Gbk Charitable Trust Form

What is the GBK Charitable Trust?

The GBK Charitable Trust is a philanthropic organization dedicated to providing financial assistance and scholarships to underprivileged students. It aims to support educational initiatives and foster opportunities for individuals who may otherwise face barriers to higher education. The trust operates by collecting donations and distributing funds through various scholarship programs, including the GBK Charitable Trust Scholarship.

Eligibility Criteria for the GBK Charitable Trust Scholarship

To qualify for the GBK Charitable Trust Scholarship, applicants typically need to meet specific criteria, which may include:

- Being a resident of the United States.

- Demonstrating financial need through appropriate documentation.

- Maintaining a minimum GPA as specified by the trust.

- Submitting a completed application form by the designated deadline.

Steps to Complete the GBK Charitable Trust Application

Completing the application for the GBK Charitable Trust involves several important steps:

- Gather necessary documents, such as proof of income and academic records.

- Fill out the application form accurately, ensuring all required fields are completed.

- Provide any additional information requested, such as letters of recommendation or personal statements.

- Review the application for completeness and accuracy before submission.

- Submit the application online or via mail, adhering to the specified deadlines.

Legal Use of the GBK Charitable Trust

The GBK Charitable Trust operates under specific legal frameworks that govern charitable organizations in the United States. Compliance with these regulations is essential to ensure that the trust's activities are legitimate and that donations are used appropriately. This includes adhering to IRS guidelines for tax-exempt organizations and maintaining transparency in financial reporting.

Required Documents for Application

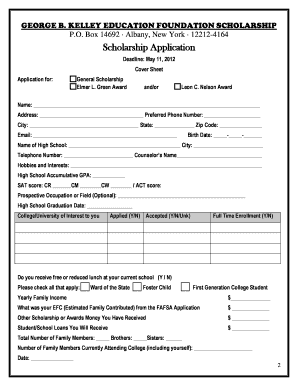

When applying for the GBK Charitable Trust Scholarship, applicants must submit various documents to support their application. Commonly required documents include:

- Completed scholarship application form.

- Proof of income, such as tax returns or pay stubs.

- Transcripts or report cards from educational institutions.

- Letters of recommendation from teachers or community leaders.

Form Submission Methods

Applicants can submit their GBK Charitable Trust application through multiple methods, ensuring flexibility and accessibility. The submission options typically include:

- Online submission via the official GBK Charitable Trust website.

- Mailing a printed application form to the designated address.

- In-person submission at specified locations, if applicable.

Quick guide on how to complete gbk charitable trust

Complete Gbk Charitable Trust effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents quickly without any delays. Manage Gbk Charitable Trust on any platform using airSlate SignNow Android or iOS apps and enhance any document-related task today.

The simplest way to modify and eSign Gbk Charitable Trust without hassle

- Find Gbk Charitable Trust and then click Get Form to begin.

- Utilize the features we provide to finish your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Produce your eSignature with the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Gbk Charitable Trust while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gbk charitable trust

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is gbk trust and how does it relate to airSlate SignNow?

gbk trust refers to the assurance and reliability offered by airSlate SignNow in securing electronic signatures and document management. Our platform adheres to strict security protocols, ensuring that your documents are safely signed and stored, providing peace of mind for businesses.

-

How much does airSlate SignNow cost for gbk trust users?

Pricing for airSlate SignNow varies based on the plans chosen, providing flexibility for gbk trust users. We offer competitive rates, with a focus on cost-effectiveness to help businesses manage their document workflows efficiently without compromising on security.

-

What features does airSlate SignNow offer for gbk trust clients?

airSlate SignNow includes a variety of features tailored for gbk trust clients, such as customizable templates, automated workflows, and in-depth analytics. Additionally, our platform supports multi-party signing, making it perfect for businesses of all sizes looking for an efficient eSignature solution.

-

How can gbk trust enhance my business's document management?

By utilizing gbk trust through airSlate SignNow, businesses can streamline their document management processes, reducing turnaround times signNowly. The secure electronic signature feature ensures legal compliance while enhancing collaboration among teams and clients.

-

Can airSlate SignNow integrate with other applications for gbk trust functionality?

Yes, airSlate SignNow offers robust integrations with popular applications, which can enhance gbk trust functionality across your business systems. This seamless integration ensures that your document workflows are consistent and coherent, eliminating data silos and improving efficiency.

-

What are the benefits of using gbk trust with airSlate SignNow?

Using gbk trust with airSlate SignNow comes with numerous benefits, including enhanced security, faster turnaround times, and improved productivity. Our platform provides a reliable eSignature solution that ensures your documents are handled efficiently and securely.

-

Is airSlate SignNow suitable for businesses of all sizes with gbk trust?

Absolutely, airSlate SignNow is designed to meet the needs of businesses of all sizes seeking gbk trust for their document signing processes. Whether you're a small startup or a large enterprise, our solution scales to fit your specific requirements.

Get more for Gbk Charitable Trust

- Metric units meters and centimeters form

- Equipment purchase request form

- Sample notice of appeal pennsylvania form

- Deferment request for admission hawaii pacific university hpu form

- Lasemd treatment consent form

- Arnold schwarzenegger encyclopedia of modern bodybuilding pdf form

- Attorney fee agreement template form

- Audit agreement template form

Find out other Gbk Charitable Trust

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF