Gst Rfd 01 Format in Excel

What is the GST RFD 01 Format in Excel

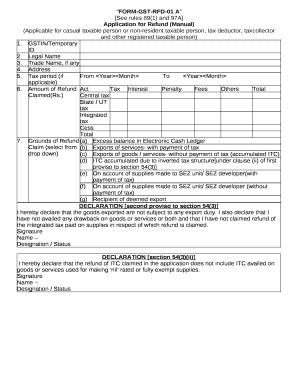

The GST RFD 01 format in Excel is a structured template used for filing a refund claim under the Goods and Services Tax (GST) regime in India. This format is essential for businesses seeking to reclaim excess input tax credit or other eligible refunds. The Excel format allows users to input necessary data systematically, ensuring compliance with GST regulations while facilitating easier data management and submission.

How to Use the GST RFD 01 Format in Excel

To effectively use the GST RFD 01 format in Excel, start by downloading the template from a reliable source. Open the file and fill in the required information, including details about the applicant, the amount of refund claimed, and the reasons for the claim. Ensure that all data is accurate and complete to avoid delays in processing. Once completed, save the document and follow the submission guidelines set by the GST authorities.

Steps to Complete the GST RFD 01 Format in Excel

Completing the GST RFD 01 format in Excel involves several key steps:

- Download the GST RFD 01 Excel template from an authorized source.

- Open the file and review the instructions provided within the template.

- Enter your business details, including GSTIN, name, and address.

- Fill in the refund details, specifying the nature and amount of the claim.

- Attach any necessary supporting documents as required by the GST guidelines.

- Double-check all entries for accuracy before saving the completed form.

Legal Use of the GST RFD 01 Format in Excel

The legal use of the GST RFD 01 format in Excel is governed by the GST Act and associated regulations. When filled out correctly, this form serves as a formal request for a refund, which must comply with the stipulated legal requirements. It is crucial to ensure that the information provided is truthful and accurate, as any discrepancies may lead to penalties or denial of the refund claim.

Key Elements of the GST RFD 01 Format in Excel

The key elements of the GST RFD 01 format in Excel include:

- Applicant Information: GSTIN, name, and address of the business.

- Refund Details: Breakdown of the claimed refund amount and the basis for the claim.

- Supporting Documents: List of documents required to substantiate the refund claim.

- Declaration: A statement confirming the accuracy of the information provided.

Form Submission Methods

The completed GST RFD 01 form can be submitted through various methods, including:

- Online Submission: Through the GST portal, where users can upload their completed Excel file directly.

- Mail Submission: Sending a printed copy of the form along with supporting documents to the appropriate GST office.

- In-Person Submission: Visiting the local GST office to hand in the completed form and documents.

Quick guide on how to complete gst rfd 01 format in excel

Complete Gst Rfd 01 Format In Excel effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents quickly and without holdups. Manage Gst Rfd 01 Format In Excel on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to adjust and eSign Gst Rfd 01 Format In Excel with ease

- Find Gst Rfd 01 Format In Excel and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Select pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to finalize your changes.

- Decide how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Gst Rfd 01 Format In Excel to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gst rfd 01 format in excel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'statement 3 for gst refund in excel utility'?

The 'statement 3 for gst refund in excel utility' is a specific document required for claiming GST refunds. It helps streamline the process by providing essential financial details in a structured format, making it simpler for businesses to ensure compliance.

-

How can airSlate SignNow assist with 'statement 3 for gst refund in excel utility'?

airSlate SignNow simplifies the process of preparing and signing the 'statement 3 for gst refund in excel utility'. Our platform enables you to easily create, edit, and eSign your documents, ensuring accuracy and efficiency in your refund process.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore our features, including those related to the 'statement 3 for gst refund in excel utility'. This enables you to understand how our platform can streamline your document management and eSigning needs.

-

What features should I expect in airSlate SignNow for GST documentation?

With airSlate SignNow, you can expect robust features such as document templates tailored for the 'statement 3 for gst refund in excel utility', eSigning capabilities, and secure cloud storage. These features work together to enhance your workflow and save time.

-

Can I integrate airSlate SignNow with other software for my GST processes?

Absolutely! airSlate SignNow integrates seamlessly with various platforms and software, allowing you to incorporate it into your existing GST processes. This includes enhancing how you manage the 'statement 3 for gst refund in excel utility' alongside your other financial tools.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a range of pricing options to fit different business needs. Whether you're a small business or a larger enterprise, you can choose a plan that suits your requirements for handling documents like the 'statement 3 for gst refund in excel utility'.

-

How secure is the use of airSlate SignNow for sensitive documents?

Security is a top priority at airSlate SignNow. Our platform ensures that all documents, including the 'statement 3 for gst refund in excel utility', are encrypted and secure, providing peace of mind while handling sensitive information.

Get more for Gst Rfd 01 Format In Excel

Find out other Gst Rfd 01 Format In Excel

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement