Rev 181 Instructions Form

What is the Rev 181 Instructions

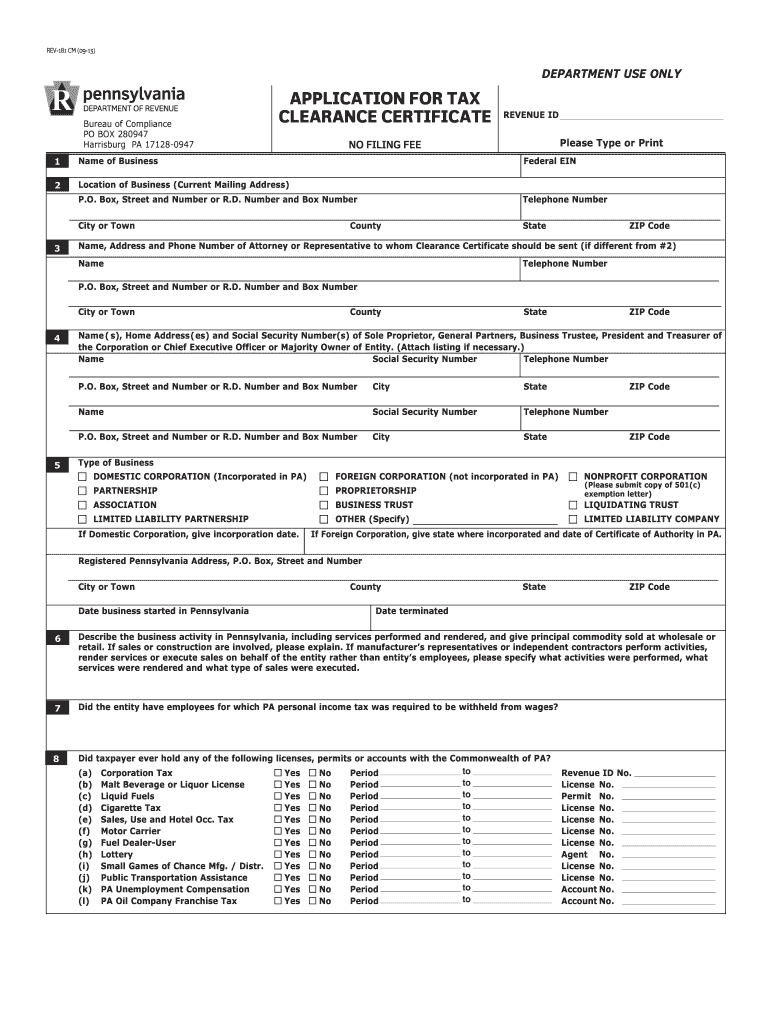

The Rev 181 instructions pertain to the Pennsylvania tax clearance certificate, a document required for various business transactions, including obtaining certain licenses and permits. This form is essential for individuals and entities seeking to demonstrate their compliance with state tax obligations. The instructions provide detailed guidance on how to complete the form accurately, ensuring that all necessary information is included to avoid delays in processing.

Steps to complete the Rev 181 Instructions

Completing the Rev 181 instructions involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your taxpayer identification number and details of any outstanding tax obligations. Next, fill out the form carefully, following the specific guidelines provided in the instructions. After completing the form, review it for any errors or omissions. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, as specified in the instructions.

Legal use of the Rev 181 Instructions

The legal use of the Rev 181 instructions is crucial for ensuring that the submitted tax clearance certificate is valid and recognized by state authorities. The instructions outline the legal framework governing the use of this form, including compliance with relevant tax laws and regulations. It is important to adhere to these guidelines to avoid potential legal issues, such as penalties or delays in obtaining necessary clearances.

Required Documents

When completing the Rev 181 instructions, certain documents are required to support your application. These may include proof of identity, such as a government-issued ID, and documentation of any tax filings or payments made. Additionally, if applicable, you may need to provide records of any business licenses or permits associated with your entity. Gathering these documents ahead of time can streamline the completion process.

Form Submission Methods

The Rev 181 form can be submitted through various methods, each catering to different preferences and needs. Options include online submission through the Pennsylvania Department of Revenue's website, mailing the completed form to the appropriate address, or delivering it in person at designated offices. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your situation.

Eligibility Criteria

To be eligible for a tax clearance certificate using the Rev 181 instructions, applicants must meet specific criteria set forth by the Pennsylvania Department of Revenue. Generally, this includes being up to date with all state tax obligations, including income, sales, and employment taxes. Individuals and businesses must also ensure that there are no outstanding tax liabilities or unresolved issues with the department to qualify for the certificate.

Quick guide on how to complete rev 181 instructions

Complete Rev 181 Instructions effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a perfect environmentally-friendly substitute to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly and without any hindrances. Manage Rev 181 Instructions on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to modify and electronically sign Rev 181 Instructions with ease

- Locate Rev 181 Instructions and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or disorganized files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Alter and electronically sign Rev 181 Instructions and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev 181 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the rev 181 instructions for using airSlate SignNow?

The rev 181 instructions for airSlate SignNow provide detailed guidelines on how to navigate the platform’s eSigning features effectively. These instructions cover everything from creating and sending documents to tracking signatures and managing team workflows. For best results, make sure to follow each step closely.

-

How does the pricing of airSlate SignNow work with rev 181 instructions?

The pricing for airSlate SignNow is structured based on selected features and team size, and the rev 181 instructions help users understand the cost implications of different plan options. Customers can choose from several tiers, each offering unique functionalities, making it easy to find a package that fits your budget and needs.

-

What features are highlighted in the rev 181 instructions?

The rev 181 instructions highlight key features such as document templates, automated workflows, and multi-party signing. These functionalities are designed to streamline your document management process and enhance collaboration among team members. By utilizing these features, you can save time and ensure accuracy.

-

Can airSlate SignNow integrate with other software using the rev 181 instructions?

Yes, airSlate SignNow can integrate with various applications, and the rev 181 instructions provide guidelines on how to set up these integrations. Connecting with tools such as CRM systems, cloud storage, and other productivity software enhances your workflow and eliminates manual entry tasks.

-

What are the benefits of following the rev 181 instructions for airSlate SignNow?

Following the rev 181 instructions ensures that you maximize the benefits of using airSlate SignNow, such as simplifying the eSigning process and improving document turnaround times. These instructions are structured to enhance your user experience, making it easier for you to adopt and implement the software effectively.

-

Is training required for using airSlate SignNow as per rev 181 instructions?

Training is not mandatory to use airSlate SignNow, but following the rev 181 instructions can signNowly speed up the learning process. The instructions are straightforward and cater to users of all technical levels, allowing you to start eSigning documents with confidence and efficiency.

-

How can I access the rev 181 instructions for airSlate SignNow?

You can access the rev 181 instructions directly through the airSlate SignNow website or within the application under the help section. These resources are readily available to assist you in navigating the platform and ensuring a smooth eSigning experience.

Get more for Rev 181 Instructions

- Bako labs form

- Care program pge form

- Whsd standard application woodland hills school district form

- Chandigarh policebook no challan form no acknowledgment chandigarhtrafficpolice

- Americas most wanted poster template form

- Dd form 2875 revised may

- Small business rate relief application bformb ealing

- Winter rose equestrian form

Find out other Rev 181 Instructions

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document