Form 23 Up Vat

What is the Form 23 Up Vat

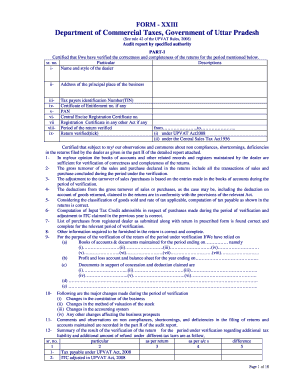

The Form 23 Up Vat is a specific tax document used for reporting value-added tax (VAT) obligations in the United States. It is essential for businesses that need to comply with state and federal tax regulations. The form captures various details about taxable sales, purchases, and the amount of VAT collected or paid. Understanding this form is crucial for accurate tax reporting and ensuring compliance with tax laws.

Steps to complete the Form 23 Up Vat

Completing the Form 23 Up Vat involves several key steps to ensure accuracy and compliance. Follow these steps:

- Gather necessary financial documents, including sales records and purchase invoices.

- Calculate the total sales and purchases subject to VAT.

- Determine the VAT amount collected from customers and the VAT paid on purchases.

- Fill out the form with the calculated figures, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

Legal use of the Form 23 Up Vat

The legal use of the Form 23 Up Vat is governed by various tax laws and regulations. It is essential for businesses to ensure that the information provided is truthful and accurate. Filing this form correctly can help avoid penalties and legal issues. The form must be submitted by the designated deadlines to maintain compliance with the Internal Revenue Service (IRS) and state tax authorities.

How to obtain the Form 23 Up Vat

The Form 23 Up Vat can typically be obtained from the official website of the state tax authority or the IRS. Many states provide downloadable versions of the form in PDF format, which can be printed and filled out manually. Additionally, some tax preparation software may include the form as part of their offerings, making it easier for users to complete their tax filings electronically.

Filing Deadlines / Important Dates

Filing deadlines for the Form 23 Up Vat vary by state and can depend on the type of business and its reporting frequency. Generally, businesses are required to file the form quarterly or annually. It is important to check with the state tax authority for specific deadlines to avoid late filing penalties. Keeping a calendar of important dates can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form 23 Up Vat can be done through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state tax authority's website, which may offer an electronic filing option.

- Mailing a hard copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if available.

Quick guide on how to complete form 23 up vat

Complete Form 23 Up Vat effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventionally printed and signed documentation, enabling you to locate the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form 23 Up Vat on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 23 Up Vat with ease

- Locate Form 23 Up Vat and click Get Form to get started.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or black out sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form retrieval, or errors that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 23 Up Vat and ensure outstanding communication at all stages of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 23 up vat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 23 up VAT and how does airSlate SignNow help with it?

Form 23 up VAT is a document used for VAT reporting in certain jurisdictions. airSlate SignNow simplifies the management of form 23 up VAT by providing a user-friendly platform that enables businesses to send and eSign their VAT documents quickly and securely.

-

Is there a pricing plan for managing form 23 up VAT with airSlate SignNow?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs, including options for managing form 23 up VAT. Each plan provides cost-effective solutions to help you streamline your document processes without breaking the bank.

-

What features are included for form 23 up VAT management in airSlate SignNow?

airSlate SignNow includes features such as customizable document templates, eSignature capabilities, and automated workflows specifically designed to help you manage form 23 up VAT efficiently. These tools enhance your productivity and ensure compliance with tax regulations.

-

How does airSlate SignNow enhance the security of form 23 up VAT documents?

The platform employs industry-standard encryption and secure access protocols to protect your form 23 up VAT documents. This level of security ensures that your sensitive financial information remains safe during transmission and storage.

-

Can I integrate airSlate SignNow with other tools for managing form 23 up VAT?

Yes, airSlate SignNow offers various integrations with popular business tools like CRM systems and accounting software. These integrations help streamline your workflow when managing form 23 up VAT and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for form 23 up VAT?

Using airSlate SignNow for form 23 up VAT provides numerous benefits, including increased speed, lower operational costs, and improved compliance. The platform's intuitive interface allows businesses to handle their VAT documents more efficiently.

-

Can I access airSlate SignNow from multiple devices for form 23 up VAT?

Absolutely! airSlate SignNow is cloud-based and can be accessed from various devices, including desktops, tablets, and smartphones. This flexibility allows you to manage your form 23 up VAT documents from anywhere at any time.

Get more for Form 23 Up Vat

- Massachusetts divorce forms pdf

- Carnet form

- Lehman formula finders fee agreement

- Employee earnings record template form

- Profco pdf form 4 statement of changes in beneficial ownership filed 052512 for the period ending 052312

- File a premium waiver claim formarizona

- Project cooperation agreement template form

- Project development agreement template form

Find out other Form 23 Up Vat

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF