Onett Computation Sheet Form

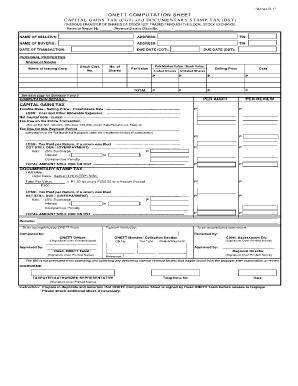

What is the Onett Computation Sheet

The Onett Computation Sheet is a specialized document used primarily for tax calculations and reporting in the United States. It serves as a tool for individuals and businesses to compute their tax liabilities accurately. This sheet is essential for ensuring compliance with federal and state tax regulations, making it a critical component of the tax filing process. The Onett Computation Sheet includes various sections that guide users through the necessary calculations, deductions, and credits applicable to their specific tax situation.

How to use the Onett Computation Sheet

Using the Onett Computation Sheet involves several straightforward steps. First, gather all relevant financial documents, including income statements, receipts for deductible expenses, and previous tax returns. Next, fill in the required fields on the sheet, which typically include personal information, income sources, and applicable deductions. It is important to follow the instructions carefully to ensure that all calculations are accurate. Once completed, review the sheet for any errors before submitting it to the appropriate tax authority.

Steps to complete the Onett Computation Sheet

Completing the Onett Computation Sheet can be done efficiently by following these steps:

- Gather all necessary financial documents, such as W-2s, 1099s, and receipts.

- Begin filling out the personal information section, including your name, address, and Social Security number.

- Input your total income from various sources, ensuring accuracy.

- List any deductions you qualify for, such as mortgage interest or educational expenses.

- Calculate your taxable income by subtracting deductions from your total income.

- Determine your tax liability using the appropriate tax rates and tables provided.

- Review the completed sheet for any discrepancies or missing information.

Legal use of the Onett Computation Sheet

The Onett Computation Sheet is legally recognized as a valid document for tax reporting when completed accurately. To ensure its legal standing, it must comply with the relevant tax laws and regulations set forth by the Internal Revenue Service (IRS) and state tax authorities. Proper completion of the sheet, including the inclusion of necessary signatures and dates, is essential for its acceptance during audits or reviews. Additionally, utilizing electronic signatures through platforms like signNow can enhance the legal validity of the completed document.

Key elements of the Onett Computation Sheet

Several key elements make up the Onett Computation Sheet, each serving a specific purpose in the tax calculation process:

- Personal Information: This section captures essential details about the taxpayer, including name, address, and Social Security number.

- Income Reporting: Users must report all sources of income, including wages, dividends, and business earnings.

- Deductions: This portion allows taxpayers to list eligible deductions that can reduce their taxable income.

- Tax Calculation: The sheet includes formulas or tables to help users calculate their total tax liability based on reported income and deductions.

- Signature Section: A designated area for the taxpayer's signature, confirming the accuracy of the information provided.

Who Issues the Form

The Onett Computation Sheet is typically issued by state tax authorities or the IRS, depending on its specific use. It may also be provided by tax preparation services or software that assist individuals and businesses in completing their tax filings accurately. Understanding the source of the form is crucial, as it ensures that users are working with the most current and legally compliant version available.

Quick guide on how to complete onett computation sheet 100413513

Effortlessly Prepare Onett Computation Sheet on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-conscious substitute for conventional printed and signed paperwork, as you can obtain the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without holdups. Handle Onett Computation Sheet on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

Steps to Modify and Electronically Sign Onett Computation Sheet Effortlessly

- Locate Onett Computation Sheet and click Access Form to initiate.

- Use the tools we offer to complete your document.

- Mark important parts of your documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for that need.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Finish button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device of your preference. Edit and electronically sign Onett Computation Sheet to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the onett computation sheet 100413513

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an onett sheet and how can it be used in airSlate SignNow?

An onett sheet is a template used for managing data in a structured format. In airSlate SignNow, it can streamline document workflows and ensure that your eSigning processes are efficient and organized. This allows users to easily customize their documents, making the signing process quick and straightforward.

-

How does pricing work for using the onett sheet feature in airSlate SignNow?

Pricing for using the onett sheet feature in airSlate SignNow varies based on the subscription plan you choose. Each plan offers different features, including access to onett sheets and other document management tools. Check the airSlate SignNow website for detailed pricing information and to find a plan that suits your business needs.

-

What features are included when using the onett sheet on airSlate SignNow?

Using the onett sheet in airSlate SignNow includes features like customizable templates, user-friendly interface, and seamless collaboration tools. You can easily integrate your onett sheet with other documents and manage workflows efficiently. This enhances productivity by providing a smooth eSigning experience.

-

What are the benefits of using onett sheets in airSlate SignNow?

The benefits of using onett sheets in airSlate SignNow include improved organization of your data, enhanced efficiency in document processing, and reduced turnaround times for eSigning. Furthermore, the onett sheets help ensure compliance and accuracy in your business documents. This ultimately leads to better workflow management.

-

Can I integrate onett sheets with other tools in airSlate SignNow?

Yes, the onett sheets feature in airSlate SignNow allows for integration with various tools and software applications. This means you can sync data from your onett sheets with other platforms you use. Integration capabilities help in streamlining processes and enhancing overall efficiency.

-

Is support available for using onett sheets in airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive support for all features, including onett sheets. You can access documentation, tutorials, and customer support to help you effectively utilize the onett sheets for your eSigning needs.

-

How secure are onett sheets created in airSlate SignNow?

Onett sheets created in airSlate SignNow are secured with industry-standard encryption protocols. This ensures that your data is protected during storage and transmission. airSlate SignNow prioritizes your data security, giving you peace of mind while using onett sheets.

Get more for Onett Computation Sheet

- Creditor mailing matrix form

- Matalan medications form

- Job shadow verification form aurora health care medicalprofessionals aurorahealthcare

- Credit application blueline rental form

- Aetna dialysis form

- Republika ng pilipinas 1702 form

- Dynamic trading robert miner pdf form

- Corporate event photography contract template form

Find out other Onett Computation Sheet

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy