Printable Texas Tax Exempt Form Shsu

What is the Printable Texas Tax Exempt Form Shsu

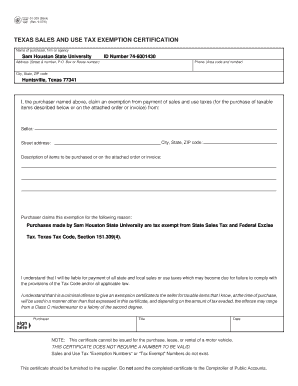

The Printable Texas Tax Exempt Form Shsu is a document used by eligible organizations to claim exemption from state sales tax in Texas. This form is essential for qualifying entities, such as educational institutions, non-profit organizations, and certain government bodies, allowing them to make tax-exempt purchases. The form serves as proof of the organization’s tax-exempt status and must be presented to vendors at the time of purchase.

How to Use the Printable Texas Tax Exempt Form Shsu

To use the Printable Texas Tax Exempt Form Shsu, organizations must first ensure they meet the eligibility criteria for tax exemption. Once eligibility is confirmed, the form should be filled out completely, including the organization's name, address, and tax identification number. After completing the form, it can be printed and presented to vendors when making purchases that qualify for tax exemption. It is important to retain a copy for the organization’s records.

Steps to Complete the Printable Texas Tax Exempt Form Shsu

Completing the Printable Texas Tax Exempt Form Shsu involves several key steps:

- Gather necessary information, including the organization’s legal name, address, and tax ID number.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Print the completed form.

- Present the form to the vendor during the purchase transaction.

Legal Use of the Printable Texas Tax Exempt Form Shsu

The legal use of the Printable Texas Tax Exempt Form Shsu requires that the organization is indeed eligible for tax exemption under Texas law. Misuse of the form, such as using it for non-qualifying purchases, can lead to penalties and fines. Organizations must ensure compliance with state regulations and maintain proper documentation to support their tax-exempt status.

Key Elements of the Printable Texas Tax Exempt Form Shsu

Key elements of the Printable Texas Tax Exempt Form Shsu include:

- Organization Name: The legal name of the entity claiming tax exemption.

- Address: The physical address of the organization.

- Tax Identification Number: The unique number assigned to the organization by the IRS.

- Signature: An authorized representative must sign the form to validate it.

Eligibility Criteria

Eligibility for using the Printable Texas Tax Exempt Form Shsu typically includes being a non-profit organization, educational institution, or governmental entity. These organizations must be recognized as tax-exempt under the relevant sections of the Internal Revenue Code. It is crucial for organizations to verify their status and ensure they meet all necessary requirements before utilizing the form.

Quick guide on how to complete printable texas tax exempt form shsu

Prepare Printable Texas Tax Exempt Form Shsu effortlessly on any device

Online document management has gained signNow traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly and without holdups. Manage Printable Texas Tax Exempt Form Shsu on any device with airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The easiest way to edit and eSign Printable Texas Tax Exempt Form Shsu with ease

- Locate Printable Texas Tax Exempt Form Shsu and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize crucial sections of the documents or hide sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information carefully and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your preference. Modify and eSign Printable Texas Tax Exempt Form Shsu to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable texas tax exempt form shsu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SHSU tax exempt form and why is it important?

The SHSU tax exempt form is a document that allows eligible organizations and individuals to make purchases without paying sales tax. By using this form, you can save money on necessary supplies and services, ensuring you use your resources more efficiently. It’s essential for maintaining compliance with tax regulations while maximizing your budget.

-

How can I obtain the SHSU tax exempt form?

You can obtain the SHSU tax exempt form by visiting the official SHSU website or contacting their financial office. Usually, these forms are available for download and can be filled out digitally. Make sure to complete all required sections to ensure a smooth processing of your exemption.

-

How does airSlate SignNow facilitate the use of the SHSU tax exempt form?

airSlate SignNow makes it easy to eSign your SHSU tax exempt form electronically, streamlining the process of sending and receiving important documents. With its user-friendly interface, you can quickly fill in the form, sign it, and share it with the necessary recipients. This not only saves time but also ensures that your document is securely stored.

-

Is there a cost associated with using airSlate SignNow for the SHSU tax exempt form?

While airSlate SignNow offers a variety of pricing plans, many users find that its cost-effective solutions easily justify the expense, especially when handling documents like the SHSU tax exempt form. There are different subscription tiers available to meet various budget needs, ensuring you only pay for the features you use.

-

Can the SHSU tax exempt form be integrated with other applications using airSlate SignNow?

Yes, airSlate SignNow allows you to integrate the SHSU tax exempt form with various applications such as Google Drive, Dropbox, and CRM systems. This flexibility enhances your workflow by allowing you to manage documents from different platforms seamlessly. These integrations help ensure that your tax-exempt processes are efficient and organized.

-

What features does airSlate SignNow offer for managing the SHSU tax exempt form?

airSlate SignNow offers robust features such as template creation, customizable workflows, and secure storage for managing your SHSU tax exempt form. These features make it easy to automate repetitive tasks, ensuring that the form processing is quick and streamlined. Additionally, you can track document status and receive notifications for completions.

-

How secure is airSlate SignNow when handling the SHSU tax exempt form?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the SHSU tax exempt form. They employ advanced encryption methods and security protocols to protect your data from unauthorized access. You can sign and share documents with peace of mind, knowing that your information is safe.

Get more for Printable Texas Tax Exempt Form Shsu

- Cooper university hospital volunteer program consent form

- Implementation report template form

- Gifted individualized education plan form

- Ellis island virtual tour worksheet form

- Veterinary release form owners fill in please

- Arkansas articles of organization for domestic limited liability company llc form

- Census language identification flashcard form

- Cell city worksheet form

Find out other Printable Texas Tax Exempt Form Shsu

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer