Form 990 N E Postcard Online View and Print Return Reachguatemala

Understanding the Form 990 N e Postcard

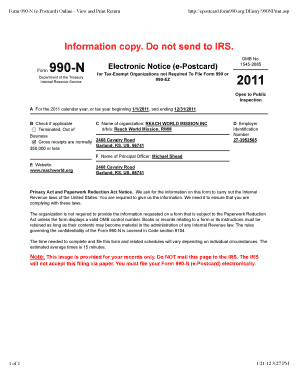

The Form 990 N e postcard, also known as the IRS 990 N e postcard, is a simplified annual reporting form for small tax-exempt organizations. It is specifically designed for organizations with gross receipts of less than fifty thousand dollars. This form allows these organizations to meet their annual filing requirements without the complexity of the full Form 990 or Form 990 EZ. By submitting the 990 N e postcard, organizations can maintain their tax-exempt status while providing the IRS with essential information about their activities.

Steps to Complete the Form 990 N e Postcard

Completing the Form 990 N e postcard involves several straightforward steps. First, gather necessary information, including the organization’s name, address, and Employer Identification Number (EIN). Next, confirm that the organization’s gross receipts are below the fifty thousand dollar threshold. Then, access the online filing system provided by the IRS, where the form must be submitted electronically. Fill in the required fields accurately, ensuring all information is complete before submitting. Finally, keep a copy of the confirmation for your records, as this serves as proof of filing.

Legal Use of the Form 990 N e Postcard

The Form 990 N e postcard is legally binding when submitted correctly and on time. Organizations must ensure compliance with IRS regulations to avoid penalties. The form serves as a declaration of the organization’s financial status and activities, which is crucial for maintaining tax-exempt status. Failure to file the form can result in automatic revocation of this status, leading to potential tax liabilities. Therefore, understanding the legal implications and ensuring timely submission is vital for compliance.

Filing Deadlines for the Form 990 N e Postcard

The filing deadline for the Form 990 N e postcard is the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this typically falls on May fifteenth. It is important to mark this date on your calendar and prepare the necessary information in advance to avoid late submissions, which can lead to penalties and loss of tax-exempt status.

Examples of Using the Form 990 N e Postcard

Small nonprofit organizations, such as community service groups, religious organizations, and educational charities, often use the Form 990 N e postcard. For instance, a local charity that raises funds to support community events and has gross receipts below fifty thousand dollars would file this form annually. This allows them to maintain their tax-exempt status while providing transparency about their financial activities to the IRS.

Required Documents for Filing the Form 990 N e Postcard

To file the Form 990 N e postcard, organizations need to have specific documents ready. These include the organization’s legal name, address, and EIN. Additionally, organizations should prepare a summary of their gross receipts for the year, ensuring it does not exceed the fifty thousand dollar limit. Having this information readily available will facilitate a smooth filing process.

Quick guide on how to complete form 990 n e postcard online view and print return reachguatemala

Complete Form 990 N e Postcard Online View And Print Return Reachguatemala seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Form 990 N e Postcard Online View And Print Return Reachguatemala on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Form 990 N e Postcard Online View And Print Return Reachguatemala effortlessly

- Find Form 990 N e Postcard Online View And Print Return Reachguatemala and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your adjustments.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Form 990 N e Postcard Online View And Print Return Reachguatemala and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 990 n e postcard online view and print return reachguatemala

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 990 n e postcard and how can it benefit my business?

The 990 n e postcard is a digital document solution that simplifies the process of sending and eSigning essential forms. It allows businesses to quickly manage their paperwork online, saving time and reducing hassles associated with traditional methods. With airSlate SignNow, utilizing the 990 n e postcard can enhance your efficiency and streamline your operations.

-

How much does it cost to use the 990 n e postcard feature?

Pricing for the 990 n e postcard feature varies depending on the plan you choose with airSlate SignNow. We offer flexible pricing options that cater to different business needs and sizes. Contact our sales team to receive a tailored quote that best fits your requirements and budget.

-

What features does the 990 n e postcard include?

The 990 n e postcard includes features such as electronic signatures, document templates, and cloud storage options. Additionally, it provides real-time tracking of your documents, ensuring you know when they are signed. These features are designed to optimize your document workflow efficiently.

-

Is the 990 n e postcard secure for sensitive documents?

Yes, the 990 n e postcard is built with robust security measures to ensure your sensitive documents are protected. airSlate SignNow complies with industry standards for encryption and privacy, safeguarding your information during the signing process. You can trust that your documents are secure and confidential.

-

Can I integrate the 990 n e postcard with other applications?

Absolutely! The 990 n e postcard can be easily integrated with a variety of applications, enhancing its functionality. Whether you need to connect with CRM systems, document management tools, or productivity suites, airSlate SignNow offers seamless integration options to streamline your workflow.

-

How does the 990 n e postcard improve my document turnaround time?

Using the 990 n e postcard dramatically reduces document turnaround time by eliminating the need for printing and mailing. With electronic signatures, your documents can be sent, signed, and returned in minutes rather than days. This quickens decision-making processes and improves overall efficiency.

-

What types of businesses can benefit from the 990 n e postcard?

Any business that requires document signing can benefit from the 990 n e postcard, including real estate, legal, healthcare, and finance sectors. Its user-friendly features make it suitable for small businesses as well as larger enterprises looking to streamline their document management processes. The versatility of airSlate SignNow ensures it meets varied business needs.

Get more for Form 990 N e Postcard Online View And Print Return Reachguatemala

- Patient attestation form solutions physical therapy and

- Ngb form 105

- New patient intake form obstetrics and gynecology weill cornell cornellobgyn

- Request for judicial intervention fillable form

- Monitronic success college application form

- How to fill out a north american money order form

- Addiction recovery contract template form

- Fire alarm monitor contract template form

Find out other Form 990 N e Postcard Online View And Print Return Reachguatemala

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple