AP 201 Texas Application for Sales and Use Tax Permit SALTware Form

What is the AP 201 Texas Application for Sales and Use Tax Permit?

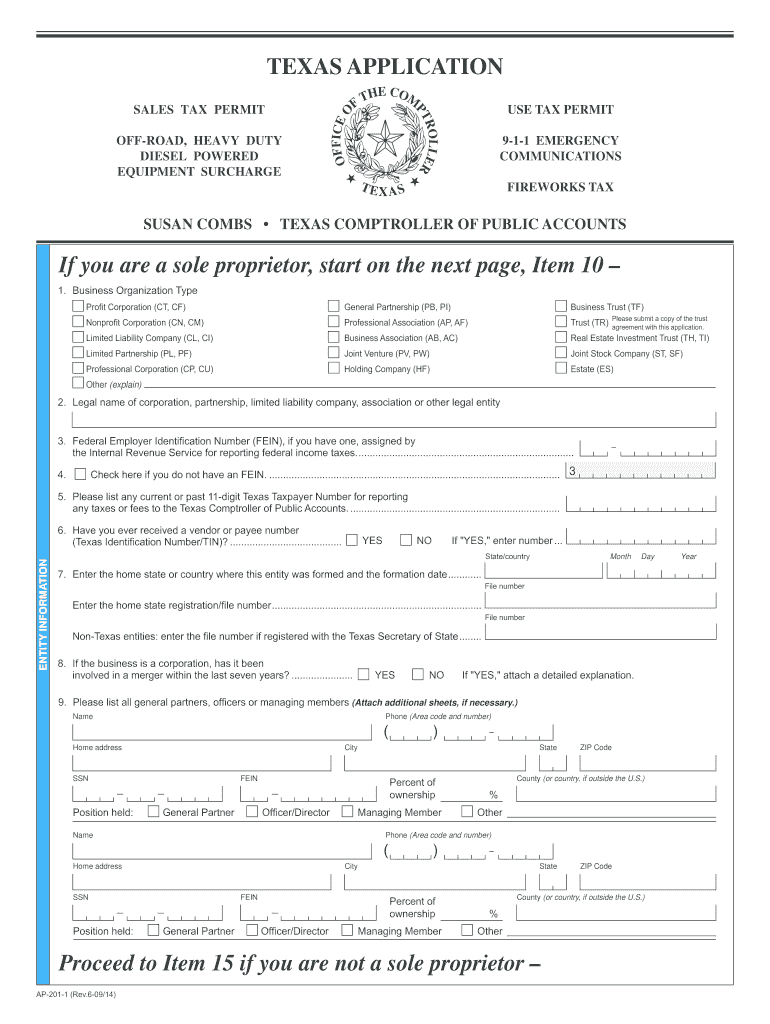

The AP 201 Texas Application for Sales and Use Tax Permit is an essential document for businesses operating in Texas that wish to collect sales tax from customers. This form allows entities to register with the Texas Comptroller of Public Accounts, enabling them to comply with state tax laws. The application is necessary for various types of businesses, including retail, wholesale, and service providers, ensuring they can legally charge sales tax on taxable sales. Understanding the purpose of the AP 201 is crucial for any business owner looking to operate within Texas's legal framework.

Steps to Complete the AP 201 Texas Application for Sales and Use Tax Permit

Completing the AP 201 requires careful attention to detail to ensure compliance with Texas regulations. Here are the steps to follow:

- Gather necessary information, including your business name, address, and federal employer identification number (EIN).

- Determine your business structure, such as sole proprietorship, partnership, or corporation, as this affects the information required.

- Complete the application form accurately, ensuring all sections are filled out, including owner information and estimated monthly sales.

- Review the application for errors or omissions before submission.

- Submit the application either online through the Texas Comptroller's website or via mail to the appropriate address.

Required Documents for the AP 201 Texas Application for Sales and Use Tax Permit

When applying for the AP 201, certain documents are necessary to support your application. These may include:

- Federal Employer Identification Number (EIN) or Social Security Number (SSN) for sole proprietors.

- Proof of business registration, such as a certificate of formation or partnership agreement.

- Identification documents for the business owner(s), which may include a driver's license or state ID.

- Any additional documentation that may be relevant to your specific business type or structure.

Eligibility Criteria for the AP 201 Texas Application for Sales and Use Tax Permit

To be eligible for the AP 201, applicants must meet specific criteria set forth by the Texas Comptroller. These criteria include:

- The business must be located in Texas or have a physical presence in the state.

- The applicant must be engaged in selling tangible personal property or taxable services.

- The business must comply with all local, state, and federal laws applicable to its operations.

Legal Use of the AP 201 Texas Application for Sales and Use Tax Permit

The AP 201 serves as a legal document that grants businesses the authority to collect sales tax in Texas. Proper use of this permit is essential for compliance with state tax laws. Businesses must display their permit number on sales receipts and ensure that they remit collected taxes to the state in a timely manner. Failure to comply with these regulations can result in penalties or fines.

Form Submission Methods for the AP 201 Texas Application for Sales and Use Tax Permit

The AP 201 can be submitted through various methods, providing flexibility for applicants. The available submission methods include:

- Online submission via the Texas Comptroller's website, which offers a streamlined process and immediate confirmation.

- Mailing the completed form to the designated address provided by the Texas Comptroller.

- In-person submission at local Comptroller offices for those who prefer face-to-face assistance.

Quick guide on how to complete ap 201 texas application for sales and use tax permit saltware

Effortlessly Prepare AP 201 Texas Application For Sales And Use Tax Permit SALTware on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage AP 201 Texas Application For Sales And Use Tax Permit SALTware from any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign AP 201 Texas Application For Sales And Use Tax Permit SALTware with Minimal Effort

- Obtain AP 201 Texas Application For Sales And Use Tax Permit SALTware and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your modifications.

- Select your preferred method for delivering your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form retrieval, or errors that necessitate the printing of new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign AP 201 Texas Application For Sales And Use Tax Permit SALTware and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I do have a EIN number and LLC DE that sell online. People say that if you are incorporated in DE as a LLC than the only thing you pay is 300$ for a year and a fill out a form 1040NR. Do I have to get register to some other permits or do I have to pay any other tax?

For the sales tax issues here, check out www.taxjar.com. They’ve got this nailed.You do NOT need to file a 1040NR. You only need to file a 1040NR if you are subject to US federal income tax. That’s the case only where you have your own people on the ground in the US operating your business.Here’s more detail on how this works: Non-US Entrepreneurs: You Can Sell Products into the US without Paying US Tax - U.S Tax Services

-

A sales tax agent is asking me for a bribe to process forms for my shop. I refused and he is not processing my application. How do I deal with this?

The action you should take very much depend on the authenticity of documents you have provided to take sales tax registration.First ask politely to Sales Tax Agent, whether your documents are in order or not. If he shows some error, better correct it first or you should consult an auditor, make sure every proof and documents you provide is in accordance with law. If you are damn sure, you are right in all aspect. You do not need to worry at all. Simply barge in Sales Tax office, go to the Sales Tax Agent (Hope you are referring it to Sales Tax Officer only). Raise your voice in his office in front of his other colleagues and pressurize him confidently to issue your shop Sales Tax Registration Number. Every Government employee is always afraid of defamation. Your loud words can yield two results.If your every document is correct, within few days, you will be issued Sales Tax Registration number at your doorstep.Usually every Sales Tax officer is power drunk. He will first try to find in deep, whether he can find an error in your application and documents. If there is one, he will reject it and stall the process. This may repeat several times, he may even fake the errors, which are not even there. You need huge amount of patience and time to waste to go through this.You can follow Virat's suggestion as in other answer, only if you are a new entrepreneur. You may succeed, yet it does not mean you will get your registration unless your documents are correct. But if you already have existing business, and this is just another venture. Beware, dont even think of following Virat's suggestion. Entire Sales Tax Dept will come after you, if you touch their colleague with Virat's method and they will make your other businesses living hell. So take your decision wisely.Frankly, consider Rs.10000 bribe is as an investment, you may bargain and reduce it to Rs.5000. Usually Government people know how to return favour, as long as you keep them happy and it's useful in long term in business.

-

How illegal immigrants file taxes (presumably using ITIN) while paying taxes using fake SSN? How IRS accepts such forms as SSN used to pay tax and ITIN used for filling tax don't match?

