Agencia Tributaria Modelo 210 Download Form

What is the Agencia Tributaria Modelo 210 Download

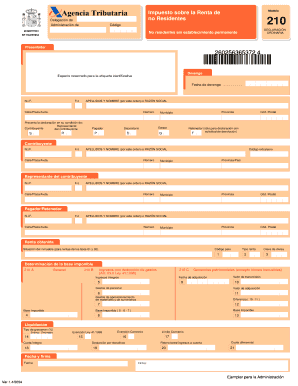

The Agencia Tributaria Modelo 210 is a tax form used in Spain for non-residents to declare income generated in the country. This form is essential for individuals who earn income from Spanish sources but do not reside in Spain. The modelo 210 English PDF download provides an accessible version for English speakers, ensuring that all necessary information is clearly presented. The form is primarily used for reporting income from property rentals, dividends, and other sources. Understanding the purpose of this form is crucial for compliance with Spanish tax regulations.

How to use the Agencia Tributaria Modelo 210 Download

Using the modelo 210 involves filling out the form accurately to report your income as a non-resident. After downloading the PDF, you can fill it out digitally or print it for manual completion. Ensure that you provide all required information, including personal identification details and specifics about the income being reported. Once completed, the form must be submitted to the Agencia Tributaria, either online or through traditional mail, depending on your preference and the submission options available.

Steps to complete the Agencia Tributaria Modelo 210 Download

Completing the modelo 210 requires careful attention to detail. Here are the steps to follow:

- Download the modelo 210 English PDF from a reliable source.

- Open the PDF and fill in your personal information, including your name, address, and tax identification number.

- Provide details of the income you are declaring, specifying the type and amount.

- Review the completed form for accuracy to avoid errors that could lead to penalties.

- Choose your submission method: online or by mail, and follow the respective instructions for each.

Legal use of the Agencia Tributaria Modelo 210 Download

The modelo 210 is legally binding when completed and submitted according to Spanish tax laws. It is crucial to ensure that the information provided is accurate and truthful. Failure to comply with tax regulations can result in penalties, including fines or legal action. Utilizing a reliable platform like signNow can enhance the security and validity of your electronic submission, ensuring compliance with relevant eSignature laws.

Key elements of the Agencia Tributaria Modelo 210 Download

Several key elements must be included when completing the modelo 210:

- Personal Information: Name, address, and tax identification number.

- Income Details: Type of income being declared and the corresponding amounts.

- Tax Calculation: Properly calculate the tax owed based on the income reported.

- Signature: Ensure that the form is signed, either electronically or physically, to validate the submission.

Form Submission Methods

The modelo 210 can be submitted through various methods, catering to different preferences:

- Online Submission: Use the Agencia Tributaria's online portal to submit your completed form electronically.

- Mail Submission: Print the completed form and send it to the appropriate tax office via postal service.

- In-Person Submission: Visit a local tax office to submit the form directly, if preferred.

Quick guide on how to complete agencia tributaria modelo 210 download

Effortlessly prepare Agencia Tributaria Modelo 210 Download on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Agencia Tributaria Modelo 210 Download on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Agencia Tributaria Modelo 210 Download effortlessly

- Obtain Agencia Tributaria Modelo 210 Download and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Select important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Decide how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, lengthy form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Agencia Tributaria Modelo 210 Download while ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the agencia tributaria modelo 210 download

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the modelo 210 English PDF download?

The modelo 210 English PDF download is a form used for tax declaration in Spain, specifically for income and property taxes. With airSlate SignNow, you can easily download this form in English, making it more accessible for English-speaking users. The downloadable PDF format allows you to fill out the information digitally and print it when needed.

-

How can I download the modelo 210 in English using airSlate SignNow?

To download the modelo 210 English PDF, simply navigate to our website and locate the download section for the form. Choose the English version and click the download button. This user-friendly process ensures that you can quickly access the modelo 210 when you need it.

-

Is the modelo 210 English PDF download free with airSlate SignNow?

Yes, the modelo 210 English PDF download is available for free to all users of airSlate SignNow. We believe in providing accessible resources to help users manage their documentation efficiently. Just visit our platform to get your free copy.

-

What features does airSlate SignNow offer for the modelo 210?

airSlate SignNow offers various features for the modelo 210, including eSigning, template storage, and document tracking. These tools help streamline the process of completing and submitting your tax forms. Our platform ensures that you can manage your documentation seamlessly.

-

Can I use the modelo 210 English PDF download on mobile devices?

Absolutely! The modelo 210 English PDF download can be accessed on mobile devices, allowing you to fill out and sign documents on-the-go. airSlate SignNow is optimized for mobile use, ensuring convenience and flexibility in managing your forms.

-

Are there integration options available for the modelo 210 with airSlate SignNow?

Yes, airSlate SignNow offers integration options with various applications, enhancing the functionality for managing the modelo 210. You can connect to popular platforms like Google Drive and Dropbox to easily store and retrieve your documents. These integrations simplify document management and improve productivity.

-

What are the benefits of using airSlate SignNow for the modelo 210?

Using airSlate SignNow for the modelo 210 provides numerous benefits, such as cost-effectiveness, ease of use, and improved compliance. The platform allows for quick eSigning, making the submission process efficient and hassle-free. Additionally, you can manage your tax forms from one central location.

Get more for Agencia Tributaria Modelo 210 Download

- Good cause waiver sample form

- Case closure form health ny

- Bpst p complete doc form

- Coam license cancellation request form

- What is the odometer brand for a mvr 330 form

- Local 804 grievance form 3421 review ave long is

- Access a ride service application winter 2 01 5 webserver mta form

- Board of directors authorization letter form

Find out other Agencia Tributaria Modelo 210 Download

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free