Mtn Tax Invoice Form

What is the Mtn Tax Invoice

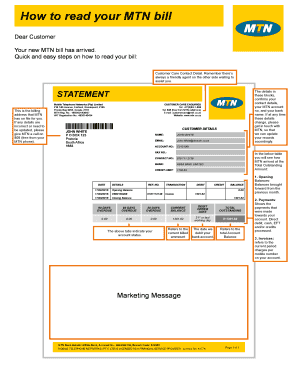

The Mtn tax invoice serves as a formal document that outlines the details of transactions related to tax obligations. It typically includes essential information such as the taxpayer's identification, the amount owed, and the services rendered. This document is crucial for maintaining accurate records for both individuals and businesses, ensuring compliance with tax regulations. Understanding the Mtn tax invoice is vital for effective financial management and tax filing.

How to Obtain the Mtn Tax Invoice

To obtain the Mtn tax invoice, individuals or businesses can typically request it through their tax authority's website or customer service. Many states offer the option to download the invoice directly as a PDF. It is advisable to have your taxpayer identification number and any relevant transaction details ready when making the request. This ensures a smooth process in acquiring the necessary documentation.

Steps to Complete the Mtn Tax Invoice

Completing the Mtn tax invoice involves several straightforward steps:

- Gather all necessary information, including your taxpayer identification number and transaction details.

- Access the Mtn tax invoice form through the appropriate online platform.

- Fill in the required fields accurately, ensuring all information is current and correct.

- Review the completed invoice for any errors or omissions.

- Submit the invoice electronically or print it for mailing, depending on your preference and the requirements of your tax authority.

Legal Use of the Mtn Tax Invoice

The Mtn tax invoice is legally binding when completed and signed according to the regulations set forth by tax authorities. It serves as proof of tax obligations and can be used in legal contexts if disputes arise. To ensure its legal standing, it is essential to follow all guidelines regarding completion, submission, and retention of the document.

Key Elements of the Mtn Tax Invoice

Key elements of the Mtn tax invoice include:

- Taxpayer Information: Name, address, and identification number.

- Invoice Number: A unique identifier for tracking purposes.

- Transaction Details: Description of services or goods provided.

- Amount Due: Total amount owed, including any applicable taxes.

- Payment Instructions: Information on how to remit payment.

IRS Guidelines

IRS guidelines dictate the proper use and submission of the Mtn tax invoice. Taxpayers must adhere to these regulations to ensure compliance and avoid penalties. The IRS provides resources and documentation to assist taxpayers in understanding their obligations and the importance of accurate record-keeping.

Quick guide on how to complete mtn tax invoice

Complete Mtn Tax Invoice effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely archive it online. airSlate SignNow equips you with all the resources you need to create, amend, and eSign your documents promptly without delays. Manage Mtn Tax Invoice on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to modify and eSign Mtn Tax Invoice with ease

- Locate Mtn Tax Invoice and then click Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for those tasks.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your alterations.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Mtn Tax Invoice and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mtn tax invoice

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an mtn tax invoice?

An mtn tax invoice is a document that provides a detailed account of the taxable supplies made by a business. It is crucial for tax purposes, as it allows businesses to report their income and enable customers to claim tax credits. Using airSlate SignNow, you can easily generate and send accurate mtn tax invoices to streamline your accounting process.

-

How can airSlate SignNow help with mtn tax invoices?

airSlate SignNow simplifies the creation and distribution of mtn tax invoices by providing a user-friendly platform. With features like document templates and electronic signatures, you can quickly generate invoices that meet all legal requirements. This saves time and reduces errors, ensuring you maintain compliance with tax regulations.

-

What are the pricing options for airSlate SignNow when using mtn tax invoices?

AirSlate SignNow offers a variety of pricing plans to accommodate different business needs. You can choose a plan that best fits your budget while enjoying features specifically designed for managing mtn tax invoices. Each tier provides the ability to send and eSign documents, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with my accounting software for mtn tax invoices?

Yes, airSlate SignNow can be easily integrated with various accounting software to streamline the management of mtn tax invoices. This integration allows for automated updates and synchronization of invoice data, reducing manual entry and potential errors. This efficiency ultimately helps improve your overall financial management.

-

What features does airSlate SignNow offer for managing mtn tax invoices?

AirSlate SignNow provides a robust set of features when managing mtn tax invoices, including customizable templates, electronic signatures, and tracking tools. These functionalities empower businesses to create legally binding invoices quickly, send them for signing, and monitor their status in real-time. This comprehensive approach enhances efficiency and accuracy.

-

Is it secure to send mtn tax invoices through airSlate SignNow?

Absolutely! airSlate SignNow prioritizes data security, ensuring that your mtn tax invoices are sent and stored safely. With advanced encryption and compliance with data protection regulations, you can be confident that your financial information is protected. This peace of mind allows you to focus on your business without worrying about security risks.

-

How can airSlate SignNow improve the speed of processing mtn tax invoices?

By using airSlate SignNow, businesses can signNowly speed up the processing of mtn tax invoices. The platform allows for instant creation, electronic signing, and quick delivery of invoices, reducing the time spent on traditional methods. This efficiency leads to faster payments and improved cash flow for your business.

Get more for Mtn Tax Invoice

Find out other Mtn Tax Invoice

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself