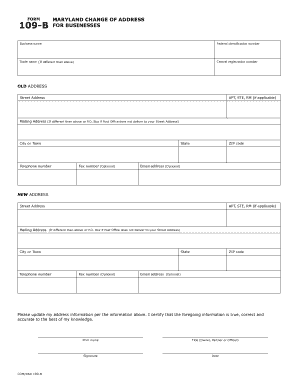

109b Form

What is the 109b Form

The 109b form is a specific document utilized in Maryland for reporting certain financial information. It is primarily used for tax purposes, allowing individuals and businesses to report income, deductions, and other relevant financial data to the state. Understanding the purpose of the 109b form is crucial for compliance with Maryland tax regulations.

How to use the 109b Form

Using the 109b form involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. Once the form is filled out, it can be submitted electronically or via mail, depending on your preference and the guidelines provided by the state.

Steps to complete the 109b Form

Completing the 109b form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents.

- Fill in your personal information, including your name and address.

- Report your income accurately, ensuring you include all sources.

- List any deductions you are eligible for, providing necessary documentation.

- Review the form for accuracy before submission.

Legal use of the 109b Form

The legal use of the 109b form is essential for compliance with Maryland tax laws. When filled out correctly, the form serves as an official document that can be used in case of audits or disputes. It is important to maintain records of the submitted form and any supporting documents for future reference.

Filing Deadlines / Important Dates

Filing deadlines for the 109b form are critical to avoid penalties. Generally, the form must be submitted by a specified date each year, often coinciding with federal tax deadlines. It is advisable to check the Maryland state tax website for the most current deadlines to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The 109b form can be submitted through various methods, providing flexibility for users. Options include:

- Online Submission: Many users prefer to submit the form electronically through the Maryland state tax portal.

- Mail: The form can be printed and mailed to the appropriate tax office.

- In-Person: Some individuals may choose to deliver the form in person at designated tax offices.

Quick guide on how to complete 109b form 21744978

Effortlessly Prepare 109b Form on Any Device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage 109b Form on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

Edit and eSign 109b Form with Ease

- Obtain 109b Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using the tools airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 109b Form to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 109b form 21744978

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 109 b?

airSlate SignNow is an easy-to-use platform that allows businesses to send and eSign documents electronically. The term '109 b' may refer to specific document types or forms that can be efficiently managed with airSlate SignNow, simplifying the process and ensuring compliance.

-

How does pricing work for airSlate SignNow related to 109 b forms?

airSlate SignNow offers a flexible pricing structure that accommodates businesses of all sizes needing to manage 109 b forms. By providing tiered plans, you can choose a package that fits your needs and budget, ensuring you get the right features to handle your specific signing needs efficiently.

-

What features does airSlate SignNow offer for handling 109 b documentation?

airSlate SignNow includes features tailored for 109 b documentation, such as customizable templates and secure electronic signatures. Additionally, the platform provides integration capabilities and a user-friendly interface, making the signing process quick and hassle-free for users.

-

Can I integrate airSlate SignNow with other applications for 109 b processing?

Yes, airSlate SignNow supports seamless integrations with various applications that are commonly used for handling 109 b forms. This ensures you can connect your existing systems and streamline your document workflows, enhancing productivity and efficiency.

-

What are the benefits of using airSlate SignNow for 109 b forms?

Using airSlate SignNow for your 109 b forms allows for faster turnaround times, reduced paper costs, and improved document security. The platform simplifies the signing process and assists in maintaining compliance with legal standards, making it an ideal choice for businesses.

-

Is airSlate SignNow mobile-friendly for managing 109 b documents?

Absolutely! airSlate SignNow features a mobile-friendly interface that allows users to manage and sign 109 b documents on-the-go. This accessibility ensures that you can handle important paperwork anytime and anywhere, which is crucial for business efficiency.

-

What kind of support does airSlate SignNow provide for 109 b issues?

airSlate SignNow offers robust customer support to assist users with any issues related to 109 b forms. Whether you have questions about the platform or need help with a specific document, their support team is available to provide timely and effective assistance.

Get more for 109b Form

- Drawdown notice template 89269682 form

- Tb questionnaire texas form

- The secret life of real estate and banking pdf form

- Japanese from zero 3 pdf form

- Driver improvement program application for review form

- Notice of claim against security deposit florida r e i form

- Personal medicine worksheet form

- Sunset counseling center form

Find out other 109b Form

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online