H1113 Form

What is the H1113 Form

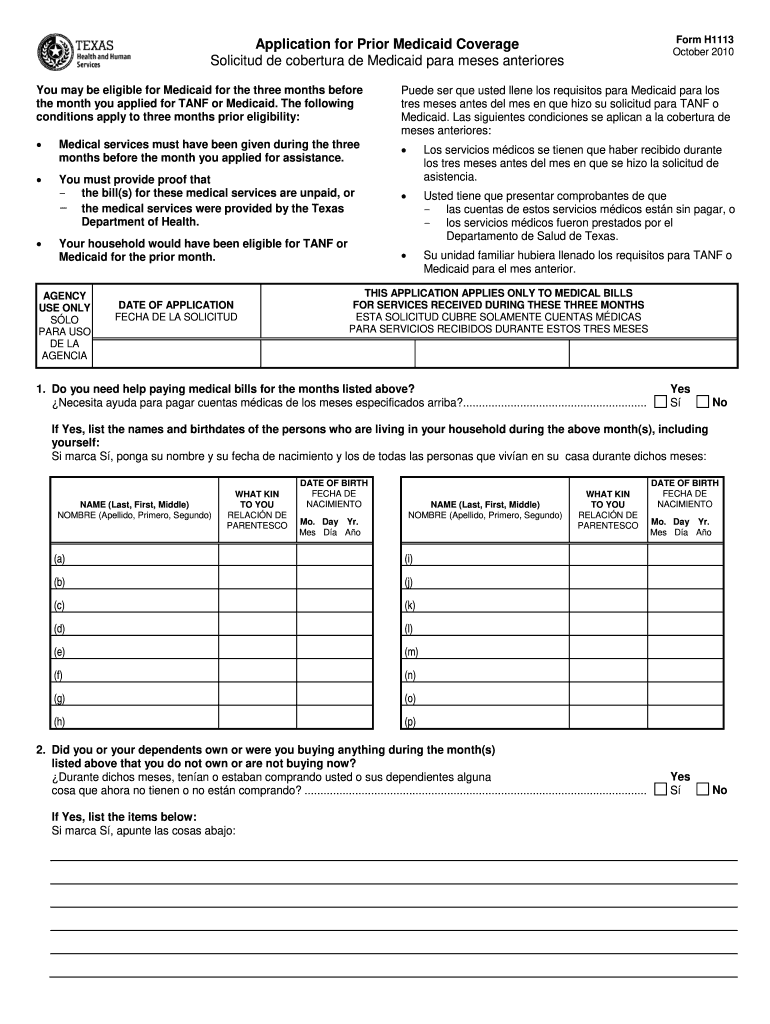

The H1113 form, also known as the form 1113, is a crucial document used in the Medicaid program in Texas. This form is primarily utilized to determine eligibility for various Medicaid services. It collects essential personal information, including income, household size, and medical expenses, to assess an applicant's financial situation. Understanding the purpose of the H1113 form is vital for individuals seeking assistance through Medicaid, as it directly impacts their access to necessary healthcare services.

Steps to Complete the H1113 Form

Completing the H1113 form requires careful attention to detail to ensure accuracy. Here are the steps to follow:

- Gather necessary documents, such as proof of income, identification, and any relevant medical records.

- Begin filling out the form by providing your personal information, including your name, address, and Social Security number.

- Detail your household information, including the number of people living with you and their relationship to you.

- Report your income sources and amounts, ensuring you include all forms of income.

- List any medical expenses that may be relevant for your Medicaid eligibility.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the H1113 Form

The H1113 form is legally binding when filled out correctly and submitted to the appropriate Medicaid office. It must comply with relevant laws and regulations governing Medicaid in Texas. This includes adherence to the Health Insurance Portability and Accountability Act (HIPAA), which protects the privacy of individuals' health information. Ensuring that the form is completed accurately and submitted on time is essential to avoid any legal complications or delays in receiving Medicaid benefits.

How to Obtain the H1113 Form

Obtaining the H1113 form is a straightforward process. Individuals can access the form through the Texas Health and Human Services website or request a physical copy from their local Medicaid office. Additionally, healthcare providers may also have copies available for patients who need assistance with the application process. It is important to ensure that you are using the most current version of the form to avoid any issues with your application.

Key Elements of the H1113 Form

The H1113 form consists of several key elements that applicants must complete to ensure their eligibility for Medicaid. These elements include:

- Personal Information: Name, address, and Social Security number.

- Household Composition: Details about all household members and their relationship to the applicant.

- Income Information: Comprehensive reporting of all income sources, including wages, benefits, and other financial support.

- Medical Expenses: Listing any relevant medical costs that may affect eligibility.

Form Submission Methods

The H1113 form can be submitted through various methods to accommodate different preferences. Applicants can choose to submit the form online through the Texas Medicaid portal, mail it directly to their local Medicaid office, or deliver it in person. Each method has its own processing times, so it is advisable to choose the one that best fits your needs and timeline. Ensure that you keep a copy of the submitted form for your records.

Quick guide on how to complete h1113 form

Complete H1113 Form effortlessly on any device

Managing documents online has become increasingly popular among both organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle H1113 Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest way to edit and eSign H1113 Form with ease

- Obtain H1113 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text (SMS), invite link, or downloading it to your PC.

Eliminate the hassle of missing or lost files, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign H1113 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the h1113 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the h1113 form and how does it work?

The h1113 form is a document used for various applications in business contexts, particularly for financial and legal purposes. With airSlate SignNow, you can easily create, send, and eSign the h1113 form through an intuitive platform, ensuring your documents are securely processed and trackable.

-

How can I integrate the h1113 form with other tools?

airSlate SignNow offers seamless integrations with popular applications like Google Drive, Salesforce, and Microsoft Office. This means you can easily import, export, and manage your h1113 form alongside other business documents, streamlining your workflow.

-

What features does airSlate SignNow offer for the h1113 form?

airSlate SignNow provides a number of features designed to enhance your h1113 form processing. These include templates for quick access, automated workflows, secure eSigning options, and real-time tracking, all aimed at saving you time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the h1113 form?

Yes, airSlate SignNow operates on a subscription model that provides various pricing plans depending on your business needs. Each plan includes access to features that facilitate the easy handling of the h1113 form, making it a cost-effective solution for document management.

-

How secure is the h1113 form when using airSlate SignNow?

Security is a top priority for airSlate SignNow, and all documents, including the h1113 form, are protected with robust encryption methods. Additionally, you can set permissions and access controls, ensuring that your data remains safe and confidential throughout the signing process.

-

Can I customize the h1113 form using airSlate SignNow?

Absolutely! airSlate SignNow allows you to fully customize the h1113 form to meet your specific requirements. You can add fields, branding, and formatting that align with your business's unique style and needs, ensuring that the document meets your expectations.

-

What are the benefits of using airSlate SignNow for the h1113 form?

Using airSlate SignNow for the h1113 form offers numerous benefits, including time savings, reduced paperwork, and improved accuracy during the signing process. The platform enhances collaboration and increases efficiency, enabling your team to focus on more strategic tasks.

Get more for H1113 Form

- Work inspection request form

- Teacher appointment form 443394907

- Notis pilihan mencarum melebihi kadar 101762845 form

- Declaration of compliance template form

- Form 3271 33 fannie mae

- Visa acquirer risk program standards guide form

- Id 401a purdue extension entomology extension entm purdue form

- Shareholder voting agreement template form

Find out other H1113 Form

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney

- How Do I Electronic signature South Carolina Unlimited Power of Attorney

- How Can I Electronic signature Alaska Limited Power of Attorney

- How To Electronic signature Massachusetts Retainer Agreement Template

- Electronic signature California Limited Power of Attorney Now

- Electronic signature Colorado Limited Power of Attorney Now

- Electronic signature Georgia Limited Power of Attorney Simple

- Electronic signature Nevada Retainer Agreement Template Myself

- Electronic signature Alabama Limited Partnership Agreement Online

- Can I Electronic signature Wisconsin Retainer Agreement Template

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy