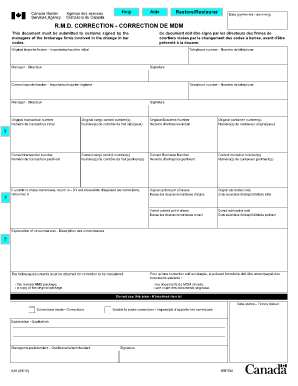

A48 Rmd Correction Form

What is the A48 RMD Correction

The A48 RMD correction form is a critical document used to rectify errors related to required minimum distributions (RMDs) from retirement accounts. This form is particularly relevant for individuals who have not taken the correct amount of RMDs or have mistakenly reported their distributions. The A48 form serves to ensure compliance with IRS regulations and to avoid potential penalties associated with RMD miscalculations. It is essential for taxpayers to understand the implications of this form to maintain their tax obligations accurately.

Steps to complete the A48 RMD Correction

Completing the A48 RMD correction involves several key steps to ensure accuracy and compliance. First, gather all relevant documentation, including previous RMD statements and any correspondence from the IRS. Next, fill out the A48 form with accurate details regarding the corrections needed. It is important to include your personal information, account details, and the specific errors being corrected. After completing the form, review it carefully for any mistakes before submission. Finally, submit the completed A48 RMD correction form to the appropriate IRS office, ensuring that you keep a copy for your records.

Legal use of the A48 RMD Correction

The A48 RMD correction form is legally recognized by the IRS as a valid means to amend RMD-related errors. To ensure its legal standing, the form must be completed in accordance with IRS guidelines, which include accurate reporting of distributions and adherence to deadlines. Utilizing this form helps taxpayers avoid penalties and ensures compliance with tax laws governing retirement accounts. It is advisable to consult with a tax professional if there are uncertainties regarding the legal implications of the corrections being made.

Required Documents

To complete the A48 RMD correction, several documents are necessary. These include your retirement account statements that reflect the RMD amounts, previous tax returns showing reported distributions, and any notices received from the IRS regarding RMD discrepancies. Additionally, having your Social Security number and account information readily available will facilitate the completion of the form. Collecting these documents beforehand can streamline the process and minimize errors.

Form Submission Methods

The A48 RMD correction form can be submitted through various methods to ensure it reaches the IRS promptly. Taxpayers can choose to file the form online through the IRS e-file system, which offers a secure and efficient way to submit documents. Alternatively, the form can be mailed directly to the appropriate IRS address, ensuring that it is sent via a traceable method for confirmation of receipt. In some cases, in-person submission may be possible at local IRS offices, although this option may vary based on location and current regulations.

Penalties for Non-Compliance

Failing to submit the A48 RMD correction form or incorrectly reporting RMDs can lead to significant penalties imposed by the IRS. These penalties may include a 50% excise tax on the amount that should have been distributed but was not. Additionally, taxpayers may face complications during future tax filings, including audits or increased scrutiny from the IRS. It is crucial to address any discrepancies promptly to avoid these penalties and maintain compliance with tax obligations.

Quick guide on how to complete a48 rmd correction

Effortlessly Prepare A48 Rmd Correction on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents swiftly and without delays. Manage A48 Rmd Correction on any device using airSlate SignNow's Android or iOS applications and simplify any document-based process today.

How to Edit and Electronically Sign A48 Rmd Correction with Ease

- Locate A48 Rmd Correction and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign A48 Rmd Correction to ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the a48 rmd correction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an RMD correction form and why is it important?

An RMD correction form is a document used to rectify any errors related to required minimum distributions from retirement accounts. Properly completing this form is crucial to avoid penalties and ensure compliance with IRS regulations. Understanding how to use the RMD correction form can help safeguard your financial future.

-

How do I fill out an RMD correction form using airSlate SignNow?

Filling out an RMD correction form using airSlate SignNow is straightforward. Users can upload the form, add necessary signatures, and fill it out electronically. This process not only saves time but also reduces the likelihood of errors, making compliance easier.

-

Are there any costs associated with using airSlate SignNow for RMD correction forms?

airSlate SignNow offers a range of pricing plans that cater to different business needs. Whether you're a small business or a large corporation, there's a plan suitable for managing RMD correction forms. Our cost-effective solutions ensure that you can manage documents without breaking the bank.

-

What features does airSlate SignNow offer for managing RMD correction forms?

airSlate SignNow provides various features designed to simplify the management of RMD correction forms. Users benefit from electronic signatures, document tracking, and integration with other tools. These features enhance efficiency and make the form completion process secure and streamlined.

-

Can I integrate airSlate SignNow with other applications for RMD correction forms?

Yes, airSlate SignNow can be easily integrated with numerous applications, enhancing your workflow for RMD correction forms. Popular integrations include CRM systems, cloud storage services, and project management tools. This interoperability allows for a seamless and efficient document management experience.

-

How does using airSlate SignNow for RMD correction forms improve compliance?

Using airSlate SignNow for RMD correction forms ensures that all necessary signatures are captured and all documentation is stored securely. This not only helps in maintaining compliance with IRS regulations but also streamlines the auditing process. With an organized digital workflow, you can reduce the risk of penalties and ensure timely submissions.

-

What support options does airSlate SignNow provide for users of RMD correction forms?

airSlate SignNow offers comprehensive customer support for users of RMD correction forms. This includes access to tutorials, documentation, and a responsive support team ready to assist with any questions. Our goal is to make sure you can efficiently manage your forms and address any issues that may arise.

Get more for A48 Rmd Correction

- Blank power of attorney form indiana

- Fragile indemnity letter form

- Lease rental mold and ventilation addendum form

- South carolina resale certificate writeable version form

- Wrap non profit organizaion multi coverage renewal application form

- Respite timesheet fill online printable fillable blank form

- Our orange county funeral home form

- Fpc527external seed order form forest products commission

Find out other A48 Rmd Correction

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple