Ri 1040mu 2018

What is the Ri 1040mu

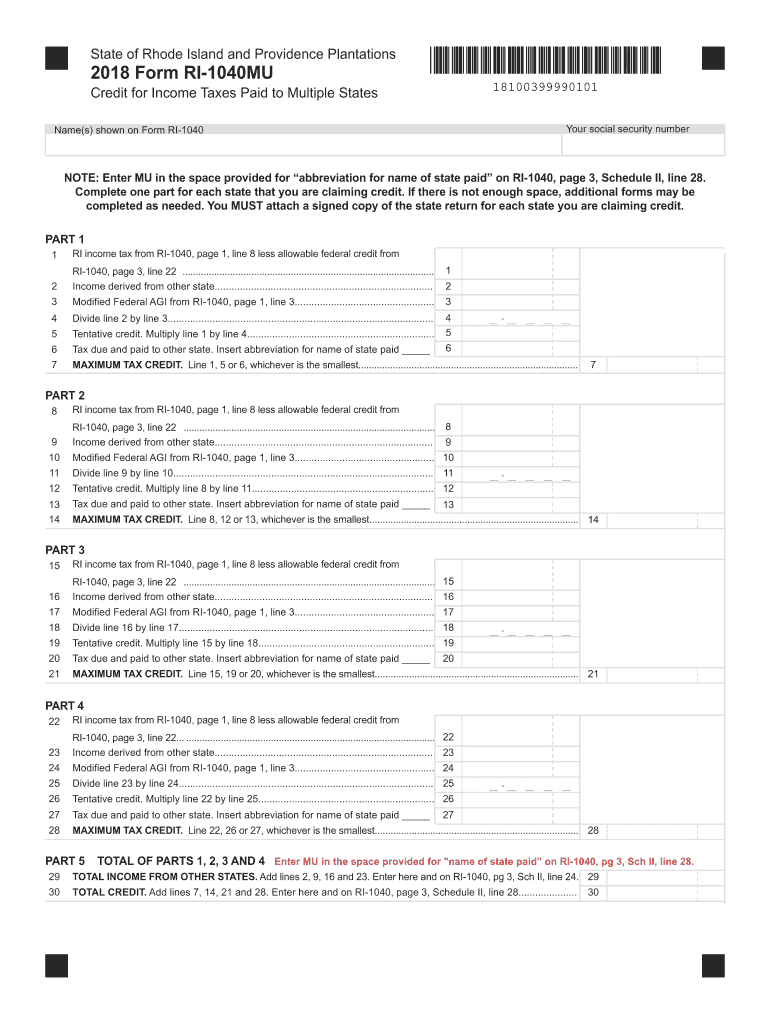

The Ri 1040mu is a specific tax form used in the state of Rhode Island. This form is essential for individuals who need to report their income and calculate their state tax obligations. It is designed to help taxpayers provide necessary information about their earnings, deductions, and credits. Understanding the purpose of the Ri 1040mu is crucial for ensuring accurate tax reporting and compliance with state tax laws.

How to use the Ri 1040mu

Using the Ri 1040mu involves filling out the form with accurate financial information. Taxpayers must report their total income, including wages, interest, and dividends. Additionally, it is important to include any applicable deductions and credits that may reduce the overall tax liability. Once completed, the form must be submitted to the Rhode Island Division of Taxation by the designated deadline. Utilizing digital tools can streamline this process and ensure that all entries are accurate.

Steps to complete the Ri 1040mu

Completing the Ri 1040mu requires several key steps:

- Gather all necessary financial documents, including W-2 forms and any other income statements.

- Fill in personal information, such as name, address, and Social Security number.

- Report total income from various sources, ensuring all figures are accurate.

- Apply any deductions or credits that you qualify for, as outlined in the instructions.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Ri 1040mu to avoid penalties. Typically, the deadline for submitting the form aligns with the federal tax filing deadline, which is usually April 15. However, taxpayers should check for any specific state extensions or changes that may apply. Staying informed about these dates can help ensure timely compliance.

Required Documents

To accurately complete the Ri 1040mu, taxpayers must gather several required documents, including:

- W-2 forms from employers to report wages.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Any other relevant financial documents that support income or deductions claimed.

Legal use of the Ri 1040mu

The Ri 1040mu is legally recognized for reporting state income taxes in Rhode Island. To ensure its legal validity, taxpayers must follow the instructions provided by the Rhode Island Division of Taxation. This includes using the most current version of the form and adhering to all filing requirements. Proper completion and submission of the Ri 1040mu help maintain compliance with state tax laws.

Quick guide on how to complete individual consumers use tax worksheet rigov

Complete Ri 1040mu effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an optimal eco-friendly alternative to conventional printed and signed paperwork, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Ri 1040mu on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and electronically sign Ri 1040mu without stress

- Find Ri 1040mu and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize essential sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or unorganized files, tiresome form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Edit and electronically sign Ri 1040mu while ensuring effective communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual consumers use tax worksheet rigov

Create this form in 5 minutes!

How to create an eSignature for the individual consumers use tax worksheet rigov

How to create an electronic signature for your Individual Consumers Use Tax Worksheet Rigov in the online mode

How to make an electronic signature for the Individual Consumers Use Tax Worksheet Rigov in Chrome

How to create an electronic signature for putting it on the Individual Consumers Use Tax Worksheet Rigov in Gmail

How to generate an eSignature for the Individual Consumers Use Tax Worksheet Rigov right from your mobile device

How to make an eSignature for the Individual Consumers Use Tax Worksheet Rigov on iOS devices

How to create an electronic signature for the Individual Consumers Use Tax Worksheet Rigov on Android devices

People also ask

-

What is the ri 1040mu form used for?

The ri 1040mu form is utilized for individual income tax return filing in Rhode Island. It allows residents to report their income and claim applicable deductions and credits. Understanding how to properly complete the ri 1040mu is essential for accurate tax reporting.

-

How can airSlate SignNow assist with the ri 1040mu filing process?

airSlate SignNow streamlines the document signing process, making it easy to send and eSign your ri 1040mu form electronically. With our intuitive platform, you can quickly gather necessary signatures, ensuring that your tax filings are submitted promptly and securely. This saves time and reduces the hassle of manual paperwork.

-

Is airSlate SignNow suitable for businesses needing to submit the ri 1040mu?

Yes, airSlate SignNow is an excellent solution for businesses filing the ri 1040mu. It provides features that enable simple document management and eSigning, making it easy to handle tax documents efficiently. This aids in ensuring compliance and timely submissions for Rhode Island tax requirements.

-

What are the pricing options for using airSlate SignNow for ri 1040mu documentation?

airSlate SignNow offers flexible pricing plans suited for various business needs, including options ideal for those needing to manage ri 1040mu forms. You can choose from monthly or annual subscriptions, allowing you to select what fits your budget best. Plus, affordable rates make it accessible for small and large businesses alike.

-

What security features does airSlate SignNow provide for sensitive documents like the ri 1040mu?

Security is a top priority at airSlate SignNow, especially for sensitive documents such as the ri 1040mu. We employ encryption, secure cloud storage, and robust authentication methods to protect your information. This ensures that your personal and financial data remains confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for my ri 1040mu processing?

Absolutely! airSlate SignNow provides seamless integrations with various applications that enhance your ri 1040mu processing. Whether you're using accounting software or CRM tools, our platform can connect for streamlined workflows, helping you manage all documents in one place.

-

What are the main benefits of using airSlate SignNow for handling the ri 1040mu?

Using airSlate SignNow for the ri 1040mu offers several benefits, including time savings, increased efficiency, and reduced errors in document handling. Our user-friendly platform allows you to quickly send, sign, and store your tax documents electronically. This not only enhances productivity but also simplifies your tax filing experience.

Get more for Ri 1040mu

- Cd application checklist calguard ca form

- Pre hospital care report ok form

- Fill training letter layout 2013 form

- Formulario b res 075

- How to fill canadore college international form

- Marriott employee discount form pdf

- Registration application for internresidentfellow or house physician form

- Government of the district of columbia notice washington dc otr cfo dc form

Find out other Ri 1040mu

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA