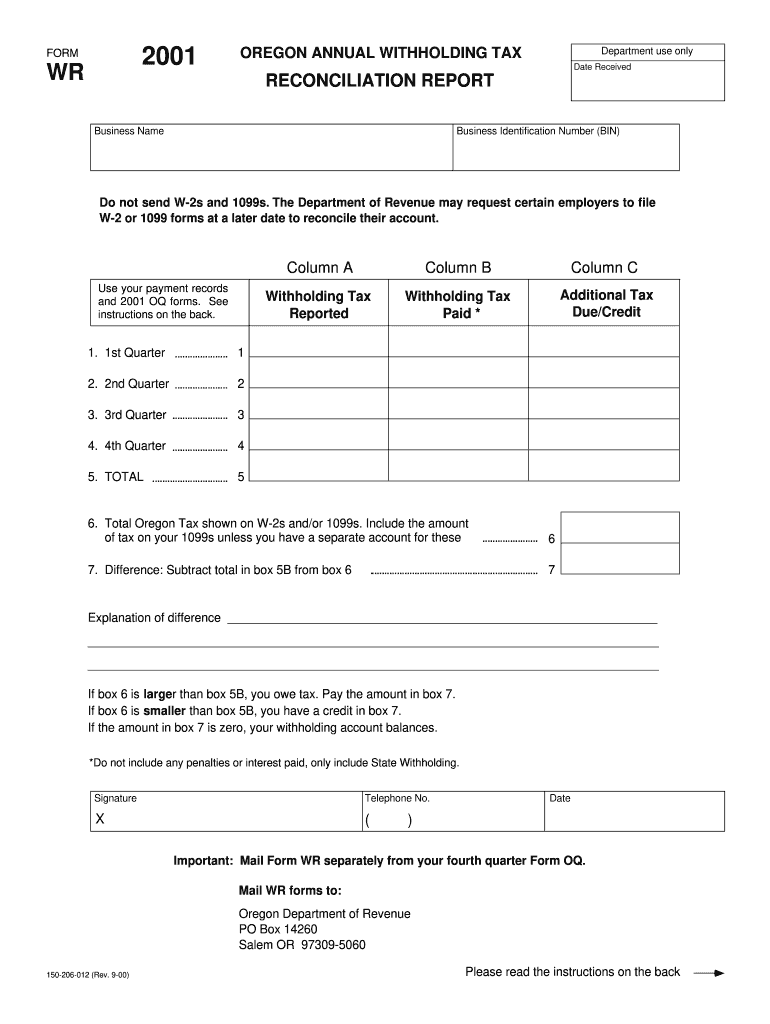

The Oregon WR form 2019, also known as the Oregon Annual Withholding Tax Reconciliation Report, is a critical document for employers in Oregon. It is used to report the total amount of state income tax withheld from employees' wages throughout the year. This form ensures that the state receives accurate records of withholding amounts, which is essential for both tax compliance and employee tax credit calculations. Employers must submit this form annually to reconcile their withholding tax obligations with the amounts reported on employees' W-2 forms.

How to Use the Or Wr Form For

To effectively use the Oregon WR form 2019, employers must first gather all relevant payroll information for the year. This includes the total wages paid to employees and the total state income tax withheld. Once this data is compiled, employers can fill out the form by entering the required figures in the designated fields. It is crucial to ensure accuracy, as discrepancies can lead to penalties or issues with the Oregon Department of Revenue. After completing the form, employers should retain a copy for their records and submit it according to the state’s guidelines.

Steps to Complete the Or Wr Form For

Completing the Oregon WR form 2019 involves several key steps:

- Gather all payroll records for the year, including W-2 forms for each employee.

- Calculate the total state income tax withheld from all employees' wages.

- Fill out the form with accurate figures, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to the Oregon Department of Revenue by the specified deadline.

Legal Use of the Or Wr Form For

The Oregon WR form 2019 is legally binding and must be completed in accordance with state tax laws. Employers are required to file this form annually to remain compliant with Oregon tax regulations. Failure to submit the form or inaccuracies in reporting can result in penalties, including fines or audits by the Oregon Department of Revenue. It is important for employers to understand their obligations regarding this form to avoid legal repercussions.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the Oregon WR form 2019. Typically, the form is due by January 31 of the following year after the tax year ends. For example, the 2019 form must be submitted by January 31, 2020. It is essential to adhere to this deadline to avoid any late fees or penalties. Employers should also keep track of any updates from the Oregon Department of Revenue regarding changes to deadlines or filing procedures.

Form Submission Methods (Online / Mail / In-Person)

The Oregon WR form 2019 can be submitted through various methods, providing flexibility for employers. The form can be filed online through the Oregon Department of Revenue's website, which is often the fastest and most efficient method. Alternatively, employers can mail a paper copy of the form to the appropriate address provided by the state. In-person submissions may also be possible at designated state offices, but it is advisable to check ahead for specific requirements and hours of operation.

Quick guide on how to complete or wr form for

Prepare Or Wr Form For effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly without delays. Handle Or Wr Form For on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and electronically sign Or Wr Form For without hassle

- Obtain Or Wr Form For and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and electronically sign Or Wr Form For and guarantee exceptional communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the or wr form for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the form or wr 2019 in airSlate SignNow?

The form or wr 2019 in airSlate SignNow is designed to streamline the document signing process for businesses. It allows users to create and manage forms efficiently, ensuring compliance and enhancing productivity.

-

How does pricing work for using airSlate SignNow with the form or wr 2019?

Pricing for airSlate SignNow varies based on the subscription plan you select. Each plan provides access to the form or wr 2019 feature, allowing businesses to choose a cost-effective solution that fits their needs.

-

Can I customize the form or wr 2019 to fit my business requirements?

Yes, airSlate SignNow allows users to customize the form or wr 2019 to align with specific business requirements. You can add custom fields, branding elements, and choose the layout that best suits your operations.

-

What are the main benefits of using the form or wr 2019 with airSlate SignNow?

Using the form or wr 2019 with airSlate SignNow offers several benefits, including enhanced document security, improved efficiency, and seamless collaboration. It scales easily to fit any business size, making it an ideal choice for diverse needs.

-

Are there any integrations available for the form or wr 2019 in airSlate SignNow?

Absolutely, the form or wr 2019 can be integrated with various third-party applications using airSlate SignNow. This ensures a smooth workflow, as you can connect with tools you already use, enhancing overall productivity.

-

Is there a mobile app for accessing the form or wr 2019 on the go?

Yes, airSlate SignNow offers a mobile app that allows users to access the form or wr 2019 on the go. This flexibility ensures that you can manage and sign documents anytime, anywhere, making it a convenient choice for busy professionals.

-

How secure is the form or wr 2019 when used in airSlate SignNow?

Security is a top priority for airSlate SignNow. The form or wr 2019 is protected with advanced encryption and authentication measures, ensuring that your documents and signatures are secure and compliant with industry standards.

Get more for Or Wr Form For

- Corgi puppy sale contract sample form

- Nmfl 1003 form

- Operations and safety procedures guide for helicopter pilots form

- Contrat de travail qubec form

- Students form 2150 nondiscrimination and student rights searches by school personnel student lockers acknowledgement concerning

- Temporary player waiver vip airsoft form

- Application for arizona watercraft certificate of amazon s3 form

- Cca 0218a sign insign out record form

Find out other Or Wr Form For

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form