Illegal immigrants are not authorized to work in the US and are not entitled to all the benefits of a citizen or legal resident, However, if they are here they are expected to pay taxes as any citizen would. If they choose to work, they are expected to pay income taxes.If they use a fake Social Security number to obtain work, it usually belongs to another person. This is illegal and could result in being ineligible to get a green card because any reported wages would be tracked to the account of the actual owner of the Social Security number along with any FICA/ Medicare taxes that the employer withholds.In order to isolate the tax reporting for the immigrant from that of the actual Social Security holder, the IRS issues an Individual Tax Identification Number (ITIN) to the immigrant under which he/she may report their earnings. When the copies of any W-2 or other withholding documents with fake SSN are included on the return, then the IRS now has the ability to segregate the wages that are incorrectly reported and notify Social Security Administration to segregate any reported FICA/ Medicare from the actual owner’s account.If the immigrant works “under the table” in either a cash-based transaction or self-employed status, it does not remove the obiligation to correctly report earnings. It just changes the forms required on the tax return and may incur penalties to worker and/or the employer.Disclaimer: Since you are not my client, the above message is not intended to constitute written tax advice,but general information for discussion purposes only. You should not, therefore, interpret the statements to be written tax advice or rely on the statements for any purpose.

-

Can an international student keep using his/her SSN after OPT ends and he/she leaves the country? I formed a US LLC for my online e-commerce business and will need SSN to open a business bank account and also apply for sales tax permit etc.

A limited liability company cannot get a social security number. Only people can. The LLC will need to get an EIN (employer identification number) from the IRS. It’s form ss-4 on the IRS website (www.irs.gov.).

Create this form in 5 minutes!

How to create an eSignature for the ap 201 texas application for sales and use tax permit saltware

How to make an eSignature for your Ap 201 Texas Application For Sales And Use Tax Permit Saltware in the online mode

How to create an eSignature for your Ap 201 Texas Application For Sales And Use Tax Permit Saltware in Google Chrome

How to create an eSignature for putting it on the Ap 201 Texas Application For Sales And Use Tax Permit Saltware in Gmail

How to generate an eSignature for the Ap 201 Texas Application For Sales And Use Tax Permit Saltware straight from your smart phone

How to generate an eSignature for the Ap 201 Texas Application For Sales And Use Tax Permit Saltware on iOS devices

How to create an electronic signature for the Ap 201 Texas Application For Sales And Use Tax Permit Saltware on Android OS

People also ask

-

What is a Texas sales tax permit application PDF?

A Texas sales tax permit application PDF is a document required for businesses in Texas to collect sales tax on taxable sales. This PDF form allows you to officially register your business with the Texas Comptroller and start compliance with state sales tax laws.

-

How can I obtain a Texas sales tax permit application PDF?

You can easily obtain a Texas sales tax permit application PDF from the Texas Comptroller's website. The application is available for download, and you can fill it out electronically or print it for submission according to the provided guidelines.

-

Is there a fee associated with the Texas sales tax permit application PDF?

No, there is no fee to submit the Texas sales tax permit application PDF. However, you might incur costs related to maintaining your business, such as sales tax collection and filing fees, depending on your business activities in Texas.

-

Can I fill out the Texas sales tax permit application PDF online?

Yes, you can fill out the Texas sales tax permit application PDF online before printing it. This option makes the process more convenient, allowing you to ensure that all required information is accurately entered before submission.

-

What are the benefits of using airSlate SignNow for the Texas sales tax permit application PDF?

Using airSlate SignNow to sign and send your Texas sales tax permit application PDF streamlines the process, making it quicker and more efficient. Our platform allows for secure electronic signatures, which not only saves time but also helps you maintain compliance with digital filing requirements.

-

Do I need a Texas sales tax permit if I am an online seller?

Yes, if you sell taxable goods or services in Texas, even online, you must complete the Texas sales tax permit application PDF and obtain a sales tax permit. This applies regardless of whether your business has a physical location in Texas.

-

How does airSlate SignNow support document integration for the Texas sales tax permit application PDF?

airSlate SignNow offers seamless integration with various document management systems, allowing you to easily manage your Texas sales tax permit application PDF alongside other business documents. This integration helps streamline your workflows and ensures that all your important paperwork is in one place.

Get more for AP 201 Texas Application For Sales And Use Tax Permit SALTware

Find out other AP 201 Texas Application For Sales And Use Tax Permit SALTware

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free