Rmft 11 a Instructions Form

What is the Rmft 11 A Instructions

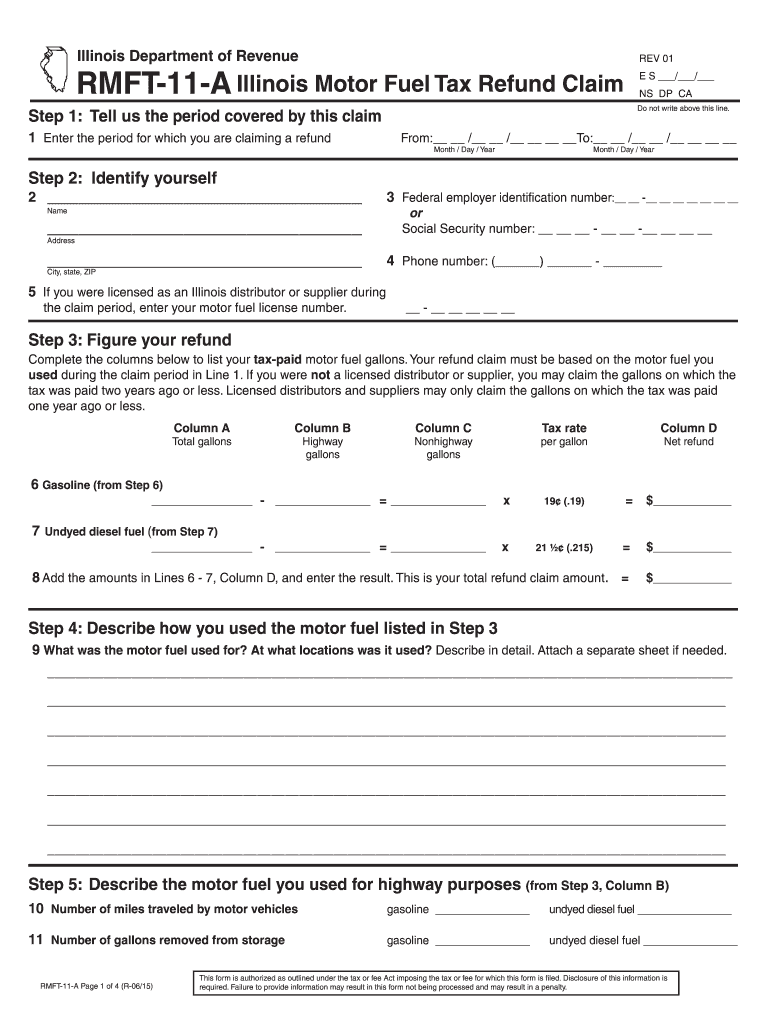

The Rmft 11 A instructions provide detailed guidance for completing the fillable form rmft 11 a, which is used in the state of Illinois for specific tax-related purposes. This form is essential for individuals and businesses to report certain financial information accurately. Understanding these instructions is crucial for ensuring compliance with state regulations and avoiding potential penalties.

Steps to Complete the Rmft 11 A Instructions

Completing the fillable form rmft 11 a involves several key steps:

- Gather necessary documentation, such as financial records and identification.

- Access the fillable form rmft 11 a online through a secure platform.

- Carefully follow the instructions provided, filling in required fields accurately.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for mailing, as per the guidelines.

Legal Use of the Rmft 11 A Instructions

The legal use of the fillable form rmft 11 a is governed by state law, which mandates accurate reporting of financial information. Adhering to the provided instructions ensures that the form is completed correctly, making it legally binding. This compliance is essential for both individuals and businesses to avoid legal repercussions and maintain good standing with state authorities.

Key Elements of the Rmft 11 A Instructions

The key elements of the Rmft 11 A instructions include:

- Identification of the filer, including name and address.

- Details regarding the financial information being reported.

- Signature requirements to validate the form.

- Submission guidelines, including deadlines and acceptable methods.

Form Submission Methods

The fillable form rmft 11 a can be submitted through various methods, ensuring flexibility for the user. The options include:

- Electronic submission via a secure online platform.

- Mailing a printed version of the completed form to the appropriate state office.

- In-person submission at designated state offices, if required.

Who Issues the Form

The fillable form rmft 11 a is issued by the Illinois Department of Revenue. This state agency is responsible for overseeing tax compliance and ensuring that all forms are up to date with current regulations. Understanding the issuing authority helps users navigate any questions or issues related to the form.

Quick guide on how to complete rmft 11 a instructions

Effortlessly Prepare Rmft 11 A Instructions on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to efficiently create, modify, and electronically sign your documents without any delays. Handle Rmft 11 A Instructions on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based process today.

How to Edit and eSign Rmft 11 A Instructions with Ease

- Locate Rmft 11 A Instructions and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Rmft 11 A Instructions and ensure efficient communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rmft 11 a instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fillable form rmft 11 a?

The fillable form rmft 11 a is a customizable document designed for specific business needs. It allows users to gather essential information easily and efficiently. Businesses can edit this form to fit their requirements, making it versatile and user-friendly.

-

How can the fillable form rmft 11 a benefit my business?

Using the fillable form rmft 11 a can streamline your document collection process. It enhances efficiency by enabling electronic filling and signing, thus reducing time spent on paperwork. This leads to quicker transactions and improved customer satisfaction.

-

Is there a cost associated with using the fillable form rmft 11 a?

Yes, there is a pricing structure for accessing the fillable form rmft 11 a through airSlate SignNow. However, prices are competitive, offering cost-effective solutions based on your business needs. You can choose a plan that fits your budget while gaining access to essential features.

-

Can I integrate the fillable form rmft 11 a with other software?

Absolutely! The fillable form rmft 11 a can be integrated with various third-party applications. This integration allows for seamless workflow management across different platforms, enhancing overall operational efficiency.

-

What features does the fillable form rmft 11 a offer?

The fillable form rmft 11 a offers features like customizable fields, electronic signatures, and automated workflows. This makes it easy to create, send, and manage documents efficiently. Its robust functionality enhances user experience and productivity.

-

Is the fillable form rmft 11 a secure?

Yes, the fillable form rmft 11 a is designed with security in mind. With encryption and compliance with legal standards, your data is safeguarded at all times. This ensures that sensitive information remains confidential and secure.

-

How do I create a fillable form rmft 11 a using airSlate SignNow?

Creating a fillable form rmft 11 a is straightforward with airSlate SignNow’s intuitive interface. Simply choose the template, customize it according to your needs, and add necessary fields. Once ready, you can share it with your clients for completion.

Get more for Rmft 11 A Instructions

- Download our latest global token review 002 april the form

- Clayton county excess funds list form

- Rosebank application forms

- Video content license agreement template form

- Video editor agreement template form

- Video license agreement template form

- Video production retainer agreement template form

- Video production agreement template form

Find out other Rmft 11 A Instructions

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement