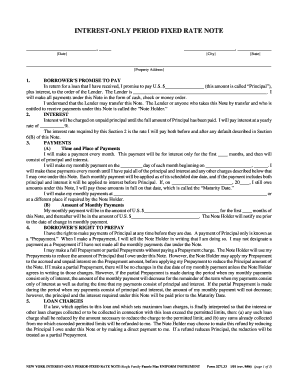

Form 3271 33 Fannie Mae

What is the FNMA Form 1033?

The FNMA Form 1033, commonly referred to as the Fannie Mae Form 1033, is a document used in the mortgage industry, specifically for the purpose of verifying income and employment. This form is essential for lenders to assess a borrower's financial stability and ability to repay a mortgage. It collects detailed information about the borrower's employment history, income sources, and other financial obligations. Understanding the purpose and requirements of this form is crucial for anyone involved in the mortgage application process.

How to Use the FNMA Form 1033

Using the FNMA Form 1033 involves several key steps that ensure accurate completion and submission. First, gather all necessary information, including employment details, income records, and any other financial documentation required. Next, fill out the form carefully, ensuring that all fields are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the form to your lender as part of your mortgage application package. Utilizing digital tools can streamline this process, allowing for easier editing and secure submission.

Steps to Complete the FNMA Form 1033

Completing the FNMA Form 1033 involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather required documents, such as pay stubs, tax returns, and employment verification letters.

- Fill in personal information, including your name, address, and Social Security number.

- Provide detailed employment information, including your job title, employer name, and duration of employment.

- List all sources of income, ensuring to include bonuses or additional earnings.

- Review the form for completeness and accuracy before submission.

Legal Use of the FNMA Form 1033

The FNMA Form 1033 is legally recognized in the United States as part of the mortgage application process. It complies with federal regulations governing income verification and lending practices. To ensure its legal validity, it is important to complete the form accurately and provide truthful information. Misrepresentation or errors on this form can lead to serious consequences, including loan denial or legal repercussions. Therefore, understanding the legal implications of the FNMA Form 1033 is essential for both borrowers and lenders.

Key Elements of the FNMA Form 1033

The FNMA Form 1033 consists of several key elements that are crucial for lenders to evaluate a borrower's financial situation. These elements include:

- Borrower Information: Personal details such as name, address, and Social Security number.

- Employment History: Information about current and previous employers, job titles, and employment duration.

- Income Details: A comprehensive breakdown of all income sources, including salary, bonuses, and additional earnings.

- Financial Obligations: Disclosure of any debts or financial commitments that may affect the borrower's ability to repay the mortgage.

Form Submission Methods

The FNMA Form 1033 can be submitted through various methods, depending on the lender's preferences. Common submission methods include:

- Online Submission: Many lenders allow for digital submission through secure portals, making it convenient for borrowers.

- Mail: Borrowers may choose to print the form and send it via postal service, although this method may take longer.

- In-Person: Some borrowers may prefer to deliver the form directly to their lender's office for immediate processing.

Quick guide on how to complete form 3271 33 fannie mae

Complete Form 3271 33 Fannie Mae effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the required form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle Form 3271 33 Fannie Mae on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Form 3271 33 Fannie Mae with ease

- Obtain Form 3271 33 Fannie Mae and then click Get Form to begin.

- Utilize the tools we provide to finish your form.

- Highlight important sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), or sharing a link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device. Modify and electronically sign Form 3271 33 Fannie Mae and ensure outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3271 33 fannie mae

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is fnma form 1033?

The FNMA Form 1033 is a crucial document used in the mortgage application process. It collects essential borrower information that lenders need to assess eligibility. By utilizing airSlate SignNow, you can easily fill out and eSign the FNMA Form 1033, streamlining your mortgage application.

-

How can airSlate SignNow help with completing fnma form 1033?

airSlate SignNow simplifies the process of completing the FNMA Form 1033 through its user-friendly interface. You can access the form online, fill it out, and eSign with just a few clicks. This convenience ensures you can complete your mortgage application efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for fnma form 1033?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs when using the FNMA Form 1033. The subscription includes features like unlimited document signing and secure cloud storage. You can choose the plan that best fits your requirements to optimize your document management.

-

What features does airSlate SignNow offer for fnma form 1033?

AirSlate SignNow includes features such as template creation, customizable workflows, and secure eSignatures specifically for the FNMA Form 1033. These features help you maintain compliance while ensuring a smooth signing process. The platform also enables you to track document status in real time.

-

Can I integrate airSlate SignNow with other tools while using fnma form 1033?

Absolutely! AirSlate SignNow offers integration capabilities with various third-party applications that enhance your use of the FNMA Form 1033. Whether it's CRM systems, cloud storage services, or productivity tools, these integrations streamline your workflow and maximize efficiency.

-

What are the benefits of using airSlate SignNow for fnma form 1033?

Using airSlate SignNow for the FNMA Form 1033 provides numerous benefits, including time savings and increased accuracy. The platform minimizes errors often associated with manual entries and speeds up the signing process. Additionally, it offers superior security for your sensitive documents.

-

How secure is the fnma form 1033 process with airSlate SignNow?

The FNMA Form 1033 process with airSlate SignNow is highly secure. The platform utilizes advanced encryption protocols and complies with industry standards to protect your data. You can confidently manage your documents, knowing that security is a top priority.

Get more for Form 3271 33 Fannie Mae

- Prince georges county third party inspection program 2005 form

- Georgia athlete agent form

- Form v005c

- Metlife soh st400s mn form

- Virginia military survivors and dependents education program roanoke va form

- Wyoming new hire form

- Arizona form 285 2006

- Pdf penfed financial hardship application non gse form 628

Find out other Form 3271 33 Fannie Mae

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online