1040me Form

What is the 1040me?

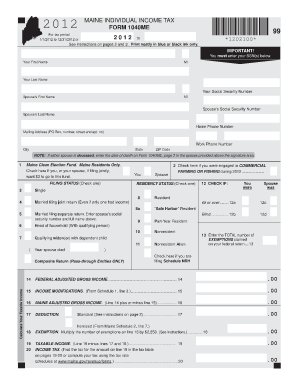

The 1040me is a state-specific tax form used by residents of Maine to report their income and calculate their tax obligations. It is part of the individual income tax filing process and is designed to ensure that taxpayers accurately report their earnings and claim any applicable deductions or credits. This form is essential for compliance with Maine's tax laws and helps the state determine the amount of tax owed by each individual taxpayer.

How to use the 1040me

Using the 1040me involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, follow the instructions provided with the form to fill it out accurately. It's important to report all sources of income and to claim any deductions or credits for which you may be eligible. Once completed, review the form for accuracy before submitting it to the appropriate state tax authority.

Steps to complete the 1040me

Completing the 1040me requires careful attention to detail. Here are the steps involved:

- Gather documents: Collect all relevant income statements and tax documents.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: List all sources of income, including wages and self-employment earnings.

- Claim deductions: Identify and enter any deductions you qualify for, such as education credits or medical expenses.

- Calculate tax owed: Use the provided tax tables to determine your tax liability based on your reported income.

- Sign and date the form: Ensure you sign the form to validate your submission.

Legal use of the 1040me

The 1040me is a legally binding document when completed and submitted according to Maine tax laws. To ensure its legal standing, it must be filled out accurately and submitted by the designated filing deadlines. The form serves as a formal declaration of income and tax liability, and any discrepancies can lead to penalties or audits by the state tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the 1040me are crucial for compliance. Typically, the deadline for submitting the form is April 15 of each year, aligning with federal tax deadlines. If April 15 falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply and ensure they file on time to avoid late fees or penalties.

Required Documents

To complete the 1040me, taxpayers must provide several key documents, including:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as interest or dividends

- Documentation for any deductions or credits claimed

Having these documents ready will streamline the process of filling out the 1040me and help ensure accuracy in reporting.

Quick guide on how to complete 1040me

Complete 1040me seamlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage 1040me on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The easiest way to modify and eSign 1040me effortlessly

- Obtain 1040me and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important portions of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional ink signature.

- Verify all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from a device of your choice. Edit and eSign 1040me and ensure smooth communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040me

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 1040me and how does it work?

1040me is an intuitive online platform designed for simplifying the tax filing process. With 1040me, users can easily prepare and eSign their tax documents, ensuring accuracy and compliance. The platform offers guided steps to help users navigate through their tax forms efficiently.

-

How much does 1040me cost?

The pricing for 1040me is competitive and designed to cater to individuals and small businesses. Users can choose from different pricing plans based on their needs, including a free trial option to evaluate the platform. This makes 1040me a cost-effective solution for managing tax documentation.

-

What features does 1040me offer?

1040me includes features such as customizable document templates, secure eSigning, and real-time collaboration. These features streamline the tax preparation process, making it easier for users to complete and submit their forms on time. With 1040me, you can also track the status of your documents for added convenience.

-

Is 1040me suitable for businesses?

Yes, 1040me is designed to cater to both individuals and businesses. It offers a range of tools tailored for business tax filings, ensuring that companies can manage their tax documentation with ease. By using 1040me, businesses can save time and minimize errors in their tax submissions.

-

What are the benefits of using 1040me?

The primary benefits of using 1040me include ease of use, enhanced security, and cost-effectiveness. Users can quickly prepare and eSign tax documents without the need for extensive training. Moreover, 1040me ensures that all data is encrypted, providing peace of mind when it comes to sensitive information.

-

Can 1040me integrate with other tools?

Yes, 1040me offers integrations with various accounting and finance tools, making it a versatile option for users. By connecting with popular software, users can streamline their workflow and easily transfer tax-related data. This integration capability enhances the overall experience when using 1040me.

-

How secure is my data with 1040me?

Security is a top priority for 1040me. The platform employs industry-standard security measures, including data encryption and secure eSigning protocols, to protect users' sensitive tax information. Users can trust that their data is safe while using 1040me.

Get more for 1040me

- Educational commission for foreign medical graduates form

- Siu financial aid selective service form

- Income driven repayment plan request form ifap ed 65670972

- Parent school authorization form

- Ignition interlock permit application nebraska dmv dmv ne form

- Note taking guide episode 602 answer key form

- Scratch lotto balancing form xcel

- Easement agreement template form

Find out other 1040me

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer