Tc 40w 2013

What is the TC 40W?

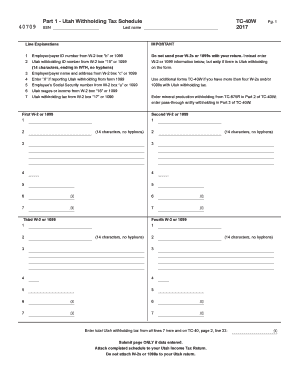

The TC 40W is a tax form used in the state of Utah, specifically designed for individuals and businesses to report certain types of income and deductions. This form is essential for ensuring compliance with state tax regulations. It allows taxpayers to accurately report their income, claim applicable deductions, and calculate their tax liability. Understanding the TC 40W is crucial for anyone looking to fulfill their tax obligations in Utah.

How to Use the TC 40W

Using the TC 40W involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s, 1099s, and any receipts for deductible expenses. Next, fill out the form by entering your personal information, income details, and deductions. After completing the form, review it for accuracy before submitting it to the appropriate state tax authority. Utilizing a digital platform like signNow can streamline this process, allowing for easy eSigning and secure submission.

Steps to Complete the TC 40W

Completing the TC 40W requires careful attention to detail. Here are the steps to follow:

- Gather all financial documents, including income statements and receipts.

- Fill in your personal information, such as name, address, and Social Security number.

- Report your total income from all sources accurately.

- List any deductions you are eligible for, ensuring you have documentation to support them.

- Calculate your total tax liability based on the provided instructions.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail to the appropriate tax authority.

Legal Use of the TC 40W

The TC 40W is legally binding when completed correctly and submitted on time. To ensure its validity, it must comply with state tax laws and regulations. This includes providing accurate information and adhering to deadlines. Using a reliable eSignature solution can enhance the legal standing of your submission by providing a secure and verifiable signature, thus meeting the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act.

Required Documents

When completing the TC 40W, certain documents are necessary to support your claims. These include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in your tax reporting.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial for avoiding penalties. The TC 40W must typically be submitted by April 15 of each year, coinciding with the federal tax deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to deadlines each tax year to ensure compliance.

Form Submission Methods

The TC 40W can be submitted through various methods, including:

- Online submission via the Utah State Tax Commission’s website.

- Mailing a paper copy to the designated tax office.

- In-person submission at local tax offices.

Choosing an electronic submission option can expedite processing times and provide immediate confirmation of receipt.

Quick guide on how to complete tc 40w

Finalize Tc 40w effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow supplies all the tools necessary to craft, modify, and eSign your documents rapidly without delays. Manage Tc 40w on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to alter and eSign Tc 40w effortlessly

- Obtain Tc 40w and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method to share your form: by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from any device you choose. Modify and eSign Tc 40w to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc 40w

Create this form in 5 minutes!

How to create an eSignature for the tc 40w

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tc 40w form, and why is it important?

The tc 40w form is a vital document used for certain regulatory and compliance purposes. It ensures that all necessary information is collected and recorded accurately, making it essential for businesses looking to maintain compliance. Knowing how to properly complete and submit the tc 40w form can save time and prevent legal issues.

-

How can airSlate SignNow assist with the tc 40w form?

airSlate SignNow streamlines the process of signing and submitting the tc 40w form by offering an intuitive eSignature solution. Users can easily upload the form, add necessary signatures, and send it securely to the relevant parties. This simplifies compliance while ensuring that all signatures are legally binding.

-

What are the pricing options for using airSlate SignNow with the tc 40w form?

airSlate SignNow offers flexible pricing plans that cater to different business needs for managing the tc 40w form. Whether you need basic features or advanced capabilities, there's a plan designed for you. This cost-effective solution enables businesses to maximize their documentation efficiency without breaking the bank.

-

Can I integrate airSlate SignNow with other software to manage the tc 40w form?

Yes, airSlate SignNow can be easily integrated with various applications, enhancing the management of the tc 40w form. This includes CRM systems, cloud storage services, and workflow management tools. Integrating these solutions can streamline your processes and enhance productivity.

-

What features does airSlate SignNow offer for the tc 40w form?

AirSlate SignNow provides a range of features specifically designed to help with the tc 40w form, including templates, bulk sending, and automated reminders. This allows users to efficiently manage the signing process and ensure timely submission. The user-friendly interface also makes it easy to navigate these features.

-

What are the security features offered by airSlate SignNow for the tc 40w form?

Security is a top priority for airSlate SignNow when handling the tc 40w form. The platform uses advanced encryption, secure access controls, and audit trails to protect your data. These measures ensure that your information remains confidential and compliant with industry regulations.

-

How does airSlate SignNow enhance the workflow for handling the tc 40w form?

By using airSlate SignNow, businesses can signNowly enhance their workflow related to the tc 40w form. With features like automated routing and notifications, the platform ensures that documents move through the required approval stages quickly and efficiently. This accelerates the overall process and minimizes delays.

Get more for Tc 40w

- A student is asking me for an access code for ceng cengage form

- Performance evaluation non exempt employees

- 16 2 pronouns practice 1 answer key form

- Form 1095 b american benefits council

- Millbrae school district form

- Telex form

- Unlv application 5753726 form

- Social media management service agreement template form

Find out other Tc 40w

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation