Form 1191

What is the Form 1191

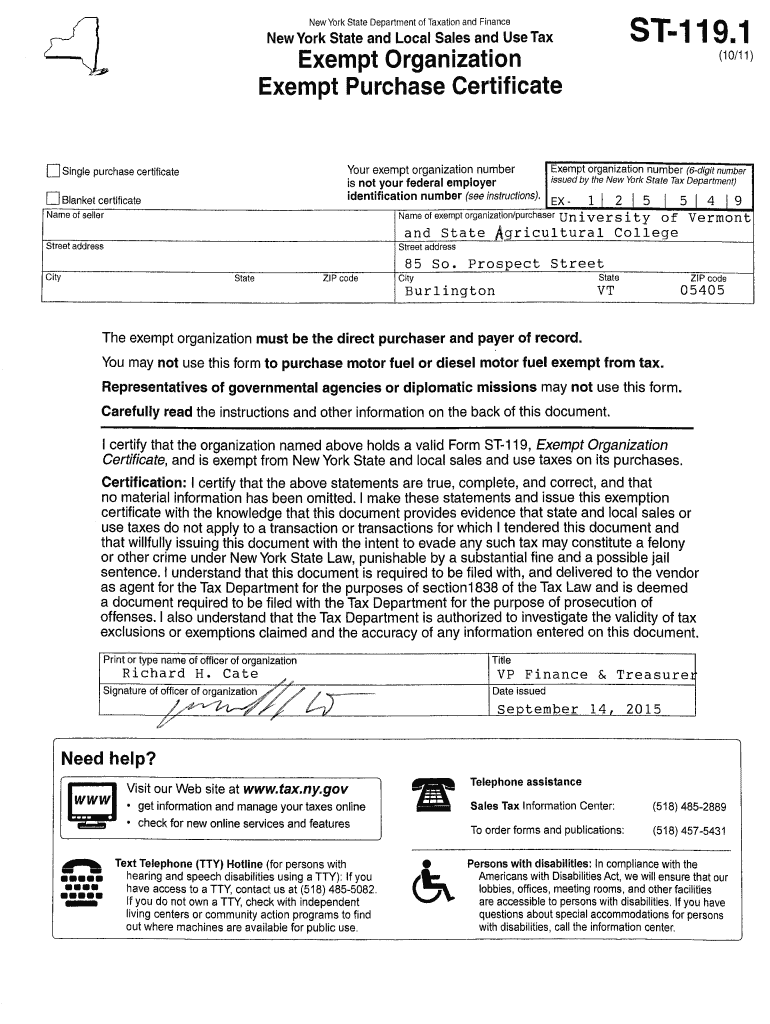

The Form 1191 is a tax-related document used in the United States, specifically designed for individuals or entities seeking a tax exemption. This form is often associated with educational institutions and is utilized to certify that certain purchases are exempt from sales tax. Understanding its purpose is essential for compliance with state tax regulations and ensuring that eligible transactions are processed correctly.

How to use the Form 1191

Using the Form 1191 involves several key steps to ensure proper completion and submission. First, gather the necessary information about the entity or individual applying for the exemption. This includes details such as the name, address, and tax identification number. Next, accurately fill out the form, ensuring all required fields are completed. After completing the form, it should be submitted to the appropriate state tax authority or vendor for processing. Keeping a copy of the submitted form for your records is also advisable.

Steps to complete the Form 1191

Completing the Form 1191 requires careful attention to detail. Follow these steps for accurate submission:

- Collect Information: Gather all necessary details, including identification numbers and contact information.

- Fill Out the Form: Enter the required information in each section, ensuring accuracy.

- Review: Double-check the completed form for any errors or omissions.

- Submit: Send the form to the designated authority or vendor, either electronically or via mail.

- Retain Copies: Keep a copy of the submitted form for your records in case of future inquiries.

Legal use of the Form 1191

The legal use of the Form 1191 is governed by state tax laws, which outline the requirements for tax exemption. To ensure compliance, it is important to understand the specific regulations that apply to the use of this form in your state. The form must be filled out accurately and submitted to the appropriate authority to be considered valid. Failure to comply with these regulations may result in penalties or denial of the tax exemption.

Eligibility Criteria

Eligibility for using the Form 1191 typically includes being a qualified educational institution or a related entity. Specific criteria may vary by state, but generally, the applicant must demonstrate that the purchases made are for educational purposes and meet the requirements set forth by state tax laws. It is advisable to review the eligibility guidelines provided by the relevant tax authority to ensure compliance.

Form Submission Methods

The Form 1191 can be submitted through various methods, depending on state regulations and the preferences of the submitting entity. Common submission methods include:

- Online Submission: Many states offer electronic filing options through their tax authority websites.

- Mail: The form can be printed and mailed to the appropriate tax authority.

- In-Person: Some entities may choose to deliver the form directly to a local tax office.

Quick guide on how to complete form 1191

Effortlessly Prepare Form 1191 on Any Device

Digital document management has gained traction among enterprises and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to acquire the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without obstacles. Manage Form 1191 across any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and eSign Form 1191 with Ease

- Obtain Form 1191 and click on Get Form to begin.

- Employ the tools we provide to fill out your document.

- Mark important parts of the document or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your desktop.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form 1191 and ensure excellent communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1191

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1191 and how can it benefit my business?

Form 1191 is a crucial document for businesses needing to verify eligibility for tax benefits. Using airSlate SignNow to manage Form 1191 allows for a seamless eSignature process, reducing the time spent on paperwork and minimizing errors. This can lead to faster approvals and increased efficiency in your business operations.

-

How much does it cost to use airSlate SignNow for Form 1191?

airSlate SignNow offers competitive pricing plans that cater to various business sizes and needs. While rates may vary, the cost of using airSlate SignNow for managing Form 1191 is designed to be budget-friendly, making it accessible for startups and established companies alike. Check our pricing page for specific details on plans that include features for Form 1191.

-

Can I integrate Form 1191 with other software using airSlate SignNow?

Yes, airSlate SignNow supports integrations with multiple applications such as CRM systems, file storage solutions, and productivity tools, enabling you to streamline your workflow around Form 1191. This flexibility allows you to automate tasks and enhance collaboration across your organization. Explore our integrations page to see how you can connect Form 1191 with your favorite tools.

-

Is it easy to eSign Form 1191 with airSlate SignNow?

Absolutely! airSlate SignNow provides an intuitive platform that simplifies the eSigning process for Form 1191. Users can easily upload, send, and sign the document from any device, ensuring a hassle-free experience. This user-friendly approach helps speed up the entire signing process.

-

What security features does airSlate SignNow offer for Form 1191?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like Form 1191. Our platform utilizes encryption, secure access controls, and audit trails to protect your data. You can trust that your Form 1191 transactions are safeguarded against unauthorized access and tampering.

-

How can airSlate SignNow improve my workflow for Form 1191 assessments?

By using airSlate SignNow, you can streamline your workflow for Form 1191 assessments through automated reminders and notifications. This keeps your team on track and ensures timely completion of necessary documents. Enhanced collaboration tools also allow multiple stakeholders to participate in the review process more efficiently.

-

What types of businesses can benefit from using Form 1191 with airSlate SignNow?

Any business that needs to file Form 1191 for tax verification can benefit from using airSlate SignNow. This includes small businesses, freelancers, and large corporations alike. The versatility of our platform ensures that regardless of your business size or industry, you can manage Form 1191 effortlessly.

Get more for Form 1191

- Organization behavioral health staff roster form

- Safety meeting outlines inc form

- Tpcastt 249588014 form

- Blank street sweeper sop forms

- Form 990 n e postcard online view and print return reachguatemala

- Hardship application form

- Sports equipment inventory template 67209794 form

- Cyber situational awareness in public private partnerships form

Find out other Form 1191

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation