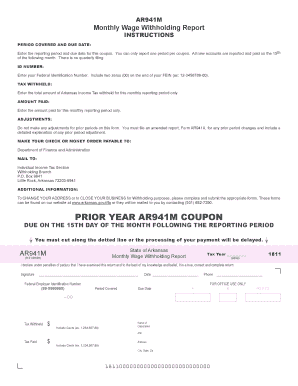

Ar941m Form

What is the AR941M?

The AR941M is a tax form used in the state of Arkansas for reporting and remitting withholding taxes. It is specifically designed for employers to report the state income tax withheld from their employees' wages. This form is crucial for ensuring compliance with Arkansas tax laws and for maintaining accurate records of tax payments made on behalf of employees. The AR941M must be submitted annually, detailing the total amount withheld during the tax year.

How to Use the AR941M

Using the AR941M involves several straightforward steps. First, gather all necessary payroll records for the year, including total wages paid and the amount of state income tax withheld. Next, accurately fill out the form, ensuring that all information is complete and correct. After completing the form, it can be submitted either electronically or via mail, depending on the preferred method of submission. It is essential to keep a copy of the submitted form for your records.

Steps to Complete the AR941M

Completing the AR941M requires careful attention to detail. Follow these steps to ensure accuracy:

- Collect payroll records for the entire year.

- Fill in the employer's identification information, including name, address, and tax identification number.

- Report the total wages paid and the total state income tax withheld.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal Use of the AR941M

The AR941M is legally binding when completed and submitted according to Arkansas state tax regulations. It is important to ensure that the information provided is truthful and accurate to avoid penalties. The form serves as an official record of tax obligations and payments, and it must comply with the relevant laws governing tax reporting in Arkansas.

Filing Deadlines / Important Dates

Timely filing of the AR941M is critical to avoid penalties. The form must be submitted by January 31 of the year following the tax year being reported. Employers should also be aware of any changes in deadlines or requirements that may occur, as these can affect their compliance status.

Form Submission Methods

The AR941M can be submitted through various methods, providing flexibility for employers. Options include:

- Online submission via the Arkansas Department of Finance and Administration website.

- Mailing a paper copy of the form to the designated tax office.

- In-person submission at local tax offices, if available.

Penalties for Non-Compliance

Failure to file the AR941M on time or inaccuracies in the form can result in penalties. Employers may face fines, interest on unpaid taxes, and potential legal action if they do not comply with state tax regulations. It is essential to understand these consequences to ensure timely and accurate submissions.

Quick guide on how to complete ar941m 16624364

Effortlessly Prepare Ar941m on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and without hassle. Handle Ar941m on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The Easiest Way to Edit and eSign Ar941m Effortlessly

- Locate Ar941m and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Ar941m and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar941m 16624364

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2019 ar941m and how does it relate to airSlate SignNow?

The 2019 ar941m refers to a specific form used in tax reporting for certain businesses. airSlate SignNow enables users to easily sign and send this document electronically, ensuring a streamlined and efficient process for submitting the 2019 ar941m. This feature can save time and help maintain compliance with tax filing requirements.

-

What features does airSlate SignNow offer for managing the 2019 ar941m?

airSlate SignNow provides a range of features to help users manage the 2019 ar941m effectively. These include customizable templates, automated workflows, and secure eSignature options. With these tools, you can accelerate the signing process and ensure all necessary documents, including the 2019 ar941m, are processed swiftly.

-

How does airSlate SignNow improve collaboration for the 2019 ar941m?

With airSlate SignNow, collaboration on the 2019 ar941m becomes seamless. Multiple users can access, review, and sign the document in real-time, making it easier to gather necessary approvals. The platform's user-friendly interface enhances team communication and reduces delays in document processing.

-

Is airSlate SignNow a cost-effective solution for submitting the 2019 ar941m?

Yes, airSlate SignNow is a cost-effective solution for handling the 2019 ar941m. With competitive pricing plans tailored for businesses of all sizes, you can save on printing and mailing costs while ensuring your documents are signed and submitted promptly. The affordability combined with efficiency makes it a smart choice for managing your tax documents.

-

What benefits does airSlate SignNow offer for handling the 2019 ar941m?

Using airSlate SignNow for the 2019 ar941m offers various benefits, including increased efficiency, enhanced security, and reduced paperwork. The electronic signing process ensures faster turnaround times and less risk of lost documents. Furthermore, the platform’s encryption features provide peace of mind while handling sensitive tax information.

-

Can airSlate SignNow integrate with my existing software for managing the 2019 ar941m?

Absolutely! airSlate SignNow offers integrations with various software applications commonly used for document management and accounting. This means you can easily incorporate the signing and submission of the 2019 ar941m into your existing workflows, ensuring a smooth transition and improved overall productivity.

-

How secure is airSlate SignNow for submitting the 2019 ar941m?

airSlate SignNow prioritizes security to protect your documents, including the 2019 ar941m. The platform employs advanced encryption protocols and complies with industry standards for data protection. With audit trails and secure storage, you can trust that your sensitive tax information is handled safely.

Get more for Ar941m

- Fancy sunglasses form

- Form ids 028

- Lilly cares refill authorization form needy meds needymeds

- Naeycassessoremploment form

- Health history questionnaire 273227666 form

- Attestation form 17255110

- Homeownership divisionhousing education programhou form

- What is a standby letter of credit sloc and how does it form

Find out other Ar941m

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself