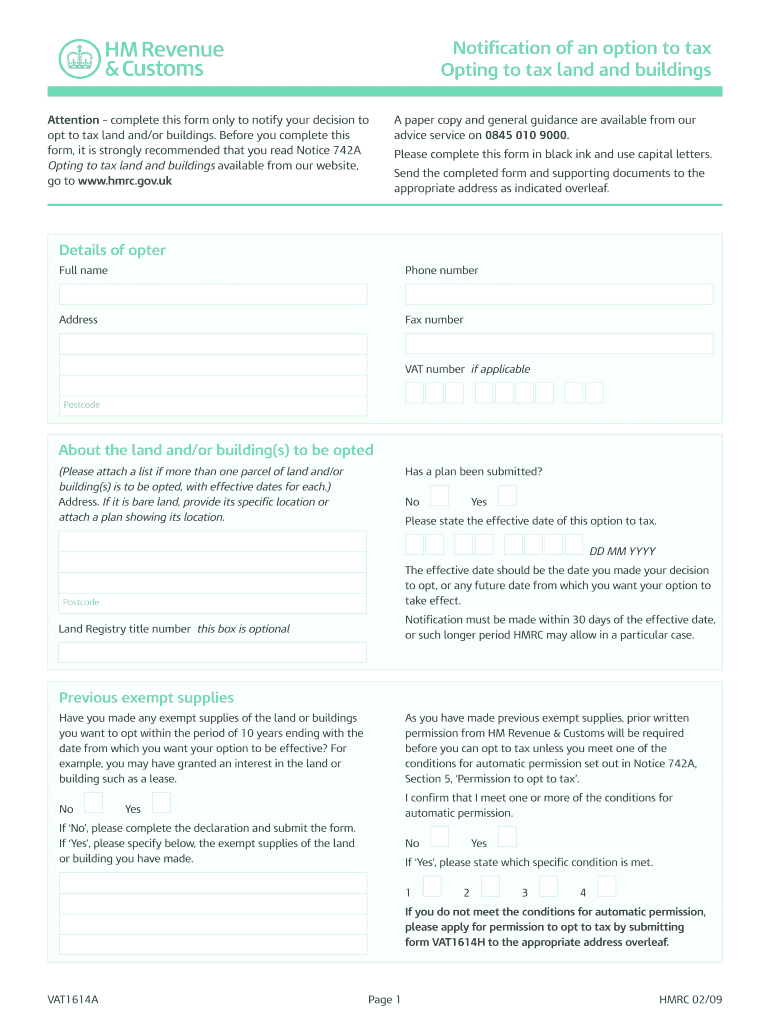

Vat 1614a Form Download 2009-2026

What is the Vat 1614a Form?

The Vat 1614a form is a specific document used for tax purposes, particularly in relation to the option to tax for VAT (Value Added Tax) in the United States. This form allows businesses to elect to charge VAT on their sales, which can have significant implications for their tax obligations and cash flow. Understanding the purpose and functionality of the Vat 1614a form is crucial for businesses that engage in taxable activities.

Steps to Complete the Vat 1614a Form

Completing the Vat 1614a form requires careful attention to detail to ensure accuracy and compliance. Here are the essential steps:

- Gather Required Information: Collect all necessary details, including your business name, address, and tax identification number.

- Fill Out the Form: Enter the required information in the appropriate fields of the form. Ensure that all entries are accurate and complete.

- Review for Errors: Double-check the form for any mistakes or omissions that could lead to complications.

- Sign and Date: Ensure that the form is signed and dated by an authorized representative of the business.

- Submit the Form: Follow the submission guidelines to send the completed form to the appropriate tax authority.

Legal Use of the Vat 1614a Form

The Vat 1614a form must be used in accordance with U.S. tax laws to ensure its legal validity. It is essential for businesses to understand the legal implications of submitting this form. Incorrect or fraudulent use of the Vat 1614a can lead to penalties, including fines or legal action. Therefore, it is advisable to consult with a tax professional to ensure compliance with all relevant regulations.

Key Elements of the Vat 1614a Form

When filling out the Vat 1614a form, certain key elements must be included to ensure its validity:

- Business Information: Accurate details about the business, including name and address.

- Tax Identification Number: This number is crucial for tax processing and identification.

- Election Statement: A clear statement indicating the business's intention to opt for VAT.

- Signature: The form must be signed by an authorized individual to validate the submission.

Form Submission Methods

The Vat 1614a form can be submitted through various methods, depending on the requirements set by the tax authority. Common submission methods include:

- Online Submission: Many tax authorities allow electronic filing, which can expedite the process.

- Mail: Completed forms can be sent via postal service to the designated tax office.

- In-Person Submission: Businesses may also have the option to deliver the form directly to a tax office.

Penalties for Non-Compliance

Failure to properly complete or submit the Vat 1614a form can result in serious penalties. These may include:

- Fines: Monetary penalties for late submissions or inaccuracies.

- Legal Action: In severe cases, businesses may face legal consequences for fraudulent claims.

- Loss of Tax Benefits: Incorrect submissions can lead to the loss of eligibility for certain tax benefits.

Quick guide on how to complete vat1614a_02_09 form for notification of an option to tax opting to tax land and buildings

A brief guide on how to create your Vat 1614a Form Download

Finding the appropriate template can prove difficult when you need to submit official international documents. Even if you possess the required form, it may be cumbersome to swiftly prepare it in line with all specifications if you utilize printed copies instead of handling everything digitally. airSlate SignNow is the web-based eSignature tool that assists you in overcoming these obstacles. It allows you to select your Vat 1614a Form Download and swiftly fill it out and sign it on the spot without needing to reprint files in case of any errors.

Here are the steps to follow in order to create your Vat 1614a Form Download with airSlate SignNow:

- Press the Get Form button to import your document into our editor right away.

- Begin with the first vacant field, enter the required information, and proceed with the Next feature.

- Complete the empty fields using the Cross and Check options from the toolbar above.

- Select the Highlight or Line features to emphasize the key details.

- Click on Image and upload one if your Vat 1614a Form Download requires it.

- Use the right-hand panel to add extra fields for you or others to complete if necessary.

- Review your entries and confirm the template by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the editing process by clicking the Done button and choosing your file-sharing preferences.

Once your Vat 1614a Form Download is prepared, you can distribute it as you wish - send it to your recipients via email, SMS, fax, or even print it directly from the editor. Additionally, you can securely save all your completed documents in your account, organized in folders according to your preferences. Avoid wasting time on manual form filling; explore airSlate SignNow!

Create this form in 5 minutes or less

FAQs

-

If I publish on Smashwords and tick on the option to take a 30 percent tax, do I still need to fill out the tax form?

If you want to get any of that tax money back in your pocket, you will have to fill out the forms.Are you a US citizen? If not, you will need to obtain an ITIN using IRS form W-7. This will allow you to file the appropriate US tax return forms and claim a refund. Depending on your country of residence, the refund could be up to 100% of the tax collected. With an ITIN, you will usually be exempt from the 30% withholding and will not be required to fill out any US tax returns at the end of the year (unless you actually reside in the US, but that is a far more complicated situation). The ITIN application process can be a royal pain in the behind, especially if you wait until after the taxes have been withheld.If your book only makes a few dollars, the hassle is not worth it. But if you hit the self-publishing lottery, you will definitely want to apply for that refund.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

What tax forms do I need to fill out for reporting bitcoin gains and loses?

IRS1040 and 1099 forms.“For instance, there is no long-term capital gains tax to pay if you are in the lower two tax brackets (less than $36,900 single income or less than $73,800 married income). The capital gains rate is only 15% for other tax brackets (less than $405,100 single income) with 20% for the final bracket.”Reference: Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule DOther References:IRS Virtual Currency Guidance : Virtual Currency Is Treated as Property for U.S. Federal Tax Purposes; General Rules for Property Transactions ApplyHow do I report taxes?Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule Dhttps://www.irs.gov/pub/irs-drop...

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

As an employer, what legal and tax forms am I required to have a new employee to fill out?

I-9, W-4, state W-4, and some sort of state new hire form. The New hire form is for dead beat parents. Don’t inform the state in time and guess what? You become personally liable for what should have been garnished from their wages.From the sound of your question I infer that you are trying to make this a DIY project. DO NOT. There are just too many things that you can F up. Seek yea a CPA or at least a payroll service YESTERDAY.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the vat1614a_02_09 form for notification of an option to tax opting to tax land and buildings

How to generate an eSignature for the Vat1614a_02_09 Form For Notification Of An Option To Tax Opting To Tax Land And Buildings in the online mode

How to create an electronic signature for your Vat1614a_02_09 Form For Notification Of An Option To Tax Opting To Tax Land And Buildings in Google Chrome

How to make an electronic signature for putting it on the Vat1614a_02_09 Form For Notification Of An Option To Tax Opting To Tax Land And Buildings in Gmail

How to make an electronic signature for the Vat1614a_02_09 Form For Notification Of An Option To Tax Opting To Tax Land And Buildings right from your smartphone

How to generate an electronic signature for the Vat1614a_02_09 Form For Notification Of An Option To Tax Opting To Tax Land And Buildings on iOS devices

How to make an eSignature for the Vat1614a_02_09 Form For Notification Of An Option To Tax Opting To Tax Land And Buildings on Android devices

People also ask

-

What is vat1614a and how does it relate to airSlate SignNow?

The vat1614a is a specific document type that airSlate SignNow can help you manage efficiently. With airSlate SignNow's user-friendly platform, you can easily send, eSign, and store vat1614a documents securely, enhancing your business workflow.

-

What features does airSlate SignNow offer for managing vat1614a documents?

AirSlate SignNow provides a variety of features for vat1614a documents, including customizable templates, automated workflows, and real-time tracking. These features ensure that your signing process is seamless, compliant, and efficient.

-

Is airSlate SignNow a cost-effective solution for processing vat1614a?

Yes, airSlate SignNow is designed to be a cost-effective solution for processing all document types, including vat1614a. With competitive pricing plans and a range of features, businesses can save both time and money while managing their documents.

-

Can I integrate airSlate SignNow with my existing tools for managing vat1614a?

Absolutely! AirSlate SignNow offers integrations with popular tools and platforms to streamline processing of vat1614a documents. This flexibility allows you to continue using your favorite applications while enhancing document management efficiency.

-

How does airSlate SignNow ensure the security of my vat1614a documents?

AirSlate SignNow prioritizes security, using advanced encryption standards to protect your vat1614a documents. Additionally, it provides features like access controls and audit trails to ensure that sensitive information remains confidential and secure.

-

What benefits does airSlate SignNow provide for businesses dealing with vat1614a?

Using airSlate SignNow for managing vat1614a offers numerous benefits, such as increased efficiency and reduced turnaround times. The platform simplifies the signing process, making it easier for businesses to focus on their core activities.

-

Can I track the status of my vat1614a documents in airSlate SignNow?

Yes, airSlate SignNow includes tracking features that allow you to monitor the status of your vat1614a documents in real-time. This transparency helps you stay informed about pending signatures and document progress.

Get more for Vat 1614a Form Download

Find out other Vat 1614a Form Download

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT