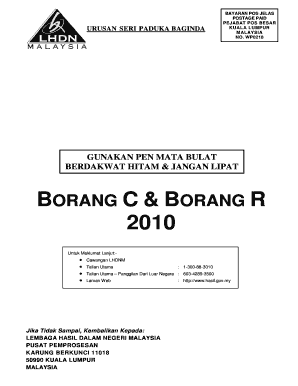

Borang C Lhdn Form

What is the Borang C Lhdn

The Borang C Lhdn is a tax form used in Malaysia, specifically for the declaration of income by companies. It is essential for businesses to report their earnings accurately to comply with the Malaysian tax regulations. This form is part of the broader framework established by the Lembaga Hasil Dalam Negeri Malaysia (LHDN), which oversees tax collection and enforcement in the country. Understanding the purpose and requirements of the Borang C Lhdn is crucial for maintaining compliance and avoiding potential penalties.

How to use the Borang C Lhdn

Using the Borang C Lhdn involves several steps to ensure accurate completion and submission. First, businesses must gather all necessary financial documents, including profit and loss statements, balance sheets, and any other relevant records. Next, fill out the form with precise information regarding income, expenses, and tax deductions. It is important to review the completed form for accuracy before submission. The Borang C Lhdn can typically be submitted online, via mail, or in person at designated LHDN offices, depending on the specific requirements of the tax year.

Steps to complete the Borang C Lhdn

Completing the Borang C Lhdn requires careful attention to detail. Here are the key steps:

- Gather necessary financial documents, including previous tax returns and financial statements.

- Accurately fill in the form, ensuring all income sources are reported.

- Claim any allowable deductions to minimize taxable income.

- Double-check all entries for accuracy and completeness.

- Submit the form by the deadline to avoid penalties.

Legal use of the Borang C Lhdn

The legal use of the Borang C Lhdn is governed by Malaysian tax laws, which mandate that all companies must file their income tax returns accurately and on time. Failure to comply can result in significant penalties, including fines and interest on unpaid taxes. It is crucial for businesses to understand their legal obligations regarding this form to ensure they meet all regulatory requirements and maintain good standing with the tax authorities.

Required Documents

When completing the Borang C Lhdn, businesses must prepare several documents to support their income declaration. Commonly required documents include:

- Financial statements (profit and loss statement, balance sheet)

- Previous year’s tax return

- Invoices and receipts for income and expenses

- Bank statements

- Any relevant tax deduction documentation

Filing Deadlines / Important Dates

Filing deadlines for the Borang C Lhdn are critical to avoid penalties. Generally, companies must submit their tax returns within seven months after the end of their financial year. It is advisable to check the LHDN website or consult with a tax professional for specific dates and any changes that may occur in the tax calendar.

Quick guide on how to complete borang c lhdn

Effortlessly Prepare Borang C Lhdn on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily obtain the necessary form and store it securely online. airSlate SignNow provides all the tools you require to swiftly create, modify, and eSign your documents without any delays. Manage Borang C Lhdn on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Simplest Way to Edit and eSign Borang C Lhdn with Ease

- Locate Borang C Lhdn and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure private information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or shareable link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Borang C Lhdn and guarantee exceptional communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borang c lhdn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'form b lhdn' and how can airSlate SignNow help?

The 'form b lhdn' is a critical tax document in Malaysia that businesses need to submit for compliance. airSlate SignNow simplifies the process by allowing users to easily fill out, sign, and send the form electronically, ensuring fast and secure submissions.

-

How does airSlate SignNow ensure the security of my 'form b lhdn'?

Security is a top priority for airSlate SignNow. Our platform uses advanced encryption and secure cloud storage to protect your 'form b lhdn' and other sensitive documents, ensuring that only authorized individuals can access them.

-

What features does airSlate SignNow offer for managing the 'form b lhdn'?

airSlate SignNow provides features like customizable templates, e-signature capabilities, and automated workflows to streamline the completion of the 'form b lhdn'. These tools help improve efficiency, reduce errors, and ensure compliance with regulatory requirements.

-

Is airSlate SignNow suitable for small businesses needing to submit 'form b lhdn'?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it an ideal solution for small businesses processing the 'form b lhdn'. Our affordable pricing plans allow even the smallest firms to access powerful document management tools.

-

Can I integrate airSlate SignNow with other software for processing 'form b lhdn'?

Yes, airSlate SignNow offers seamless integrations with popular applications such as Google Workspace, Microsoft 365, and CRM systems. This connectivity enables users to manage their 'form b lhdn' alongside other business functions, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for 'form b lhdn' management?

Using airSlate SignNow for 'form b lhdn' management brings several benefits, including faster processing times, improved accuracy in document handling, and reduced paper usage. These advantages lead to streamlined operations and ensure timely compliance with tax regulations.

-

How does e-signing the 'form b lhdn' work on airSlate SignNow?

eSigning the 'form b lhdn' on airSlate SignNow is simple and efficient. Users can invite signers via email, track the signing process in real-time, and receive notifications when the document is signed, allowing for prompt follow-up and submission.

Get more for Borang C Lhdn

- F14104 fit to facc member flyer p1 accorg form

- Verizon wireless com form

- Wisconsin uniform building permit application

- Casm critical appraisal of systematic review or meta wvsha form

- Tc661 74903383 form

- Manulife affinity markets claim form

- Social security claim form ssa 1724 f4

- Supporting statement for form ssa 1372 bk and

Find out other Borang C Lhdn

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free