Franchise and Excise Tax Exempt Entity Disclosure of Activity Form 2009

What is the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form

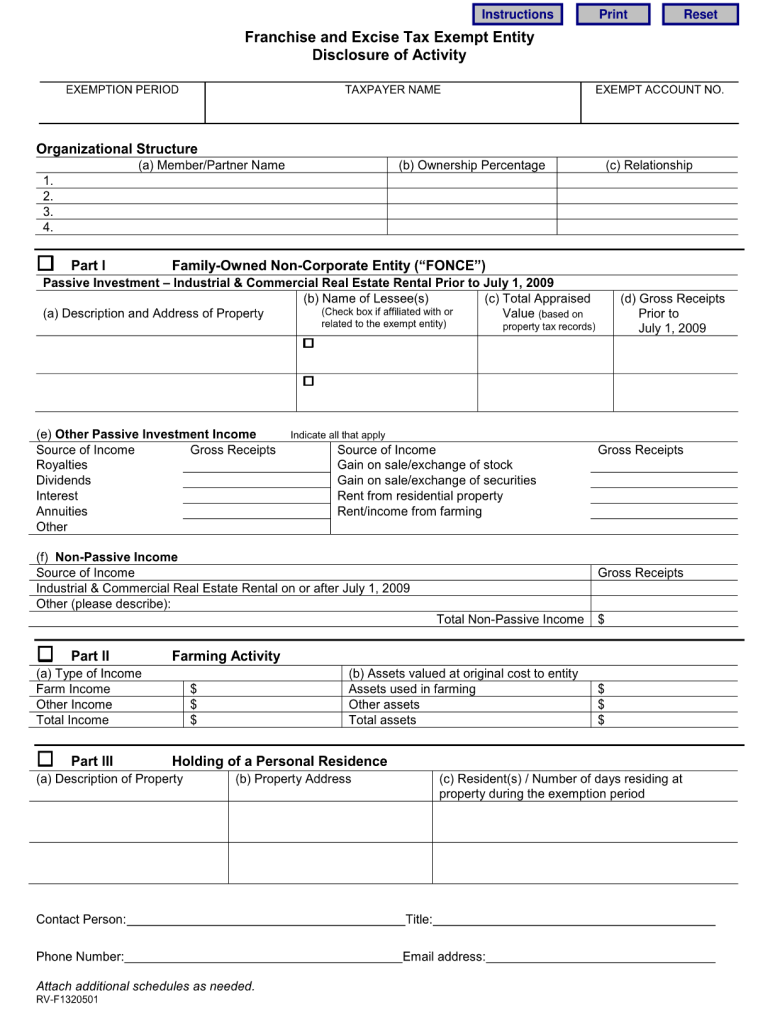

The Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form is a specific document used by exempt entities to report their activities related to franchise and excise taxes. This form is essential for organizations that qualify for tax exemptions under U.S. federal and state laws. It provides a structured way to disclose the nature of activities conducted by the entity, ensuring compliance with tax regulations. By accurately completing this form, exempt entities can maintain their tax-exempt status while fulfilling their reporting obligations.

Steps to complete the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form

Completing the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form involves several clear steps:

- Gather necessary information about the entity, including its legal name, address, and tax identification number.

- Review the specific instructions provided with the form to understand the required disclosures.

- Fill out the form accurately, ensuring all sections are completed as per the guidelines.

- Double-check the information for accuracy and completeness to avoid delays in processing.

- Sign the form electronically using a compliant eSignature solution, ensuring it meets the legal requirements.

- Submit the completed form through the designated method, whether online, by mail, or in person.

How to use the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form

The Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form is utilized primarily to report the activities of tax-exempt organizations. To use the form effectively, follow these guidelines:

- Ensure that your organization qualifies for tax exemption under applicable laws.

- Complete the form with detailed descriptions of the activities that qualify for tax-exempt status.

- Maintain a copy of the completed form for your records, as it may be required for future audits or compliance checks.

- Stay informed about any changes in tax law that may affect your reporting requirements.

Legal use of the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form

The legal use of the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form is critical for maintaining compliance with tax regulations. This form serves as an official record of the activities conducted by exempt entities. It is legally binding and must be completed truthfully and accurately. Misrepresentation or failure to disclose required information can lead to penalties, including the loss of tax-exempt status. Therefore, it is essential for organizations to understand the legal implications of the information provided on this form.

Filing Deadlines / Important Dates

Filing deadlines for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form vary depending on the specific requirements set by state and federal authorities. Generally, organizations must submit this form annually, aligning with their tax filing schedule. It is crucial to be aware of these deadlines to avoid late fees or penalties. Organizations should consult the relevant tax authority or a tax professional to confirm specific filing dates and any changes that may occur annually.

Form Submission Methods (Online / Mail / In-Person)

The Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form can be submitted through various methods, providing flexibility for organizations. Common submission methods include:

- Online: Many states allow electronic submission through their tax portals, making it easy to file and track the status of the form.

- Mail: Organizations can print the completed form and send it via postal service to the designated tax authority.

- In-Person: Some entities may choose to submit the form in person at local tax offices, ensuring immediate confirmation of receipt.

Quick guide on how to complete franchise and excise tax exempt entity disclosure of activity 2009 form

Your assistance manual on preparing your Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form

If you’re wondering how to finalize and submit your Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form, here are a few brief instructions to make tax filing easier.

To begin, you just need to create your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to edit, draft, and finalize your income tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and revert to modify details as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form in no time:

- Establish your account and start working on PDFs in a matter of minutes.

- Utilize our directory to locate any IRS tax document; navigate through versions and schedules.

- Press Get form to access your Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form in our editor.

- Provide the mandatory fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that paper filing can lead to increased return errors and delayed refunds. Naturally, before e-filing your taxes, consult the IRS website for submission guidelines applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct franchise and excise tax exempt entity disclosure of activity 2009 form

FAQs

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the franchise and excise tax exempt entity disclosure of activity 2009 form

How to generate an electronic signature for your Franchise And Excise Tax Exempt Entity Disclosure Of Activity 2009 Form online

How to generate an electronic signature for your Franchise And Excise Tax Exempt Entity Disclosure Of Activity 2009 Form in Google Chrome

How to generate an electronic signature for putting it on the Franchise And Excise Tax Exempt Entity Disclosure Of Activity 2009 Form in Gmail

How to generate an electronic signature for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity 2009 Form straight from your smartphone

How to generate an electronic signature for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity 2009 Form on iOS devices

How to create an electronic signature for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity 2009 Form on Android

People also ask

-

What is the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form?

The Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form is a document used by exempt entities to report their business activities. This form helps to clarify tax obligations and ensures compliance with state regulations regarding franchise and excise taxes.

-

How can airSlate SignNow assist with the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form?

airSlate SignNow provides an efficient platform to prepare, send, and eSign the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form. Our solution simplifies the document process, making it easy for exempt entities to handle necessary paperwork quickly and securely.

-

Are there any costs associated with using airSlate SignNow for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form?

Yes, there are pricing plans available for using airSlate SignNow to handle the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form. We offer flexible, cost-effective solutions tailored to meet the needs of various businesses while providing the tools necessary for efficient document management.

-

What features does airSlate SignNow offer for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form. This helps businesses streamline their processes and ensures accurate completion of forms.

-

Can I integrate airSlate SignNow with other software for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form?

Yes, airSlate SignNow offers various integrations with popular software platforms that can assist in managing the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form. This allows businesses to enhance their workflow and improve efficiency across their operations.

-

What are the benefits of using airSlate SignNow for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form?

Using airSlate SignNow for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form provides several benefits, including reduced paperwork, improved compliance, and faster transaction speeds. Our platform empowers businesses to focus on their core activities without getting bogged down by document management.

-

Is airSlate SignNow user-friendly for submitting the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form?

Absolutely! airSlate SignNow is designed to be user-friendly, allowing anyone to navigate the platform easily when preparing the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form. Our intuitive interface ensures that users can complete forms quickly and efficiently.

Get more for Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form

- Panera menu pdf form

- La parmigiana pasta machine form

- Marshall cavendish books pdf download form

- Kinship application form

- Casual leave form education department

- Test tray evaluation form

- Cmp mandate debit sbi life insurance form

- Ch 116 s order on request to continue hearing temporary restraining order clets tch judicial council forms

Find out other Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast