Ecs Mandate Form

What is the ECS Mandate?

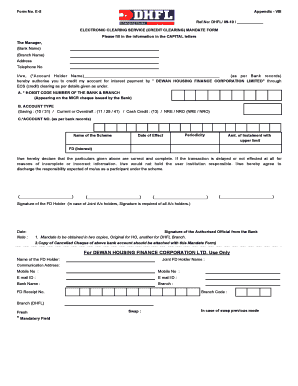

The ECS mandate, or Electronic Clearing Service mandate, is a financial instrument that allows for automatic debit transactions from a borrower's bank account. This process is commonly used for loan repayments, including home loans from DHFL. By setting up an ECS mandate, borrowers authorize their bank to deduct specified amounts on predetermined dates, ensuring timely payments without the need for manual intervention.

How to Use the ECS Mandate

Using the ECS mandate involves several straightforward steps. First, borrowers must fill out the ECS mandate form, providing necessary details such as bank account information and loan specifics. Once completed, the form should be submitted to the lender, in this case, DHFL. After processing, the lender will initiate the automatic debit process, allowing for seamless repayments. It is crucial to ensure that sufficient funds are available in the account on the scheduled deduction dates to avoid penalties.

Steps to Complete the ECS Mandate

Completing the ECS mandate requires careful attention to detail. Here are the essential steps:

- Obtain the ECS mandate form from DHFL or their website.

- Fill in your personal details, including your name, address, and loan account number.

- Provide your bank account information, including the bank name, branch, and account number.

- Specify the amount to be debited and the frequency of the payments.

- Sign the form to authorize the automatic deductions.

- Submit the completed form to DHFL for processing.

Legal Use of the ECS Mandate

The ECS mandate is legally binding once it is signed and submitted. It complies with the Electronic Transactions Act, which recognizes electronic signatures and transactions as valid. This legal framework ensures that both borrowers and lenders adhere to agreed terms, providing protection against unauthorized transactions. It is advisable for borrowers to keep a copy of the signed mandate for their records.

Key Elements of the ECS Mandate

Several key elements must be included in the ECS mandate for it to be valid:

- Borrower Details: Full name, address, and contact information.

- Bank Account Information: Bank name, branch, and account number.

- Loan Details: Loan account number and the specific amount to be debited.

- Authorization Signature: The borrower’s signature is essential to validate the mandate.

- Frequency of Payment: Indicate whether the payments will be monthly, quarterly, etc.

Form Submission Methods

To submit the ECS mandate form, borrowers have a few options. The most common method is to deliver the form in person to a DHFL branch. Alternatively, some lenders may allow for online submission through their secure portal. It is important to check with DHFL for their specific submission guidelines to ensure proper processing of the mandate.

Quick guide on how to complete ecs mandate 27570330

Easily prepare Ecs Mandate on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely preserve it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly and efficiently. Manage Ecs Mandate on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Ecs Mandate effortlessly

- Obtain Ecs Mandate and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or censor confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ecs Mandate and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ecs mandate 27570330

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dhfl ecs stop application process?

The dhfl ecs stop application process allows users to easily halt electronic credit services associated with their DHFL loans. By completing this application, you can prevent further ECS deductions from your bank account. This streamlined process is designed for convenience and quick action.

-

How can I access the dhfl ecs stop application through airSlate SignNow?

To access the dhfl ecs stop application via airSlate SignNow, you need to log into your account and navigate to the document section. From there, you can upload your application and utilize our eSigning features to finalize it quickly and securely.

-

Is there a fee for submitting the dhfl ecs stop application?

Submitting the dhfl ecs stop application through airSlate SignNow is free of charge. Our platform offers affordable pricing for additional features, but the basic application submission remains part of our core services without any costs involved.

-

What features does airSlate SignNow offer for the dhfl ecs stop application?

AirSlate SignNow offers features such as secure eSignatures, document templates, and real-time tracking for the dhfl ecs stop application. Our user-friendly interface ensures that you can complete the process efficiently, making it an ideal solution for your documentation needs.

-

What are the benefits of using airSlate SignNow for the dhfl ecs stop application?

Using airSlate SignNow for the dhfl ecs stop application simplifies the entire process, saving you time and effort. Our platform enhances convenience with features like mobile access and instant notifications, allowing you to stay informed about your application status.

-

Can I integrate airSlate SignNow with other applications for the dhfl ecs stop application?

Yes, airSlate SignNow can be integrated with various applications to streamline your workflow for the dhfl ecs stop application. This integration capability enhances productivity by allowing you to link with tools you already use, such as CRMs and document management systems.

-

How long does the dhfl ecs stop application take to process?

The processing time for the dhfl ecs stop application can vary depending on your bank's policies and procedures. However, with airSlate SignNow, the submission process is expedited, and you can follow up easily for updates through our platform.

Get more for Ecs Mandate

- Dasp online application form

- Arpico finance fd rates form

- Burrell v riverside hospital medical malpractice complaint virginia bb form

- Va lender certification form

- Knbs application form pdf download 522083068

- Rev 1220 385416300 form

- Da form 4798 r

- 470 2965 iowa medicaid provider agreement general terms dhs iowa form

Find out other Ecs Mandate

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online