Nirc Lawphil Form

What is the NIRC Lawphil?

The NIRC Lawphil, or the National Internal Revenue Code of the Philippines, serves as the foundational legal framework governing taxation in the Philippines. This code outlines the rules and regulations regarding various taxes, including income tax, estate tax, and value-added tax. Understanding the NIRC is crucial for individuals and businesses to ensure compliance with tax obligations and to avoid penalties.

How to Use the NIRC Lawphil

Utilizing the NIRC Lawphil involves familiarizing oneself with its provisions and applying them to specific tax situations. Taxpayers can reference the code to determine applicable tax rates, filing requirements, and deadlines. It is advisable to consult the NIRC when preparing tax returns or when seeking to understand tax liabilities. Accessing the code online or through legal publications can facilitate this process.

Steps to Complete the NIRC Lawphil

Completing the NIRC Lawphil requires a systematic approach:

- Identify the relevant sections of the NIRC that apply to your tax situation.

- Gather necessary documentation, such as income statements and receipts.

- Calculate tax liabilities based on the guidelines provided in the NIRC.

- Prepare the required forms accurately, ensuring all information aligns with the NIRC provisions.

- Submit the completed forms to the appropriate tax authority by the specified deadlines.

Legal Use of the NIRC Lawphil

The legal use of the NIRC Lawphil is essential for ensuring compliance with tax laws. Taxpayers must adhere to the provisions outlined in the code to avoid legal repercussions. This includes understanding rights and responsibilities as a taxpayer, as well as the implications of non-compliance. Legal counsel may be sought for complex tax issues to navigate the intricacies of the NIRC effectively.

Required Documents

When dealing with the NIRC Lawphil, certain documents are essential for proper compliance:

- Income statements, including W-2s and 1099s for individuals.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any correspondence from the tax authority regarding previous filings.

Filing Deadlines / Important Dates

Filing deadlines are critical for compliance with the NIRC Lawphil. Typically, individual income tax returns are due on April fifteenth of each year. Businesses may have different deadlines based on their fiscal year. It is important to stay informed about these dates to avoid penalties and interest on late payments. Marking these deadlines on a calendar can help ensure timely submissions.

Quick guide on how to complete nirc lawphil

Effortlessly Handle Nirc Lawphil on Any Device

Digital document management has gained traction among both businesses and individuals. It serves as an optimal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly and without holdups. Manage Nirc Lawphil on any device using the airSlate SignNow applications for Android or iOS, and simplify any document-related task today.

The Simplest Method to Edit and eSign Nirc Lawphil Effortlessly

- Obtain Nirc Lawphil and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight signNow sections of your documents or obscure confidential information using tools specifically offered by airSlate SignNow.

- Create your electronic signature through the Sign tool, which takes mere seconds and holds the same legal value as a traditional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you'd like to send your form—via email, SMS, or an invite link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, and errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Nirc Lawphil and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nirc lawphil

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

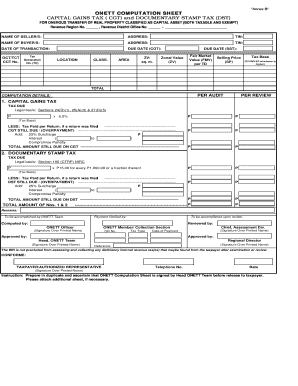

What is an onett computation sheet?

An onett computation sheet is a specialized document used for calculating taxes, credits, and other financial metrics effectively. It simplifies the process of financial assessment for businesses, ensuring accuracy and compliance with regulations.

-

How can airSlate SignNow help with the onett computation sheet?

With airSlate SignNow, you can easily create, edit, and eSign your onett computation sheets securely. The platform streamlines the document workflow, minimizing delays in approvals and enhancing collaboration between team members.

-

What are the pricing options for using airSlate SignNow for onett computation sheets?

airSlate SignNow offers various pricing plans, catering to different business needs. You can choose from monthly or annual subscriptions, ensuring that you only pay for what you need while enjoying full access to features that assist with your onett computation sheets.

-

What features should I look for in an onett computation sheet tool?

When selecting an onett computation sheet tool, key features to consider include customizable templates, document tracking, eSignature options, and robust collaboration tools. airSlate SignNow provides all these features, allowing for an efficient and user-friendly experience.

-

Can I integrate airSlate SignNow with other software for onett computation sheets?

Yes, airSlate SignNow offers seamless integrations with many popular software platforms, enhancing your workflow for managing onett computation sheets. Integrating with tools like Google Drive, Salesforce, or Microsoft Office provides a more cohesive and efficient document management solution.

-

What benefits does airSlate SignNow provide for managing onett computation sheets?

Using airSlate SignNow for your onett computation sheets streamlines the eSigning process, reduces paperwork, and improves overall productivity. Its user-friendly interface ensures that your team can complete and send documents quickly, all while maintaining security and compliance.

-

Is airSlate SignNow secure for handling sensitive onett computation sheets?

Absolutely! airSlate SignNow prioritizes security, employing robust encryption and compliance with industry standards to protect your sensitive onett computation sheets. That means your documents are safe from unauthorized access and bsignNowes.

Get more for Nirc Lawphil

Find out other Nirc Lawphil

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile